Eagle Pharmaceuticals Reports Second Quarter 2023 Results

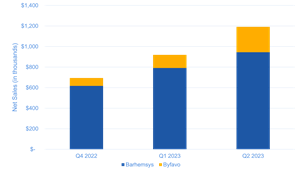

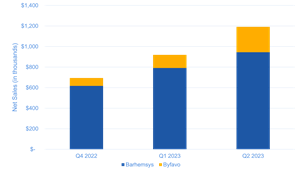

Acacia Quarterly Sales and Growth

• Total revenue for Q2 2023 was $64.6 million

• Q2 2023 net income was $0.39 per basic and diluted share and adjusted non-GAAP net income1 was $1.18 per basic and diluted share

• Q2 2023 net income was $5.2 million

• Q2 2023 adjusted non-GAAP EBITDA1 was $20.7 million

• Gross margin was 74% for the first half of 2023, up from 73% for the first half of 2022

• Adjusted non-GAAP gross margin1 was 83% for the first half of 2023, up from 74% for the first half of 2022

• Gross profit in its oncology business was $41.9 million in the second quarter of 2023 compared with $38.7 million in the prior year period, representing gross margin of 80% and 72%, respectively

• Adjusted non-GAAP gross profit1 in its oncology business was $43.8 million in the second quarter of 2023 compared with $38.7 million in the prior year period, representing adjusted non-GAAP gross margin1 of 84% and 72%, respectively

• An estimated 19,000 patients2 were dosed with Barhemsys® or Byfavo® during the second quarter of 2023; combined sales of Barhemsys and Byfavo were $1.2 million, representing approximately 30% sequential growth for the last two quarters

• BENDEKA® and BELRAPZO® combined had approximately 84% share of the bendamustine U.S. market in the second quarter of 20233

• Company reiterates raised full-year guidance of adjusted non-GAAP EBITDA1 of $78.0-$84.0 million and adjusted non-GAAP earnings per share1 of $4.40-$4.70; resumed share repurchase program in July 2023

WOODCLIFF LAKE, N.J., Aug. 08, 2023 (GLOBE NEWSWIRE) -- Eagle Pharmaceuticals, Inc. (Nasdaq: EGRX) (“Eagle” or the “Company”) today announced financial results for the three and six months ended June 30, 2023.

“We delivered a strong second quarter with impressive earnings and revenue, continuing the positive trajectory from an outstanding 18 months of business performance,” stated Scott Tarriff, President and Chief Executive Officer of Eagle Pharmaceuticals. “Our marketed drugs across oncology and our hospital business are performing well. We’re particularly excited with the revenue ramp for Barhemsys and Byfavo; our share of the commercial U.S. pemetrexed market has more than tripled since the end of 2022, and Bendeka and Belrapzo continue to outperform. In light of these and other positive factors, which we believe reflect a broader continuation of strength, we recently raised our full-year 2023 guidance and resumed our share repurchase program.”

“Our expectation is that the growth that began in 2022 will continue, and we have confidence that 2023 will be another great year for Eagle,” stated Tarriff. “Going forward, we intend to build on our sales momentum and also to leverage our commercial infrastructure and working capital position to add complementary products, either through R&D or acquisition.”

Recent Business Highlights:

An estimated 19,000 patients were dosed with Barhemsys or Byfavo during the second quarter of 2023, and 275 health care facilities purchased the products out of a total targeted market of approximately 4,000.2 Combined sales of Barhemsys and Byfavo were $1.2 million, representing approximately 30% sequential growth for the last two quarters. A summary of the sequential quarter sales growth for Barhemsys and Byfavo is provided below:

The Company completed the expansion of its hospital and oncology commercial teams. Eagle believes the new commercial infrastructure of approximately 80 people enables the Company to bring in additional products, through R&D or acquisition, with minimal additional commercialization costs.

Eagle is scheduled to have a Type C meeting with the U.S. Food and Drug Administration (FDA) in August 2023 for EA-114, its estrogen receptor antagonist product candidate for the treatment of HR+/HER- advanced breast cancer.

FDA granted Qualified Infectious Disease Product (QIDP) Designation and Fast Track Designation for CAL02, a novel first-in-class anti-toxin drug candidate, being developed to treat severe community-acquired bacterial pneumonia (SCABP) as an adjunctive therapy to standard of care, entitling Eagle to an additional five years of marketing exclusivity upon approval.

First patients were randomized in a multi-center adaptive, randomized, double-blind, placebo-controlled Phase 2 study designed to assess the efficacy and safety of CAL02 administered intravenously in addition to standard of care in patients with SCABP. The study plans to enroll approximately 276 patients at more than 100 sites in over 20 countries worldwide, with 100 sites expected to be up by year-end in time for the northern hemisphere’s pneumonia season. Depending upon recruitment rates, Eagle anticipates having its 50% interim report around the first half of 2024.

Second Quarter 2023 Financial Results

Total revenue for the second quarter of 2023, was $64.6 million, as compared to $74.1 million for the second quarter of 2022.

Second quarter 2023 royalty revenue was $21.7 million, compared to $24.9 million in the prior year quarter.

A summary of total revenue is outlined below:

| Three Months Ended June 30, |

| Six Months Ended June 30, |

| |||||||||||

|

| 2023 |

|

|

| 2022 |

|

|

| 2023 |

|

|

| 2022 |

|

| (unaudited) |

| (unaudited) |

| (unaudited) |

| (unaudited) |

| |||||||

Revenue (in thousands): |

|

|

|

|

|

|

|

| |||||||

Product sales, net | $ | 42,993 |

|

| $ | 49,201 |

|

| $ | 89,214 |

|

| $ | 139,289 |

|

Royalty revenue |

| 21,653 |

|

|

| 24,935 |

|

|

| 41,737 |

|

|

| 50,721 |

|

Total revenue | $ | 64,646 |

|

| $ | 74,136 |

|

| $ | 130,951 |

|

| $ | 190,010 |

|

|

|

|

|

|

|

|

|

| |||||||

Gross margin was 74% during the second quarter of 2023, compared to 68% in the second quarter of 2022.

R&D expense was $9.8 million for the second quarter of 2023, compared to $11.4 million for the second quarter of 2022. The decrease was primarily due to lower spend on the Company’s EA-114 program, which was in a large-scale study during the second quarter of 2022.

