Eagle Bancorp Montana Inc (EBMT) Reports Mixed Results for Q4 and Full Year 2023

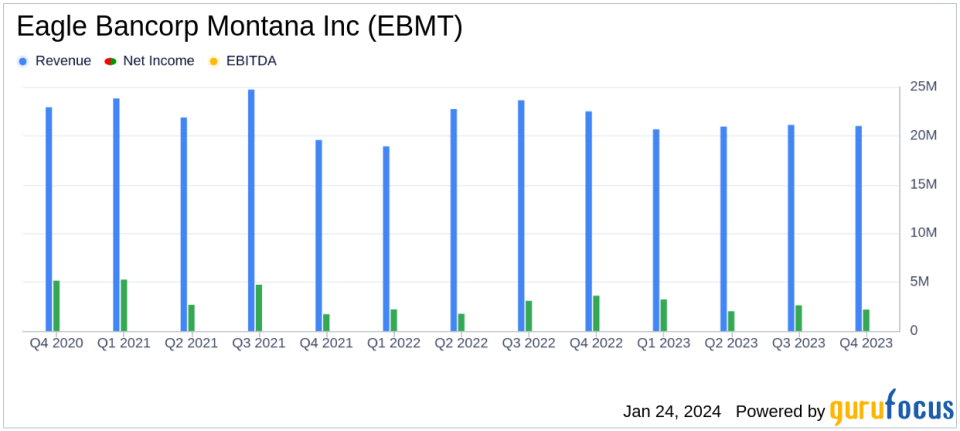

Net Income: Q4 net income fell to $2.2 million, or $0.28 per diluted share, from $3.6 million, or $0.47 per diluted share, in Q4 2022.

Annual Earnings: Full-year net income reached $10.1 million, or $1.29 per diluted share, compared to $10.7 million, or $1.45 per diluted share, in 2022.

Dividend: Declared a quarterly cash dividend of $0.14 per share, payable on March 1, 2024.

Loan Growth: Achieved a 9.7% year-over-year loan growth, with a total loan portfolio yield of 5.70%.

Net Interest Margin: NIM contracted to 3.32% in Q4 2023 from 4.10% in Q4 2022.

Asset Quality: The allowance for credit losses represented 1.11% of portfolio loans and 196.0% of nonperforming loans as of December 31, 2023.

Capital Management: Tangible common equity to tangible assets increased to 6.32% at the end of Q4 2023.

On January 23, 2024, Eagle Bancorp Montana Inc (NASDAQ:EBMT) released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The bank holding company, which operates Opportunity Bank of Montana, reported a decrease in net income for both the quarter and the year, while maintaining a steady growth in loans and declaring a consistent dividend.

Eagle Bancorp Montana Inc provides a range of loan and deposit services, focusing on residential loans, commercial real estate loans, and consumer loans, among others. The company's deposit accounts include checking, savings, and various other types of accounts.

Financial Performance and Challenges

The fourth quarter saw a decrease in net income to $2.2 million, or $0.28 per diluted share, from $3.6 million, or $0.47 per diluted share, in the same quarter of the previous year. The full-year net income also saw a slight decrease from $10.7 million in 2022 to $10.1 million in 2023. These figures reflect the challenges faced by the bank, including a high interest rate environment and a contraction in net interest margin (NIM) by 78 basis points year-over-year to 3.32% in the fourth quarter.

The bank's performance is significant as it demonstrates resilience in a challenging economic climate. The steady growth in loans by 9.7% year-over-year is a positive indicator of the bank's core business strength. However, the contraction in NIM suggests that the bank is facing pressure on its interest income relative to interest expenses, which is a key metric for profitability in the banking sector.

Financial Achievements and Importance

Despite the challenges, Eagle Bancorp Montana Inc achieved loan growth and maintained strong credit fundamentals. The total loan portfolio yield improved slightly, and the bank's asset quality metrics remained solid, with the allowance for credit losses representing a healthy 196.0% of nonperforming loans. These achievements are important as they indicate the bank's ability to grow its loan portfolio while managing credit risk effectively, which is crucial for long-term financial stability and profitability.

Key Financial Details

The bank's balance sheet showed total assets increasing by 6.5% to $2.08 billion at the end of 2023. The investment securities portfolio stood at $318.3 million, and total loans increased to $1.48 billion. The average cost of deposits rose to 1.49% in the fourth quarter of 2023 from 0.40% in the same quarter of the previous year, reflecting the higher interest rate environment.

Shareholders equity increased to $169.3 million, with book value per share rising to $21.11. The bank's capital management showed an improvement with tangible common equity to tangible assets ratio increasing to 6.32%.

"Our full year 2023 results reflect steady organic loan growth," said Laura F. Clark, President and CEO. "We made efforts to attract high quality loans and were successful, achieving loan growth of 9.7% for the year."

Analysis of Performance

The bank's performance in 2023 indicates a mixed outcome with solid loan growth and asset quality but faced with margin pressures and a slight decline in profitability. The bank's strategic focus on attracting high-quality loans and maintaining strong credit fundamentals has helped it navigate a challenging interest rate environment. The declared dividend reflects confidence in the bank's capital position and commitment to shareholder returns.

Overall, Eagle Bancorp Montana Inc's financial results for the fourth quarter and full year of 2023 demonstrate the bank's focus on growth and stability, even as it manages the headwinds of a dynamic economic landscape.

Explore the complete 8-K earnings release (here) from Eagle Bancorp Montana Inc for further details.

This article first appeared on GuruFocus.