Earnings growth of 15% over 1 year hasn't been enough to translate into positive returns for Huadi International Group (NASDAQ:HUDI) shareholders

While it may not be enough for some shareholders, we think it is good to see the Huadi International Group Co., Ltd. (NASDAQ:HUDI) share price up 24% in a single quarter. It's not great that the stock is down over the last year. But it did better than its market, which fell 22%.

If the past week is anything to go by, investor sentiment for Huadi International Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Huadi International Group

While Huadi International Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Huadi International Group saw its revenue grow by 22%. That's definitely a respectable growth rate. Considering the limp overall market, the share price loss of 15% over the year isn't too bad. We'd venture the revenue growth helped inspire some faith from holders. So we definitely think this is a good candidate for further research; share price down, revenue up.

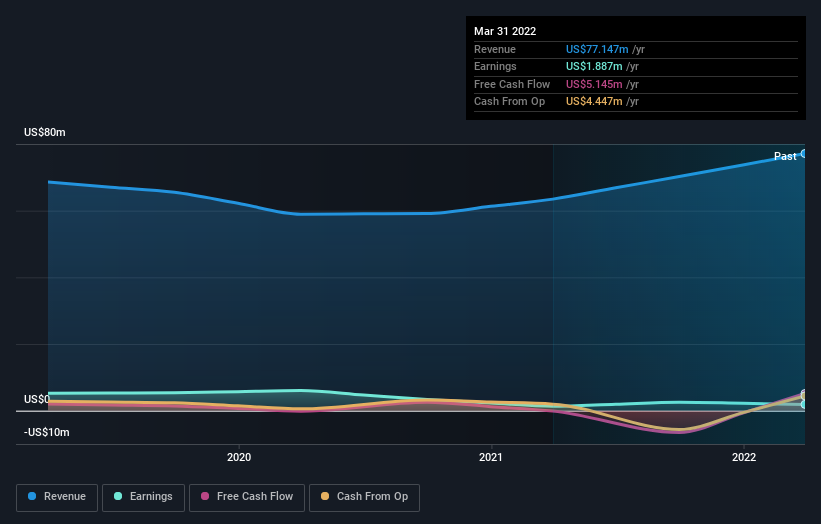

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's not great that Huadi International Group shares failed to make money for shareholders in the last year, but the silver lining is that the loss of 15%, wasn't as bad as the broader market loss of about 22%. At least the recent returns have been positive, with the stock up 24% in around 90 days. The recent uptick could be an early suggestion that the prior falls were too extreme; but we'll need to see how the business progresses. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Huadi International Group .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here