SG&A expenses in the second quarter of 2023 were $27.7 million compared to $36.8 million in the second quarter of 2022. This decrease was driven largely by the non-recurrence of Acacia-related acquisition costs and severance, partially offset by higher personnel related costs given the Company’s expanded hospital and oncology sales teams as well as higher selling and marketing costs for Barhemsys and Byfavo.

Net income for the second quarter of 2023 was $5.2 million, or $0.39 per basic and diluted share, compared to net loss of $(9.5) million, or $(0.74) per basic and diluted share, in the second quarter of 2022, primarily as a result of the factors discussed above.

Adjusted non-GAAP net income for the second quarter of 2023 was $15.5 million, or $1.18 per basic and diluted share, compared to adjusted non-GAAP net income of $20.3 million, or $1.58 per basic and $1.56 per diluted share, in the second quarter of 2022.

Adjusted non-GAAP EBITDA for the second quarter of 2023 was $20.7 million, compared to adjusted non-GAAP EBITDA of $25.9 million in the second quarter of 2022.

2023 Full-Year Guidance

The Company reiterated its recently announced raised guidance as follows:

Adjusted non-GAAP EBITDA of $78.0-$84.0 million

Adjusted non-GAAP earnings per share of $4.40-$4.70

Adjusted non-GAAP R&D expense of $41.0-$45.0 million

Adjusted non-GAAP SG&A expense of $86.0-$90.0 million

Liquidity

As of June 30, 2023, Eagle had $15.4 million in cash and cash equivalents, $115.1 million in accounts receivable, net, and $71.3 million in outstanding debt on the Company’s $150.0 million credit facility with JPMorgan. As of June 30, 2023, the Company had drawn $25.0 million on its $100.0 million revolving credit facility, which is included in outstanding debt.

As of June 30, 2023, Eagle had working capital of $100.6 million, after significant direct investment in R&D to fund the Company’s promising product candidates, the acquisition of Acacia Pharma Inc.’s outstanding shares and debt in 2022, and the purchase of an equity stake in and option to acquire Enalare Therapeutics Inc.

Conference Call

As previously announced, Eagle management will host its second quarter 2023 conference call as follows:

Date | Tuesday, August 8, 2023 |

Time | 8:30 a.m. ET |

Toll free (U.S.) | 800-343-4136 |

International | 203-518-9814 |

Webcast (live and replay) | www.eagleus.com, under the “Investor Relations” section |

A replay of the conference call will be available for two weeks after the call's completion by dialing 800-839-9409 (U.S.) or 402-220-6088 (International) and entering conference call ID EGRXQ223. The webcast will be archived for 30 days at the aforementioned URL.

About Eagle Pharmaceuticals, Inc.

Eagle is a fully integrated pharmaceutical company with research and development, clinical, manufacturing and commercial expertise. Eagle is committed to developing innovative medicines that result in meaningful improvements in patients’ lives. Eagle’s commercialized products include PEMFEXY®, RYANODEX®, BENDEKA®, BELRAPZO®, TREAKISYM® (Japan), and Byfavo® and Barhemsys® through its wholly owned subsidiary Acacia Pharma Inc. Eagle’s oncology and CNS/metabolic critical care pipeline includes product candidates with the potential to address underserved therapeutic areas across multiple disease states. Additional information is available on Eagle’s website at www.eagleus.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, and other securities law. Forward-looking statements are statements that are not historical facts. Words and phrases such as “anticipated,” “forward,” “will,” “would,” “could,” “may,” “remain,” “potential,” “prepare,” “expected,” “believe,” “plan,” “near future,” “belief,” “guidance,” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding the Company’s financial projections and guidance, including anticipated financial performance for 2023, including expected adjusted EBITDA, adjusted non-GAAP earnings per share, adjusted non-GAAP R&D expense and adjusted non-GAAP SG&A expense; the Company’s expectations for the design and timing of clinical trials and studies, including with respect to enrollment, site selection, data meetings with regulatory agencies, and the timing thereof; statements regarding potential regulatory exclusivity; statements regarding the Company’s expectations with respect to building on its sales momentum leveraging its commercial infrastructure and working capital position to add complementary products, either through R&D or acquisition; and the potential of the Company’s pipeline and product candidates to address underserved therapeutic areas across multiple disease states. All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the Company’s control, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Such risks and uncertainties include, but are not limited to: the impacts of the post- COVID-19 environment and geopolitical factors such as the conflict in Ukraine; delay in or failure to obtain regulatory approval of the Company's or its partners’ product candidates and successful compliance with FDA, European Medicines Agency and other governmental regulations applicable to product approvals; changes in the regulatory environment; the uncertainties and timing of the regulatory approval process; whether the Company can successfully market and commercialize its product candidates; the success of the Company's relationships with its partners; the outcome of litigation involving any of its products or that may have an impact on any of its products; the strength and enforceability of the Company’s intellectual property rights or the rights of third parties; competition from other pharmaceutical and biotechnology companies and the potential for competition from generic entrants into the market; unexpected safety or efficacy data observed during clinical trials; clinical trial site activation or enrollment rates that are lower than expected; the risks inherent in drug development and in conducting clinical trials; unanticipated factors in addition to the foregoing that may impact the Company’s financial and business projections and guidance and may cause the Company’s actual results and outcomes to materially differ from its projections and guidance; and those risks and uncertainties identified in the “Risk Factors” sections of the Company's Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 23, 2023, the Company’s Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023 and its other subsequent filings with the SEC, including the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023. Readers are cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements contained in this press release speak only as of the date on which they were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

Non-GAAP Financial Performance Measures

In addition to financial information prepared in accordance with U.S. GAAP, this press release contains non-GAAP financial measures, including adjusted non-GAAP net income, adjusted non-GAAP EBITDA, adjusted non-GAAP earnings per share, adjusted non-GAAP gross margin, adjusted non-GAAP gross profit, adjusted non-GAAP R&D expense and adjusted non-GAAP SG&A expense. The Company believes these measures provide investors and management with supplemental information relating to operating performance and trends that facilitate comparisons between periods and with respect to projected information.

