East West Bancorp Inc Reports Solid Full Year 2023 Earnings with Net Income of $1.2 Billion

Net Income: Reported $1.2 billion for full year 2023, a 3% increase year-over-year.

Diluted Earnings per Share: $8.18 for full year, with an adjusted EPS of $8.56 after excluding specific charges.

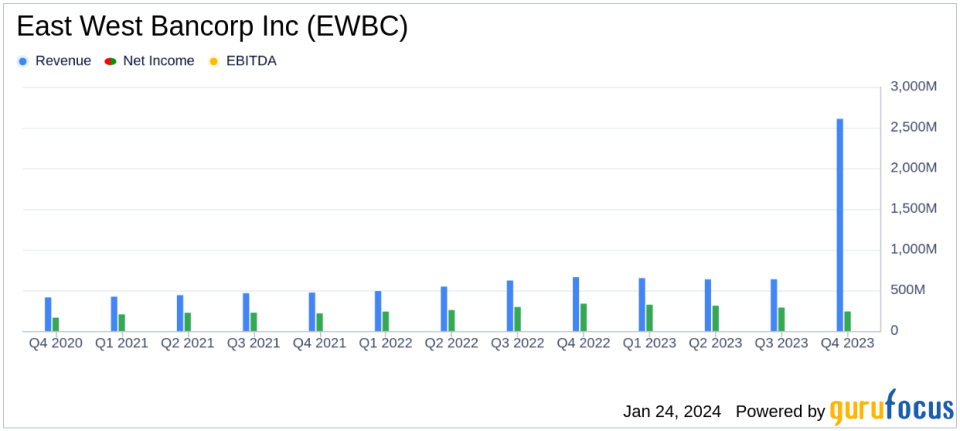

Revenue: Reached a record $2.6 billion, up 11% from the previous year.

Dividend: Increased quarterly common stock dividend by 15%, now $0.55 per share.

Assets: Total assets grew by 9% year-over-year to $69.6 billion.

Loan Portfolio: Total loans increased by 8% year-over-year, reaching a record $52.2 billion.

Capital Ratios: Common equity tier 1 (CET1) capital ratio increased to 13.31%.

On January 23, 2024, East West Bancorp Inc (NASDAQ:EWBC) released its 8-K filing, announcing its financial results for the full year and fourth quarter of 2023. The company, which operates East West Bank with a unique focus on the United States and China cross-border operations, reported a net income of $1.2 billion, or $8.18 per diluted share for the full year. Adjusted for specific charges, the diluted earnings per share stood at $8.56. The fourth quarter net income was reported at $239 million, or $1.69 per diluted share, with an adjusted figure of $2.02.

East West Bancorp Inc's performance in 2023 was marked by resilience and growth, despite a challenging economic environment. The company's revenue increased by 11% to a record $2.6 billion, and its adjusted pre-tax, pre-provision income rose by 12% to $1.8 billion. The bank's strategic focus on expanding its deposit base and leveraging its cross-border expertise has contributed to its financial achievements.

Financial Performance and Balance Sheet Strength

East West Bancorp Inc's total assets grew significantly, with a 9% increase year-over-year, totaling $69.6 billion. The loan portfolio also saw robust growth, with total loans reaching $52.2 billion, a record high for the bank. This growth in loans reflects the bank's ability to attract and retain customers, as well as its sound lending practices. The total deposits increased modestly by $125 million from the previous year, indicating a stable deposit base.

The bank's capital levels remained strong, with stockholders' equity rising to $7.0 billion, a 5% increase from the previous quarter. The tangible book value per share increased by 18% year-over-year to $46.27, demonstrating the bank's ability to grow shareholder value. Furthermore, the CET1 capital ratio improved, highlighting the bank's robust capital position and its preparedness to navigate potential economic uncertainties.

Challenges and Adjustments

Despite the positive financial outcomes, East West Bancorp Inc faced challenges, including a $70 million FDIC special assessment-related expense and net losses on an available-for-sale (AFS) debt security. These factors necessitated adjustments to the reported earnings per share. The bank's efficiency ratio, a measure of noninterest expense to revenue, worsened slightly in the fourth quarter due to these charges. However, the adjusted efficiency ratio remained strong, reflecting the bank's continued focus on cost control and operational efficiency.

Dividend Payout and Share Repurchase

In a move that underscores confidence in its financial health and commitment to shareholder returns, East West Bancorp Inc increased its quarterly common stock dividend by 15%. The bank also continued its share repurchase program, buying back 1.5 million shares of common stock during the fourth quarter for approximately $82 million. This capital action, along with the dividend increase, signals the bank's strong capital generation capabilities and its proactive approach to capital management.

As East West Bancorp Inc moves forward, the bank's financial results reflect a solid foundation for continued growth and a commitment to delivering value to shareholders. The bank's strategic positioning, with its focus on cross-border banking services and a diversified balance sheet, positions it well to capitalize on new opportunities and navigate potential challenges in the financial landscape.

For more detailed insights and analysis, investors and interested parties are invited to join East West Bancorp Inc's conference call discussing the fourth quarter 2023 earnings and operating developments.

Explore the complete 8-K earnings release (here) from East West Bancorp Inc for further details.

This article first appeared on GuruFocus.