Earnings growth of 0.4% over 5 years hasn't been enough to translate into positive returns for Malvern Bancorp (NASDAQ:MLVF) shareholders

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Malvern Bancorp, Inc. (NASDAQ:MLVF), since the last five years saw the share price fall 39%. More recently, the share price has dropped a further 11% in a month. We do note, however, that the broader market is down 6.2% in that period, and this may have weighed on the share price.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Malvern Bancorp

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Malvern Bancorp became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Arguably, the revenue drop of 3.3% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

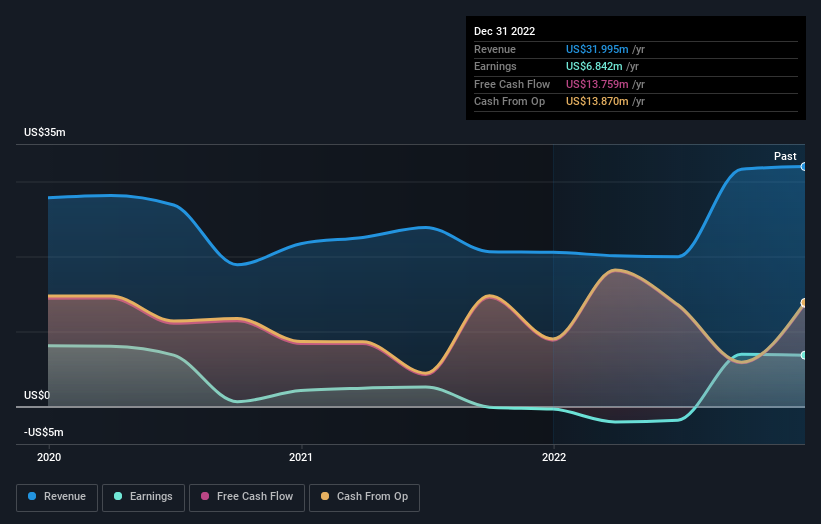

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Malvern Bancorp's earnings, revenue and cash flow.

A Different Perspective

While it's never nice to take a loss, Malvern Bancorp shareholders can take comfort that their trailing twelve month loss of 2.4% wasn't as bad as the market loss of around 7.3%. Of far more concern is the 7% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Malvern Bancorp , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here