Adjusted non-GAAP net income and related earnings per share information excludes amortization expense, stock-based compensation expense, depreciation expense, severance expense, non-cash interest expense, fair value adjustments on equity investment, fair value adjustments related to derivative instruments, foreign currency exchange gain or loss, amortization of inventory step-up, acquisition related costs, legal settlement, convertible promissory note related adjustments, and the tax effect of these adjustments.

Adjusted non-GAAP EBITDA excludes interest expense net of interest income, income tax provision, depreciation and amortization expense, stock-based compensation expense, fair value adjustments on equity investment, convertible promissory note related adjustments, fair value adjustments related to derivative instruments, foreign currency exchange gain or loss, gain on Euro debt, legal settlement, acquisition related costs, debt issuance cost, and severance expense.

Adjusted non-GAAP Gross Profit excludes amortization expense and amortization of inventory step-up.

Adjusted non-GAAP R&D expense excludes stock-based compensation expense, depreciation expense and severance expense.

Adjusted non-GAAP SG&A expense excludes stock-based compensation expense, depreciation expense, severance expense, acquisition related costs, and legal settlement.

The Company believes the use of non-GAAP financial measures helps indicate underlying trends in the Company’s business and are important in comparing current results with prior period results and understanding projected operating performance. Non-GAAP financial measures provide the Company and its investors with an indication of the Company’s baseline performance before items that are considered by the Company not to be reflective of the Company’s ongoing results. See the attached reconciliation tables for details of the amounts excluded and included to arrive at certain of the non-GAAP financial measures for historical periods.

Investors should note that reconciliations of the forward-looking or projected non-GAAP financial measures included in this press release to their most comparable GAAP financial measures cannot be provided because the Company cannot do so without unreasonable efforts due to the unavailability of information needed to calculate the reconciling items and the variability, complexity, and limited visibility of comparable GAAP measures, and the reconciling items that would be excluded from the non-GAAP financial measures in the future. Likewise, the Company is unable to provide projected GAAP financial measures. GAAP projections and reconciliations of the components of projected adjusted non-GAAP EBITDA, adjusted non-GAAP R&D expenses, adjusted non-GAAP SG&A expenses and adjusted non-GAAP earning per share to their most comparable GAAP financial measures are not provided because the quantification of projected GAAP R&D expenses, SG&A expenses, net income and earnings per share and the reconciling items between projected GAAP to adjusted non-GAAP EBITDA, adjusted non-GAAP R&D expenses, adjusted non-GAAP SG&A expenses and adjusted non-GAAP earnings per share cannot be reasonably calculated or predicted at this time without unreasonable efforts. For example, with respect to GAAP net income and R&D Expense, the Company is not able to calculate the favorable or unfavorable expenses related to the fair value adjustments on equity investments and derivative instruments primarily due to nature of these transactions. Such unavailable information could be significant such that actual GAAP net income, R&D expenses, SG&A expenses and earnings per share would vary significantly from projected GAAP and adjusted non-GAAP EBITDA, adjusted non-GAAP R&D expenses, adjusted non-GAAP SG&A expenses and adjusted non-GAAP earnings per share.

These non-GAAP financial measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with U.S. GAAP. In addition, from time to time in the future there may be other items that the Company may exclude for purposes of its non-GAAP financial measures; and the Company has ceased, and may in the future cease, to exclude items that it has historically excluded for purposes of its non-GAAP financial measures. For example, commencing in 2023, the Company no longer excludes expense of acquired in-process research & development from the Company’s adjusted non-GAAP net income or adjusted non-GAAP EBITDA, their line item components, and non-GAAP earnings per share. For purposes of comparability, non-GAAP adjusted financial measures for the three and six months ended June 30, 2022 have been updated to reflect this change. Accordingly, such expenses are not excluded from the Company’s non-GAAP financial measures for the three and six months ended June 30, 2023 and 2022, as detailed in the reconciliation tables that follow, or from 2023 non-GAAP adjusted net income and adjusted non-GAAP earnings per share guidance. Likewise, the Company may determine to modify the nature of its adjustments to arrive at its non-GAAP financial measures. The Company strongly encourages investors to review its consolidated financial statements and publicly-filed reports in their entirety and cautions investors that the non-GAAP financial measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures.

Investor Relations for Eagle Pharmaceuticals, Inc.:

Lisa M. Wilson

In-Site Communications, Inc.

T: 212-452-2793

E: lwilson@insitecony.com

Public Relations for Eagle Pharmaceuticals, Inc.:

Faith Pomeroy-Ward

T: 817-807-8044

E: faith@eagleus.com

EAGLE PHARMACEUTICALS, INC. |

| |||||||

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

| |||||||

(In thousands, except share amounts) |

| |||||||

|

|

|

|

| ||||

|

|

|

|

| ||||

| June 30, 2023 |

| December 31, 2022 |

| ||||

ASSETS |

|

|

|

| ||||

Current assets: |

|

|

|

| ||||

Cash and cash equivalents | $ | 15,354 |

|

| $ | 55,321 |

|

|

Accounts receivable, net |

| 115,140 |

|

|

| 72,439 |

|

|

Inventories |

| 42,482 |

|

|

| 47,794 |

|

|

Prepaid expenses and other current assets |

| 14,274 |

|

|

| 13,200 |

|

|

Total current assets |

| 187,250 |

|

|

| 188,754 |

|

|

Property and equipment, net |

| 1,013 |

|

|

| 1,168 |

|

|

Intangible assets, net |

| 107,406 |

|

|

| 118,327 |

|

|

Goodwill |

| 45,033 |

|

|

| 45,033 |

|

|

Deferred tax asset, net |

| 30,715 |

|

|

| 27,146 |

|

|

Other assets |

| 33,405 |

|

|

| 25,732 |

|

|

Total assets | $ | 404,822 |

|

| $ | 406,160 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| ||||

Current liabilities: |

|

|

|

| ||||

Accounts payable | $ | 15,843 |

|

| $ | 18,993 |

|

|

Accrued expenses and other liabilities |

| 62,490 |

|

|

| 85,844 |

|

|

Short-term debt, net |

| 8,297 |

|

|

| 6,250 |

|

|

Total current liabilities |

| 86,630 |

|

|

| 111,087 |

|

|

Long-term debt, net |

| 61,896 |

|

|

| 56,216 |

|

|

Other long-term liabilities |

| 4,256 |

|

|

| 5,297 |

|

|

Total liabilities |

| 152,782 |

|

|

| 172,600 |

|

|

Commitments and Contingencies |

|

|

|

| ||||

Stockholders' equity: |

|

|

|

| ||||

Preferred stock, 1,500,000 shares authorized and no shares issued or outstanding as of June 30, 2023 and December 31, 2022 |

