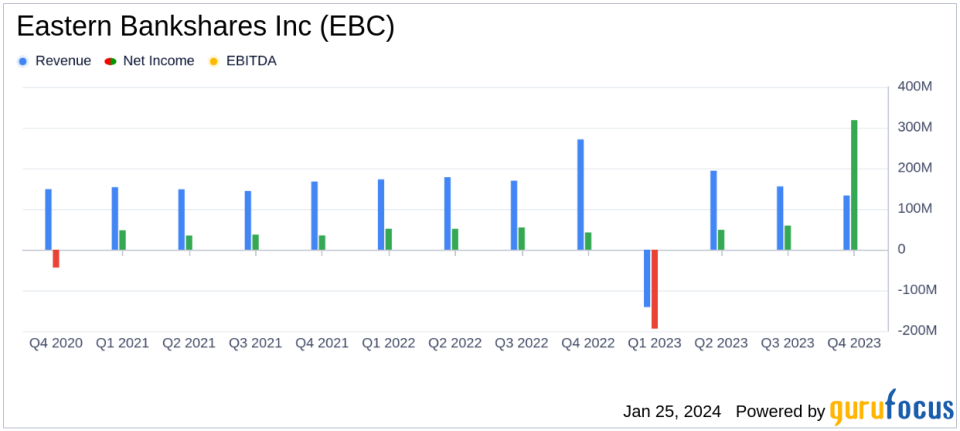

Eastern Bankshares Inc (EBC) Reports Significant Gain from Insurance Operations Sale in Q4 2023

Net Income: Reported a substantial increase to $318.5 million, or $1.95 per diluted share, largely due to the sale of Eastern Insurance.

Core Deposits Growth: Core deposits rose by $516.2 million, reflecting a 3.0% increase from the previous quarter.

Loan Portfolio Expansion: Total loans saw a modest uptick, increasing by $54.2 million to $14.0 billion.

Net Interest Margin: Experienced a slight compression to 2.69%, an 8 basis point decrease from the prior quarter.

Asset Quality: Nonperforming loans (NPLs) represented 0.38% of total loans, with an annualized net charge-off rate of 0.32% for the quarter.

Dividend Declaration: Announced a quarterly cash dividend of $0.11 per common share, payable on March 15, 2024.

Capital Strength: Shareholders equity increased by $528.3 million, primarily due to the net gain from the insurance transaction.

On January 25, 2024, Eastern Bankshares Inc (NASDAQ:EBC) released its 8-K filing, detailing the financial outcomes of the fourth quarter of 2023. The company, a commercial bank serving retail, commercial, and small business customers with a variety of products including lending, deposit, wealth management, and insurance, reported a significant increase in net income, largely attributable to the sale of its insurance operations.

The strategic sale of Eastern Insurance to Arthur J. Gallagher & Co. for $515 million resulted in an after-tax gain of $294.5 million, which is reflected in the fourth quarter results. This transaction has not only improved Eastern's capital and funding position but also sharpened its focus on core banking business growth and strategic initiatives, such as the pending merger with Cambridge Bancorp.

CEO Bob Rivers commented on the year's strategic repositioning, highlighting the challenges faced by banks due to higher interest rates and a difficult macroeconomic environment. Rivers noted the company's proactive steps, including repositioning its securities portfolio and capitalizing on the valuation premium commanded by Eastern Insurance. He expressed confidence that these transactions have laid a stronger financial foundation and will lead to enhanced shareholder earnings.

"2023 was a year of strategic repositioning for Eastern," said Bob Rivers, Chief Executive Officer and Chair of the Board of Eastern Bankshares, Inc. and Eastern Bank. "We realized early in 2023 that all banks were going to face significant challenges due to higher interest rates, changing customer deposit preferences and a very difficult macroeconomic environment. We responded by repositioning our securities portfolio in the first quarter, which allowed us to improve both our liquidity and earnings outlook, and followed with the sale of Eastern Insurance in the second half of the year to capitalize on the valuation premium it commanded. The insurance transaction provided us additional liquidity and capital, and positioned us to announce our merger with Cambridge Bancorp, a highly attractive in-market merger partner with a valuable wealth management business. We are very confident that these transactions provide us with a greater financial foundation, stronger earnings for our shareholders, and a leading market share in our footprint. The upcoming merger is the next step in our journey and we all look forward to welcoming the colleagues and customers of Cambridge Trust to Eastern."

Eastern Bankshares Inc's balance sheet remained stable with total assets at $21.1 billion. The company saw an increase in total deposits and loans, indicating continued growth in its core banking operations. The net interest margin, however, experienced a slight compression, which is a critical metric for the banking industry as it reflects the difference between the interest income generated and the amount of interest paid out to lenders, relative to the bank's interest-earning assets.

Asset quality remained solid with nonperforming loans constituting a small fraction of the total loan portfolio. The company's capital adequacy was strengthened, with shareholders' equity increasing significantly, primarily due to the net gain from the insurance transaction. This increase in capital provides a buffer against potential losses and supports future growth opportunities.

Eastern Bankshares Inc's performance in the fourth quarter of 2023 demonstrates its ability to navigate a challenging economic landscape and make strategic decisions that enhance its financial position. The company's focus on core deposit growth and prudent loan expansion, coupled with strategic transactions like the sale of its insurance operations, positions it well for continued success in the competitive banking sector.

Explore the complete 8-K earnings release (here) from Eastern Bankshares Inc for further details.

This article first appeared on GuruFocus.