Eastman Chemical (EMN) to Post Q3 Earnings: What's in Store?

Eastman Chemical Company EMN is scheduled to release third-quarter 2023 results after the closing bell on Oct 26.

The company surpassed Zacks Consensus Estimate for earnings in three of the last four quarters while missing it once. It delivered a trailing four-quarter earnings surprise of around 2.2% on average. It pulled off an earnings surprise of 2.1% in the last reported quarter.

Eastman is expected to have benefited from cost-cutting and productivity initiatives, as well as its innovation-driven growth strategy. However, headwinds, including lower demand and customer de-stocking, are likely to have weighed on its third-quarter performance.

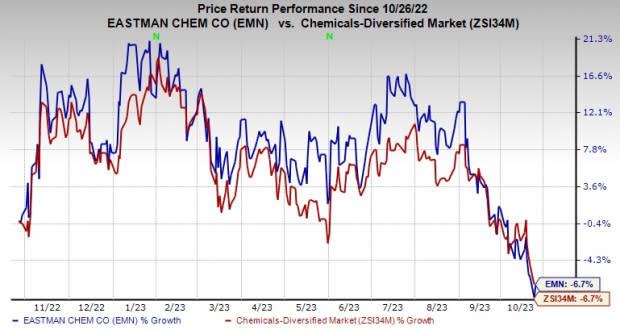

The stock has lost 6.7% in the past year in line with industry’s fall of 6.7%.

Image Source: Zacks Investment Research

What Do the Estimates Say?

The Zacks Consensus Estimate for sales for the to-be-reported quarter is currently pegged at $2,260.8 million, which implies a decline of 16.6% from the year-ago reported number.

Our estimate for EMN’s Additives and Functional Products division’s revenues is pegged at $736.1 million, suggesting a fall of 18.8% year over year. The same for the Advanced Materials unit’s revenues is $741.5 million, indicating a decline of 16.5%.

Our estimate for Eastman’s Chemical Intermediates segment’s revenues is pegged at $470.5 million, suggesting a decline of 29.3%. The same for Fiber Segment stands at $318.1 million, indicating an increase of 27.3% year over year.

Some Factors to Watch

Eastman is expected to have benefited from its cost-cutting measures. The company's operational transformation effort is likely to have resulted in decreased operating costs in the third quarter. It is on target to save more than $200 million in production, supply chain and non-manufacturing costs by 2023, net of inflation. Lower raw material and energy costs, as well as pricing actions, are likely to have aided the company's bottom line.

The company’s performance is likely to have been supported by efforts to generate new business revenues from its innovative growth model. Its innovation and market development initiatives are expected to have aided sales volumes in the quarter.

Eastman Chemical's performance is likely to have been hurt by the lingering impacts of customer inventory de-stocking. In the second quarter of 2023, the company saw lackluster demand and customer de-stocking in its consumer durables, building & construction, consumables and agriculture end markets. De-stocking is likely to have had an impact on the company's volumes and top line in the third quarter as well.

The company, in July 2023, reduced its demand growth prediction and now anticipates primary demand in several of its end markets to be flat in the second half compared to the first. It also anticipates that customer de-stocking will continue. EMN expects adjusted earnings per share to be lower in the second half of 2023 than in the first half.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Eastman Chemical this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for Eastman Chemical is -2.59%. This is because the Most Accurate Estimate is currently pegged at $1.41 while the Zacks Consensus Estimate stands at $1.45. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Eastman Chemical currently carries a Zacks Rank #3.

Eastman Chemical Company Price and EPS Surprise

Eastman Chemical Company price-eps-surprise | Eastman Chemical Company Quote

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider, as our model shows these have the right combination of elements to post an earnings beat this quarter:

Kinross Gold Corporation KGC, slated to release earnings on Nov 8, has an Earnings ESP of +8.70% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks Rank #1 stocks here.

The Zacks Consensus Estimate for earnings for KGC for the third quarter is pegged at 9 cents.

LyondellBasell Industries N.V. LYB, scheduled to release earnings on Oct 27, has an Earnings ESP of +5.14% and carries a Zacks Rank #3.

The consensus estimate for LYB’s earnings for the third quarter is currently pegged at $1.98.

IAMGOLD Corporation IAG, which is scheduled to release earnings on Nov 9, has an Earnings ESP of +100.00% and carries a Zacks Rank #1.

The consensus estimate for IAG for the third quarter is currently pegged at a loss of 2 cents.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Iamgold Corporation (IAG) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report