| — |

|

|

| — |

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized; 17,647,390 and 17,569,375 shares issued as of June 30, 2023 and December 31, 2022, respectively |

| 18 |

|

|

| 18 |

|

|

Additional paid in capital |

| 373,831 |

|

|

| 366,265 |

|

|

Accumulated other comprehensive (loss) |

| (1,112 | ) |

|

| (1,112 | ) |

|

Retained earnings |

| 122,418 |

|

|

| 111,504 |

|

|

Treasury stock, at cost, 4,552,730 and 4,552,730 shares as of June 30, 2023 and December 31, 2022, respectively |

| (243,115 | ) |

|

| (243,115 | ) |

|

Total stockholders' equity |

| 252,040 |

|

|

| 233,560 |

|

|

Total liabilities and stockholders' equity | $ | 404,822 |

|

| $ | 406,160 |

|

|

|

|

|

|

| ||||

EAGLE PHARMACEUTICALS, INC. |

| |||||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |

| |||||||||||||||

(In thousands, except share and per share amounts) |

| |||||||||||||||

|

|

|

|

|

| |||||||||||

|

|

|

|

|

| |||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, |

| |||||||||||||

|

| 2023 |

|

|

| 2022 |

|

|

| 2023 |

|

|

| 2022 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales, net | $ | 42,993 |

|

| $ | 49,201 |

|

| $ | 89,214 |

|

| $ | 139,289 |

|

|

Royalty revenue |

| 21,653 |

|

|

| 24,935 |

|

|

| 41,737 |

|

|

| 50,721 |

|

|

Total revenue |

| 64,646 |

|

|

| 74,136 |

|

|

| 130,951 |

|

|

| 190,010 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales |

| 16,858 |

|

|

| 21,171 |

|

|

| 34,158 |

|

|

| 46,347 |

|

|

Cost of royalty revenue |

| — |

|

|

| 2,493 |

|

|

| — |

|

|

| 5,072 |

|

|

Research and development |

| 9,833 |

|

|

| 11,437 |

|

|

| 19,105 |

|

|

| 17,545 |

|

|

Selling, general and administrative |

| 27,651 |

|

|

| 36,832 |

|

|

| 55,611 |

|

|

| 59,014 |

|

|

Total operating expenses |

| 54,342 |

|

|

| 71,933 |

|

|

| 108,874 |

|

|

| 127,978 |

|

|

Income from operations |

| 10,304 |

|

|

| 2,203 |

|

|

| 22,077 |

|

|

| 62,032 |

|

|

Interest income |

| 195 |

|

|

| 244 |

|

|

| 407 |

|

|

| 398 |

|

|

Interest expense |

| (1,448 | ) |

|

| (552 | ) |

|

| (2,964 | ) |

|

| (918 | ) |

|

Other income (expense), net |

| 247 |

|

|

| (7,763 | ) |

|

| 9 |

|

|

| (9,720 | ) |

|

Total other expense, net |

| (1,006 | ) |

|

| (8,071 | ) |

|

| (2,548 | ) |

|

| (10,240 | ) |

|

Income (loss) before income tax provision |

| 9,298 |

|

|

| (5,868 | ) |

|

| 19,529 |

|

|

| 51,792 |

|

|

Income tax provision |

| (4,134 | ) |

|

| (3,582 | ) |

|

| (8,615 | ) |

|

| (17,184 | ) |

|

Net income (loss) | $ | 5,164 |

|

| $ | (9,450 | ) |

| $ | 10,914 |

|

| $ | 34,608 |

|

|

Earnings (loss) per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic | $ | 0.39 |

|

| $ | (0.74 | ) |

| $ | 0.83 |

|

| $ | 2.71 |

|

|

Diluted | $ | 0.39 |

|

| $ | (0.74 | ) |

| $ | 0.83 |

|

| $ | 2.67 |

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| 13,090,852 |

|

|

| 12,836,116 |

|

|

| 13,075,090 |

|

|

| 12,773,727 |

|

|

Diluted |

| 13,154,599 |

|

|

| 12,836,116 |

|

|

| 13,151,107 |

|

|

| 12,951,788 |

|

|

|

|

|

|

|

| |||||||||||

EAGLE PHARMACEUTICALS, INC. |

| ||||||||||||||||

RECONCILIATION OF GAAP NET INCOME (LOSS) TO ADJUSTED NON-GAAP NET INCOME AND |

| ||||||||||||||||

GAAP EARNINGS PER SHARE TO ADJUSTED NON-GAAP EARNINGS PER SHARE (UNAUDITED) |

| ||||||||||||||||

(In thousands, except share and per share amounts) |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

