The Eastern Co (EML) Reports Mixed Results for Q4 and Full Year 2023

Gross Margin: Increased to 26.8% in Q4 2023 from 16.6% in Q4 2022.

Operational Cash Flow: Rose by $19.0 million for the year ended December 30, 2023.

Earnings Per Share (EPS): Increased to $0.56 in Q4 2023 from $0.03 in Q4 2022.

Net Sales: Decreased by 3.0% in Q4 and 2.0% for the full year 2023.

Net Income: Increased in Q4 to $3.5 million but decreased 22% to $8.6 million for the full year.

Adjusted EBITDA: Improved to $7.2 million in Q4 2023 from $3.3 million in Q4 2022.

Debt Reduction: Achieved a $20.2 million debt paydown enabled by increased cash flow.

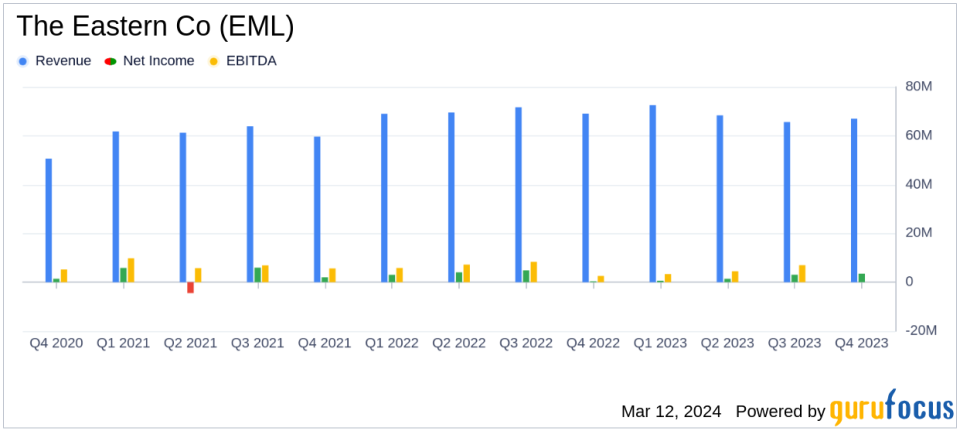

The Eastern Co (NASDAQ:EML) released its 8-K filing on March 12, 2024, disclosing its financial performance for the fourth quarter and full year ended December 30, 2023. The company, known for its engineered solutions serving various industrial markets, has reported mixed results with a notable increase in gross margin and operational cash flow, despite a decline in net sales.

Financial Performance Summary

The Eastern Co (NASDAQ:EML) experienced a sequential increase in gross margin throughout 2023, culminating in a significant rise to 26.8% in the fourth quarter compared to the same period in the previous year. This improvement reflects lower material and freight costs, improved pricing, and a favorable adjustment to the LIFO reserve. Operational cash flow also saw a substantial increase, allowing the company to pay down $20.2 million in debt.

However, net sales saw a slight decline, with a 3.0% decrease in the fourth quarter and a 2.0% decrease for the full year, primarily due to lower demand for truck accessories and returnable transport packaging products. Despite this, the company's backlog increased by 10.5%, indicating potential for future revenue growth.

Challenges and Strategic Focus

President and CEO Mark Hernandez highlighted the challenges faced in 2023, including decreased revenues due to supply chain normalization and capacity issues in the commercial truck sector. Nevertheless, the company's strategic focus on disciplined operations, capital utilization, focused commercial business, and value-adding acquisitions has led to improved gross margin, earnings, and cash flow.

"Our plan to drive shareholder value is working well and we are continuing to follow our strategy in 2024," said Hernandez. "Our greatly strengthened balance sheet increases our opportunity to add accretive acquisitions to Easterns existing portfolio."

Despite the positive momentum in operational efficiency, net income for the full year decreased by 22% to $8.6 million, impacted by various adjustments and expenses, including pension cost adjustments and the closure of Associated Toolmakers Ltd.

Looking Ahead

The Eastern Co (NASDAQ:EML) is committed to continuing its strategic initiatives into 2024, with a focus on optimizing its supply chain under the "One Eastern" approach. This strategy aims to reduce manufacturing and supply chain costs, increase earnings from operations, and enhance product competitiveness and profitability.

Investors and stakeholders can access further details of The Eastern Co's financial performance and strategic outlook during the conference call scheduled for March 13, 2024.

The Eastern Co's ability to improve operational efficiency and gross margin in a challenging sales environment demonstrates resilience and strategic adaptability. As the company continues to execute its growth strategy and optimize operations, investors may find The Eastern Co (NASDAQ:EML) an interesting prospect for value creation.

For a detailed analysis of The Eastern Co's financials and strategic initiatives, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Eastern Co for further details.

This article first appeared on GuruFocus.