East West Bancorp (EWBC) Q2 Earnings Meet, Expenses Rise Y/Y

East West Bancorp’s EWBC earnings per share of $2.20 in the quarter met the Zacks Consensus Estimate. The bottom line jumped 21.5% from the prior-year quarter.

Results were primarily aided by higher net interest income (NII) and reflected an improvement in profitability ratios. The company also witnessed a rise in loan and deposit balances during the quarter. However, an increase in non-interest expenses and higher provisions were the undermining factors.

Net income was $312 million, surging 20.8% from the year-ago quarter. Our estimate for the metric was $301.8 million.

Revenues Improve, Expenses Rise

Net revenues came in at $645.4 million, rising 17% year over year. However, the top line missed the Zacks Consensus Estimate of $658.4 million.

NII was $566.7 million, which grew 19.8% year over year. Net interest margin (NIM) expanded 32 basis points to 3.55%. We had expected NII and NIM to be $594.9 and 3.88%, respectively, but substantially higher deposit account expenses led the company to post lower numbers.

Non-interest income was $78.6 million, marginally up from the year-ago quarter. The improvement was driven by an increase in lending fees, foreign exchange income, wealth management fees and other income. We had estimated non-interest income to be $60.7 million on the back of a challenging operating backdrop. However, a slight improvement in the operating environment in the later part of the quarter helped the company to report higher numbers.

Non-interest expenses were up 33% to $261.8 million. The increase was mainly due to a rise in all components except data processing expenses. Our estimate for the same was $251.7 million.

Efficiency ratio was 40.56%, up from 35.70% in the prior-year quarter. A rise in the efficiency ratio indicates a decrease in profitability.

As of Jun 30, 2023, net loans were $49.2 billion, up 1.9% sequentially. Total deposits were increased 1.7% to $55.7 billion. Our estimate for net loans and total deposits were $49.4 billion and $54.2 billion, respectively.

Credit Quality Worsens

Annualized quarterly net charge-offs were 0.06% of average loans held for investment against net recoveries of 0.06% year over year. As of Jun 30, 2023, non-performing assets amounted to $115.5 million, rising 28.5%.

Provision for credit losses was $26 million, which rose 92.6% from $13.5 million in the prior-year quarter. Our estimate for the same was $33.6 million.

Capital Ratios and Profitability Ratios Improve

As of Jun 30, 2023, the common equity Tier 1 capital ratio was 13.17%, up from 11.97% as of Jun 30, 2022. Total risk-based capital ratio was 14.60%, up from 13.25% in the prior-year quarter.

At the end of the second quarter, the return on average assets was 1.85%, up from 1.66% as of Jun 30, 2022. Return on average tangible equity was 21.01%, up from 19.94% as of Jun 30, 2022.

Our View

East West Bancorp is well-poised for organic growth on continued improvement in loan balances, increasing interest rates and efforts to improve fee income. However, a rise in expenses and a tough macroeconomic environment are likely to hurt the bottom line.

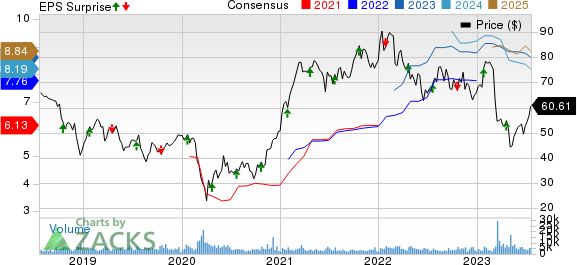

East West Bancorp, Inc. Price, Consensus and EPS Surprise

East West Bancorp, Inc. price-consensus-eps-surprise-chart | East West Bancorp, Inc. Quote

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

First Horizon National Corporation’s FHN second-quarter 2023 adjusted earnings per share (excluding notable items) of 39 cents surpassed the Zacks Consensus Estimate. The figure also improved 14.7% year over year.

Results benefited from higher NII and non-interest income. Also, improving loan and deposit balances were tailwinds. However, FHN's higher provisions and rising expenses were undermining factors.

KeyCorp’s KEY second-quarter 2023 earnings from continuing operations of 27 cents per share missed the Zacks Consensus Estimate of 29 cents. The bottom line declined 50% from the prior-year quarter.

KEY's results have been primarily hurt by declines in NII and fee income. A significant increase in provisions was another negative. However, marginally lower expenses aided the results to some extent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KeyCorp (KEY) : Free Stock Analysis Report

First Horizon Corporation (FHN) : Free Stock Analysis Report

East West Bancorp, Inc. (EWBC) : Free Stock Analysis Report