|

| Three Months Ended June 30, |

| Six Months Ended June 30, |

| ||||||||||||

|

|

| 2023 |

|

|

| 2022 |

|

|

| 2023 |

|

|

| 2022 |

|

|

Net income (loss) - GAAP | $ | 5,164 |

|

| $ | (9,450 | ) |

| $ | 10,914 |

|

| $ | 34,608 |

|

| |

|

|

|

|

|

|

|

|

|

| ||||||||

Adjustments: |

|

|

|

|

|

|

|

| |||||||||

Cost of product revenues: |

|

|

|

|

|

|

|

| |||||||||

| Amortization expense |

| 5,459 |

|

|

| 1,466 |

|

|

| 10,901 |

|

|

| 2,197 |

|

|

| Amortization of inventory step-up |

| 416 |

|

|

| — |

|

|

| 736 |

|

|

| — |

|

|

Research and development: |

|

|

|

|

|

|

|

| |||||||||

| Stock-based compensation expense |

| 527 |

|

|

| 601 |

|

|

| 1,214 |

|

|

| 1,244 |

|

|

| Depreciation expense |

| 32 |

|

|

| 44 |

|

|

| 62 |

|

|

| 92 |

|

|

| Severance |

| 44 |

|

|

| — |

|

|

| 44 |

|

|

| — |

|

|

Selling, general and administrative: |

|

|

|

|

|

|

|

| |||||||||

| Stock-based compensation expense |

| 3,665 |

|

|

| 3,899 |

|

|

| 7,617 |

|

|

| 7,551 |

|

|

| Depreciation expense |

| 77 |

|

|

| 124 |

|

|

| 157 |

|

|

| 253 |

|

|

| Severance |

| 154 |

|

|

| 7,742 |

|

|

| 197 |

|

|

| 7,791 |

|

|

| Acquisition related costs |

| — |

|

|

| 9,849 |

|

|

| — |

|

|

| 11,339 |

|

|

| Legal settlement |

| — |

|

|

| — |

|

|

| — |

|

|

| 300 |

|

|

Other: |

|

|

|

|

|

|

|

| |||||||||

| Non-cash interest expense |

| 115 |

|

|

| 278 |

|

|

| 237 |

|

|

| 396 |

|

|

| Fair value adjustments on equity investment |

| (210 | ) |

|

| 700 |

|

|

| 193 |

|

|

| 3,230 |

|

|

| Convertible promissory note related adjustments |

| — |

|

|

| (19 | ) |

|

| — |

|

|

| (28 | ) |

|

| Fair value adjustments related to derivative instruments |

| — |

|

|

| 6,239 |

|

|

| (77 | ) |

|

| 5,631 |

|

|

| Foreign currency exchange (gain) loss |

| (35 | ) |

|

| 798 |

|

|

| (125 | ) |

|

| 798 |

|

|

Tax effect of the non-GAAP adjustments |

| 91 |

|

|

| (1,956 | ) |

|

| (35 | ) |

|

| (2,935 | ) |

| |

Adjusted non-GAAP net income | $ | 15,499 |

|

| $ | 20,315 |

|

| $ | 32,035 |

|

| $ | 72,467 |

|

| |

|

|

|

|

|

|

|

|

|

| ||||||||

Earnings (loss) per share: |

|

|

|

|

|

|

|

| |||||||||

Basic | $ | 0.39 |

|

| $ | (0.74 | ) |

| $ | 0.83 |

|

| $ | 2.71 |

|

| |

Diluted | $ | 0.39 |

|

| $ | (0.74 | ) |

| $ | 0.83 |

|

| $ | 2.67 |

|

| |

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

| |||||||||

Basic |

| 13,090,852 |

|

|

| 12,836,116 |

|

|

| 13,075,090 |

|

|

| 12,773,727 |

|

| |

Diluted |

| 13,154,599 |

|

|

| 12,836,116 |

|

|

| 13,151,107 |

|

|

| 12,951,788 |

|

| |

|

|

|

|

|

|

|

|

|

| ||||||||

Adjusted non-GAAP earnings per share: |

|

|

|

|

|

|

|

| |||||||||

Basic | $ | 1.18 |

|

| $ | 1.58 |

|

| $ | 2.45 |

|

| $ | 5.67 |

|

| |

Diluted | $ | 1.18 |

|

| $ | 1.56 |

|

| $ | 2.44 |

|

| $ | 5.60 |

|

| |

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

| |||||||||

Basic |

| 13,090,852 |

|

|

| 12,836,116 |

|

|

| 13,075,090 |

|

|

| 12,773,727 |

|

| |

Diluted |

| 13,154,599 |

|

|

| 12,997,602 |

|

|

| 13,151,107 |

|

|

| 12,951,788 |

|

| |

|

|

|

|

|

|

|

|

|

| ||||||||

EAGLE PHARMACEUTICALS, INC. |

| |||||||||||||||||||||||

RECONCILIATION OF GAAP NET INCOME (LOSS) TO ADJUSTED NON-GAAP EBITDA (UNAUDITED) |

| |||||||||||||||||||||||

(In thousands) |

| |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

| Three Months Ended |

| Six Months Ended |

| Twelve Months Ended |

| Twelve Months Ended December 31, |

| |||||||||||||||

|

|

| 2023 |

|

|

| 2022 |

|

|

| 2023 |

|

|

| 2022 |

|

| 2023 |

|

|

| 2022 |

|

|

Net income (loss) - GAAP | $ | 5,164 |

|

| $ | (9,450 | ) |

| $ | 10,914 |

|

| $ | 34,608 |

| $ | 11,948 |

|

| $ | 35,642 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Add back: |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Interest expense, net of interest income |

| 1,253 |

|

|

| 308 |

|

|

| 2,557 |

|

|

| 520 |

|

| 5,811 |

|

|

| 3,774 |

|

|

| Income tax provision |

| 4,134 |

|

|

| 3,582 |

|

|

| 8,615 |

|

|

| 17,184 |

|

| 17,222 |

|

|

| 25,791 |

|

|

| Depreciation and amortization expense |

| 5,984 |

|

|

| 1,634 |

|

|

| 11,856 |

|

|

| 2,542 |

|

| 21,884 |

|

|

| 12,570 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Add back: |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Stock-based compensation expense |

