Before Earnings on Wednesday, Look at Etsy, Inc.'s (NASDAQ:ETSY) Ownership Structure

This article was originally published on Simply Wall St News

A look at the shareholders of Etsy, Inc. (NASDAQ:ETSY) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies.

Etsy seems to be a loved by "Smart Money", because it is predominantly owned by institutions. In this article, we will analyze what that means for the stock and what can keep in mind on Wednesday's earnings call.

Etsy is a pretty big company. It has a market capitalization of US$23b.

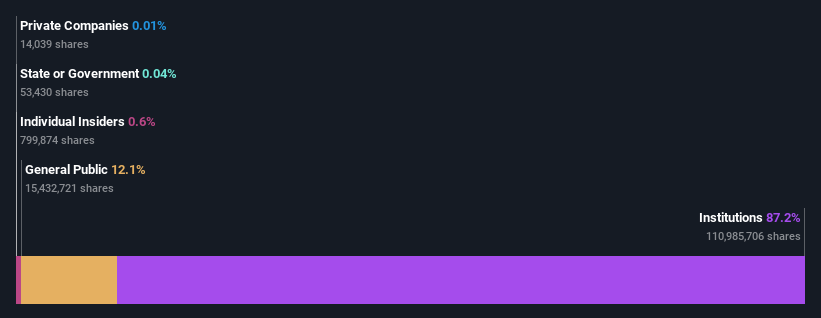

Taking a look at our data on the ownership groups (below), it seems that ownership is split between institutional investors and the general public.

We can zoom in on the different ownership groups, to learn more about Etsy.

See our latest analysis for Etsy

What Does The Institutional Ownership Tell Us About Etsy?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

We can see that Etsy does have institutional investors, and they hold about 87% of the company's stock.

This implies the analysts working for those institutions have looked at the stock and they like it. Most of the large holders employ predominantly long strategies, and it would take some rough volatility to shake them out of their positions. You can view the list of major holders for Etsy HERE.

Institutions engage in stocks that have a positive growth outlook or are engaged in maximizing value. Since Etsy is a young growing, their future outlook is very important and earnings calls are meaningful. That is why we are going to look at how much and in what way Etsy is estimated to grow.

You can see Etsy's historic earnings and revenue below, but keep in mind there's always more to the story.

We can see that Etsy has grown and is also expected to grow quite a bit. The possible growth pathways are via expansion and acquisitions. Etsy is currently profitable and starting to grow via Acquisitions. On 2nd June 2021 Etsy announced the acquisition of Depop for US$1.6b and on the 28th June they also announced the acquisition of Elo7 Serviços de Informática for US$220m.

This is also signaling a different approach by the company to institutional investors. Meaning that Etsy will need more legal, financial and consulting services as their expense items, and that organic growth is not keeping up with the market cap of the company.

Hedge funds don't have many shares in Etsy. The Vanguard Group, Inc. is currently the largest shareholder, with 11% of shares outstanding. For context, the second largest shareholder holds about 7.9% of the shares outstanding, followed by an ownership of 6.6% by the third-largest shareholder.

Looking at the shareholder registry, we can see that 51% of the ownership is controlled by the top 17 shareholders, meaning that no single shareholder has a majority interest in the ownership.

Key Takeaways

Etsy's Wednesday earnings call is meaningful for investors as it will tell us if the company is on track, or that products have become too discrete (luxurious, expensive) for the current purchasing power of consumers.

Institutions own and control the company, but no-one has the majority of shares. This gives management more steering power in the company as long as they deliver on the bottom line.

Etsy has strong growth outlooks, and institutions may ride the stock even during volatility because it has large profit potential.

It's always worth thinking about the different groups who own shares in a company. But to understand Etsy better, we need to consider many other factors. For instance, we've identified 2 warning signs for Etsy that you should be aware of.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com