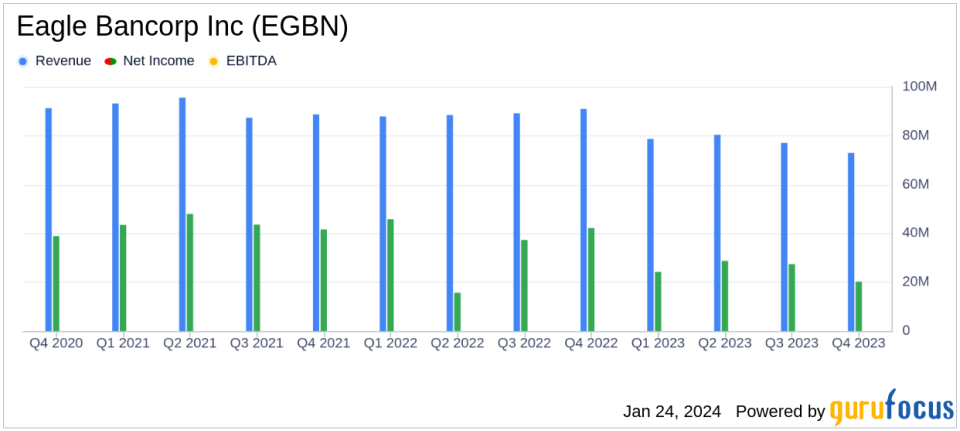

Eagle Bancorp Inc (EGBN) Reports Q4 2023 Earnings: Net Income Declines to $20.2 Million

Net Income: $20.2 million for Q4 2023, a decrease from $27.4 million in Q3 2023.

Earnings Per Share: $0.67 diluted EPS for Q4 2023, down from $0.91 in the prior quarter.

Net Interest Income: Increased to $73.0 million in Q4 2023 from $70.7 million in Q3 2023.

Deposits: Grew by 5.2% to $8.8 billion, with a significant rise in noninterest bearing demand deposits.

Loan Portfolio: Slight increase to $8.0 billion, up 0.6% from the prior quarter-end.

Provision for Credit Losses: Rose to $14.5 million in Q4 2023, compared to $5.6 million in Q3 2023.

Asset Quality: Nonperforming assets at 0.57% of total assets, with a net charge-off rate of 0.60%.

Eagle Bancorp Inc (NASDAQ:EGBN) released its 8-K filing on January 24, 2024, detailing its financial performance for the fourth quarter of 2023. The bank holding company, which operates through its subsidiary EagleBank, reported a net income of $20.2 million, or $0.67 per diluted share, a decrease from the $27.4 million, or $0.91 per diluted share, reported in the previous quarter. The decline in earnings was primarily due to a higher provision for credit losses and lower noninterest income, partially offset by an increase in net interest income.

Company Overview

Eagle Bancorp Inc, through EagleBank, provides a comprehensive suite of commercial and consumer banking services. The bank's offerings include commercial loans for various business purposes, asset-based lending, real estate loans, consumer lines of credit, and residential mortgage loans. EagleBank's focus on building strong relationships with its clients is evident in its commitment to service and community engagement.

Financial Performance and Challenges

The company's performance in the fourth quarter reflects the resilience of its business model amidst a challenging economic environment. President and CEO Susan G. Riel highlighted the bank's strong capital levels and operating efficiency, noting that deposits increased for the first time in six quarters. However, the normalization of asset quality metrics and elevated funding costs due to higher interest rates posed challenges. The bank's strategic focus on improving the quality of its deposit portfolio and reducing reliance on wholesale funding is aimed at positioning the company for sustainable growth.

"The EagleBank team is committed to continuing its efforts to grow and improve the quality of our deposit portfolio, reduce the reliance on wholesale funding, and grow our commercial lending team," said Susan G. Riel, President and CEO of Eagle Bancorp Inc.

Financial Highlights

The bank's net interest income rose to $73.0 million, driven by an increase in earning assets and higher yields on loans and investments. The provision for credit losses increased to $14.5 million, reflecting the partial charge-off of an office loan and the sale of a CRE multi-family construction loan. Noninterest income declined to $2.9 million due to market value adjustments on derivative books. Noninterest expense saw a slight decrease to $37.1 million.

Balance Sheet and Asset Quality

Eagle Bancorp Inc's total loans increased modestly to $8.0 billion, with nonperforming assets representing 0.57% of total assets. The bank's allowance for credit losses stood at 1.08% of total loans at quarter-end. The company's deposit growth contributed to a lower loan-to-deposit ratio of 90% as of December 31, 2023.

Capital and Shareholder Value

Shareholders' equity increased to $1.3 billion, with a book value per share of $42.58 and a tangible book value per share of $39.08. The company declared a quarterly dividend of $0.45 per share, underscoring its commitment to delivering shareholder value.

Eagle Bancorp Inc's earnings report reflects a mixed performance, with challenges in credit losses and noninterest income being mitigated by growth in net interest income and deposits. The bank's focus on strategic initiatives and asset quality management positions it for potential future growth, making it a noteworthy consideration for value investors.

Explore the complete 8-K earnings release (here) from Eagle Bancorp Inc for further details.

This article first appeared on GuruFocus.