| 4,192 |

|

|

| 4,500 |

|

|

| 8,831 |

|

|

| 8,795 |

|

| 16,487 |

|

|

| 16,451 |

|

|

| Fair value adjustments on equity investment |

| (210 | ) |

|

| 700 |

|

|

| 193 |

|

|

| 3,230 |

|

| 1,420 |

|

|

| 4,457 |

|

|

| Convertible promissory note related adjustments |

| — |

|

|

| 26 |

|

|

| — |

|

|

| 62 |

|

| 4,180 |

|

|

| 4,242 |

|

|

| Fair value adjustments related to derivative instrument |

| — |

|

|

| 6,239 |

|

|

| (77 | ) |

|

| 5,631 |

|

| 2,257 |

|

|

| 7,965 |

|

|

| Foreign currency exchange (gain) loss |

| (35 | ) |

|

| 798 |

|

|

| (125 | ) |

|

| 798 |

|

| (1,570 | ) |

|

| (647 | ) |

|

| Gain on euro debt |

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| (264 | ) |

|

| (264 | ) |

|

| Legal settlement |

| — |

|

|

| — |

|

|

| — |

|

|

| 300 |

|

| — |

|

|

| 300 |

|

|

| Acquisition related costs |

| — |

|

|

| 9,849 |

|

|

| — |

|

|

| 11,339 |

|

| 1,783 |

|

|

| 13,122 |

|

|

| Debt issuance cost |

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

| 258 |

|

|

| 258 |

|

|

| Severance |

| 198 |

|

|

| 7,742 |

|

|

| 241 |

|

|

| 7,791 |

|

| 901 |

|

|

| 8,451 |

|

|

Adjusted Non-GAAP EBITDA | $ | 20,680 |

|

| $ | 25,928 |

|

| $ | 43,005 |

|

| $ | 92,800 |

| $ | 82,317 |

|

| $ | 132,112 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

EAGLE PHARMACEUTICALS, INC. | |||||||||||||

RECONCILIATION OF GAAP RESEARCH AND DEVELOPMENT AND | |||||||||||||

SELLING, GENERAL AND ADMINISTRATIVE TO ADJUSTED NON-GAAP RESEARCH | |||||||||||||

AND DEVELOPMENT AND SELLING, GENERAL AND ADMINISTRATIVE (UNAUDITED) | |||||||||||||

(In thousands) | |||||||||||||

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

| |||||

|

| Three Months Ended June 30, |

| Six Months Ended June 30, | |||||||||

|

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

|

Research and development - GAAP | $ | 9,833 |

| $ | 11,437 |

| $ | 19,105 |

| $ | 17,545 |

| |

Add back: |

|

|

|

|

|

|

| ||||||

| Stock-based compensation expense |

| 527 |

|

| 601 |

|

| 1,214 |

|

| 1,244 |

|

| Depreciation expense |

| 32 |

|

| 44 |

|

| 62 |

|

| 92 |

|

| Severance |

| 44 |

|

| — |

|

| 44 |

|

| — |

|

Research and development - Non-GAAP | $ | 9,230 |

| $ | 10,792 |

| $ | 17,785 |

| $ | 16,209 |

| |

|

|

|

|

|

|

|

|

| |||||

|

| Three Months Ended June 30, |

| Six Months Ended June 30, | |||||||||

|

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

|

Selling, general and administrative - GAAP | $ | 27,651 |

| $ | 36,832 |

| $ | 55,611 |

| $ | 59,014 |

| |

Add back: |

|

|

|

|

|

|

| ||||||

| Stock-based compensation expense |

| 3,665 |

|

| 3,899 |

|

| 7,617 |

|

| 7,551 |

|

| Depreciation expense |

| 77 |

|

| 124 |

|

| 157 |

|

| 253 |

|

| Severance |

| 154 |

|

| 7,742 |

|

| 197 |

|

| 7,791 |

|

| Acquisition related costs |

| — |

|

| 9,849 |

|

| — |

|

| 11,339 |

|

| Legal settlement |

| — |

|

| — |

|

| — |

|

| 300 |

|

Selling, general and administrative - Non-GAAP | $ | 23,755 |

| $ | 15,218 |

| $ | 47,640 |

| $ | 31,780 |

| |

|

|

|

|

|

|

|

|

| |||||

EAGLE PHARMACEUTICALS, INC. |

| |||||||||||

RECONCILIATION OF GAAP GROSS PROFIT TO |

| |||||||||||

ADJUSTED NON-GAAP GROSS PROFIT (UNAUDITED) |

| |||||||||||

(In thousands) |

| |||||||||||

|

|

|

|

|

|

|

|

| ||||

| Three Months Ended June 30, |

| Six Months Ended June 30, |

| ||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

|

Revenue: |

|

|

|

|

|

|

|

| ||||

Product sales, net | $ | 42,993 |

| $ | 49,201 |

| $ | 89,214 |

| $ | 139,289 |

|

Royalty revenue |

| 21,653 |

|

| 24,935 |

|

| 41,737 |

|

| 50,721 |

|

Total revenue | $ | 64,646 |

| $ | 74,136 |

| $ | 130,951 |

| $ | 190,010 |

|

Cost of product sales |

| 16,858 |

|

| 21,171 |

|

| 34,158 |

|

| 46,347 |

|

Cost of royalty revenue |

| — |

|

| 2,493 |

|

| — |

|

| 5,072 |

|

Gross Profit | $ | 47,788 |

| $ | 50,472 |

| $ | 96,793 |

| $ | 138,591 |

|

Adjustments: |

|

|

|

|

|

|

|

| ||||

Cost of product revenues: |

|

|

|

|

|

|

|

| ||||

Amortization expense |

| 5,459 |

|

| 1,466 |

|

| 10,901 |

|

| 2,197 |

|

Amortization of inventory step-up |

| 416 |

|

| — |

|

| 736 |

|

| — |

|

Adjusted Non-GAAP Gross Profit | $ | 53,663 |

| $ | 51,938 |

| $ | 108,430 |

| $ | 140,788 |

|

|

|

|

|

|

|

|

|

| ||||

EAGLE PHARMACEUTICALS, INC. |

| |||||||||||

RECONCILIATION OF GAAP ONCOLOGY GROSS PROFIT TO |

| |||||||||||

ADJUSTED ONCOLOGY NON-GAAP GROSS PROFIT (UNAUDITED) |

| |||||||||||

(In thousands) |

| |||||||||||

|

|

|

|

|

|

|

|

| ||||

| Three Months Ended June 30, |

| Six Months Ended June 30, |

| ||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

|

Revenue: |

|

|

|

|

|

|

|

| ||||

PEMFEXYTM | $ | 19,400 |

| $ | 16,504 |

| $ | 42,348 |

| $ | 53,686 |

|

BELRAPZO® |

| 6,848 |

|

| 8,131 |

|

| 13,198 |

|

| 14,080 |

|

BENDEKA® |

| 3,780 |

|

| 3,497 |

|

| 6,174 |

|

| 8,050 |

|

TREAKISYM |

| 728 |

|

| 812 |

|

| 2,083 |

|

| 2,266 |

|

Oncology product sales, net | $ | 30,756 |

| $ | 28,944 |

| $ | 63,803 |

| $ | 78,082 |

|

|

|

|

|

|

|

|

|

| ||||

BENDEKA® |

| 20,485 |

|

| 22,969 |

|

| 39,380 |

|

| 46,792 |

|

TREAKISYM |

| 1,168 |

|

| 1,966 |

|

| 2,357 |

|

| 3,929 |

|

Oncology royalty revenue | $ | 21,653 |

| $ | 24,935 |

| $ | 41,737 |

| $ | 50,721 |

|

|

|

|

|

|

|

|

|

| ||||

Oncology Total Revenue | $ | 52,409 |

| $ | 53,879 |

| $ | 105,540 |

| $ | 128,803 |

|

|

|

|

|

|

|

|

|

| ||||

Oncology cost of product sales |

| 10,466 |

|

| 12,653 |

|

| 20,146 |

|

| 25,340 |

|

Oncology cost of royalty revenue |

| — |

|

| 2,493 |

|

| — |

|

| 5,072 |

|

Oncology Gross Profit | $ | 41,943 |

| $ | 38,733 |

| $ | 85,394 |

| $ | 98,391 |

|

Adjustments: |

|

|

|

|

|

|

|

| ||||

Oncology cost of product revenues: |

|

|

|

|

|

|

|

| ||||

Oncology amortization expense |

| 1,867 |

|

| — |

|

| 3,714 |

|

| — |

|

Adjusted Oncology Non-GAAP Gross Profit | $ | 43,810 |

| $ | 38,733 |

| $ | 89,108 |

| $ | 98,391 |

|

|

|

|

|

|

|

|

|

| ||||

Important Safety Information for BARHEMSYS® (amisulpride)4 Injection

Contraindication

BARHEMSYS is contraindicated in patients with known hypersensitivity to amisulpride.

QT Prolongation

BARHEMSYS causes dose- and concentration-dependent prolongation of the QT interval. The recommended dosage is 5 mg or 10 mg as a single intravenous (IV) dose infused over 1 to 2 minutes.

Avoid BARHEMSYS in patients with congenital long QT syndrome and in patients taking droperidol.

Electrocardiogram (ECG) monitoring is recommended in patients with pre-existing arrhythmias/cardiac conduction disorders, electrolyte abnormalities (e.g., hypokalemia or hypomagnesemia), congestive heart failure, and in patients taking other medicinal products (e.g., ondansetron) or with other medical conditions known to prolong the QT interval.

Adverse Reactions

Common adverse reactions reported in ≥ 2% of adult patients who received BARHEMSYS 5 mg (n=748) and at a higher rate than placebo (n=741) in clinical trials for the prevention of PONV were: chills (4% vs. 3%), hypokalemia (4% vs. 2%), procedural hypotension (3% vs. 2%), and abdominal distention (2% vs. 1%).

Serum prolactin concentrations were measured in one prophylaxis study where 5% (9/176) of BARHEMSYS-treated patients had increased blood prolactin reported as an adverse reaction compared with 1% (1/166) of placebo-treated patients.

The most common adverse reaction, reported in ≥ 2% of adult patients who received BARHEMSYS 10 mg (n=418) and at a higher rate than placebo (n=416), in clinical trials for the treatment of PONV was infusion site pain (6% vs. 4%).

Use in Specific Populations

Lactation

Amisulpride is present in human milk. There are no reports of adverse effects on the breastfed child and no information on the effects of amisulpride on milk production.

BARHEMSYS may result in an increase in serum prolactin levels, which may lead to a reversible increase in maternal milk production. In a clinical trial, serum prolactin concentrations in females (n=112) increased from a mean of 10 ng/mL at baseline to 32 ng/mL after BARHEMSYS treatment and from 10 ng/mL to 19 ng/mL in males (n=61). No clinical consequences due to elevated prolactin levels were reported.

To minimize exposure to a breastfed infant, lactating women may consider interrupting breastfeeding and pumping and discarding breast milk for 48 hours after receiving a dose of BARHEMSYS.

Pediatric Use

Safety and effectiveness in pediatric patients have not been established.

Geriatric Use

No overall differences in safety or effectiveness were observed between these patients and younger patients, and other reported clinical experience has not identified differences in responses between the elderly and younger patients, but greater sensitivity of some older individuals cannot be ruled out.

Renal Impairment

Avoid BARHEMSYS in patients with severe renal impairment (estimated glomerular filtration rate [eGFR] < 30 mL/min/1.73 m2). The pharmacokinetics of amisulpride in patients with severe renal impairment have not been adequately studied in clinical trials. Amisulpride is known to be substantially excreted by the kidneys, and patients with severe renal impairment may have increased systemic exposure and an increased risk of adverse reactions.

No dosage adjustment is necessary in patients with mild to moderate renal impairment

(eGFR ≥ 30 mL/min/1.73 m2).

Drug Interactions

BARHEMSYS causes dose- and concentration-dependent QT prolongation. To avoid potential additive effects, avoid use of BARHEMSYS in patients taking droperidol.

ECG monitoring is recommended in patients taking other drugs known to prolong the QT interval (e.g., ondansetron).

Reciprocal antagonism of effects occurs between dopamine agonists (e.g., levodopa) and BARHEMSYS. Avoid using levodopa with BARHEMSYS.

Important Safety Information for BYFAVO™ (remimazolam)5 Injection

Indications

BYFAVO is a benzodiazepine indicated for the induction and maintenance of procedural sedation in adults undergoing procedures lasting 30 minutes or less.

Important Safety Information

WARNING: PERSONNEL AND EQUIPMENT FOR MONITORING AND RESUSCITATION AND RISKS FROM CONCOMITANT USE WITH OPIOID ANALGESICS

Personnel and Equipment for Monitoring and Resuscitation

Only personnel trained in the administration of procedural sedation, and not involved in the conduct of the diagnostic or therapeutic procedure, should administer BYFAVO.

Administering personnel must be trained in the detection and management of airway obstruction, hypoventilation, and apnea, including the maintenance of a patent airway, supportive ventilation, and cardiovascular resuscitation.

BYFAVO has been associated with hypoxia, bradycardia, and hypotension. Continuously monitor vital signs during sedation and during the recovery period.

Resuscitative drugs, and age- and size-appropriate equipment for bag-valve-mask–assisted ventilation must be immediately available during administration of BYFAVO.

Risks From Concomitant Use With Opioid Analgesics and Other Sedative-Hypnotics

Concomitant use of benzodiazepines, including BYFAVO, and opioid analgesics may result in profound sedation, respiratory depression, coma, and death. The sedative effect of intravenous BYFAVO can be accentuated by concomitantly administered CNS depressant medications, including other benzodiazepines and propofol. Continuously monitor patients for respiratory depression and depth of sedation.

Contraindication

BYFAVO is contraindicated in patients with a history of severe hypersensitivity reaction to dextran 40 or products containing dextran 40.

Personnel and Equipment for Monitoring and Resuscitation

Clinically notable hypoxia, bradycardia, and hypotension were observed in Phase 3 studies of BYFAVO. Continuously monitor vital signs during sedation and through the recovery period. Only personnel trained in the administration of procedural sedation, and not involved in the conduct of the diagnostic or therapeutic procedure, should administer BYFAVO. Administering personnel must be trained in the detection and management of airway obstruction, hypoventilation, and apnea, including the maintenance of a patent airway, supportive ventilation, and cardiovascular resuscitation. Resuscitative drugs, and age- and size-appropriate equipment for bag-valve-mask–assisted ventilation must be immediately available during administration of BYFAVO. Consider the potential for worsened cardiorespiratory depression prior to using BYFAVO concomitantly with other drugs that have the same potential (e.g., opioid analgesics or other sedative-hypnotics). Administer supplemental oxygen to sedated patients through the recovery period. A benzodiazepine reversal agent (flumazenil) should be immediately available during administration of BYFAVO.

Risks From Concomitant Use With Opioid Analgesics and Other Sedative-Hypnotics

Concomitant use of BYFAVO and opioid analgesics may result in profound sedation, respiratory depression, coma, and death. The sedative effect of IV BYFAVO can be accentuated when administered with other CNS depressant medications (eg, other benzodiazepines and propofol). Titrate the dose of BYFAVO when administered with opioid analgesics and sedative-hypnotics to the desired clinical response. Continuously monitor sedated patients for hypotension, airway obstruction, hypoventilation, apnea, and oxygen desaturation. These cardiorespiratory effects may be more likely to occur in patients with obstructive sleep apnea, the elderly, and ASA-PS class III or IV patients.

Hypersensitivity Reactions

BYFAVO contains dextran 40, which can cause hypersensitivity reactions, including rash, urticaria, pruritus, and anaphylaxis. BYFAVO is contraindicated in patients with a history of severe hypersensitivity reaction to dextran 40 or products containing dextran 40.

Neonatal Sedation

Use of benzodiazepines during the later stages of pregnancy can result in sedation (respiratory depression, lethargy, hypotonia) in the neonate. Observe newborns for signs of sedation and manage accordingly.

Pediatric Neurotoxicity

Published animal studies demonstrate that anesthetic and sedation drugs that block NMDA receptors and/or potentiate GABA activity increase neuronal apoptosis in the developing brain and result in long-term cognitive deficits when used for longer than 3 hours. The clinical significance of this is not clear. However, the window of vulnerability to these changes is believed to correlate with exposures in the third trimester of gestation through the first several months of life but may extend out to approximately 3 years of age in humans.

Anesthetic and sedation drugs are a necessary part of the care of children needing surgery, other procedures, or tests that cannot be delayed, and no specific medications have been shown to be safer than any other. Decisions regarding the timing of any elective procedures requiring anesthesia should take into consideration the benefits of the procedure weighed against the potential risks.

Adverse Reactions

The most common adverse reactions reported in >10% of patients (N=630) receiving BYFAVO 5-30 mg (total dose) and undergoing colonoscopy (two studies) or bronchoscopy (one study) were: hypotension, hypertension, diastolic hypertension, systolic hypertension, hypoxia, and diastolic hypotension.

Use in Specific Populations

Pregnancy

There are no data on the specific effects of BYFAVO on pregnancy. Benzodiazepines cross the placenta and may produce respiratory depression and sedation in neonates. Monitor neonates exposed to benzodiazepines during pregnancy and labor for signs of sedation and respiratory depression.

Lactation

Monitor infants exposed to BYFAVO through breast milk for sedation, respiratory depression, and feeding problems. A lactating woman may consider interrupting breastfeeding and pumping and discarding breast milk during treatment and for 5 hours after BYFAVO administration.

Pediatric Use

Safety and effectiveness in pediatric patients have not been established. BYFAVO should not be used in patients less than 18 years of age.

Geriatric Use

No overall differences in safety or effectiveness were observed between these subjects and younger subjects. However, there is a potential for greater sensitivity (eg, faster onset, oversedation, confusion) in some older individuals. Administer supplemental doses of BYFAVO slowly to achieve the level of sedation required and monitor all patients closely for cardiorespiratory complications.

Hepatic Impairment

In patients with severe hepatic impairment, the dose of BYFAVO should be carefully titrated to effect. Depending on the overall status of the patient, lower frequency of supplemental doses may be needed to achieve the level of sedation required for the procedure. All patients should be monitored for sedation-related cardiorespiratory complications.

Abuse and Dependence

BYFAVO is a federally controlled substance (CIV) because it contains remimazolam which has the potential for abuse and physical dependence.

1 Adjusted non-GAAP net income, adjusted non-GAAP earnings per share, adjusted non-GAAP EBITDA, adjusted non-GAAP gross margin, adjusted non-GAAP gross profit, adjusted non-GAAP R&D expense and adjusted non-GAAP SG&A expense are non-GAAP financial measures. For descriptions and reconciliations of these non-GAAP financial measures for historical periods to their most comparable GAAP financial measures, please see below and the tables at the end of this press release.

2 Data on file.

3 IQVIA SMART-US weekly volume data for the second quarter of 2023.

4 https://bynder.acaciapharma.com/m/5d7c2cd0d58865f7/original/Barhemsys-Prescribing-Information.pdf

5 https://bynder.acaciapharma.com/m/403e8c343b2922de/original/Byfavo-PI.pdf

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/14a8361c-807d-4ff7-a73f-200b78f19bd4