Eastman Chemical (EMN) Q3 Earnings & Sales Beat Estimates

Eastman Chemical Company EMN recorded a third-quarter 2023 profit of $178 million or $1.49 per share compared with $301 million or $2.46 in the year-ago quarter.

Barring one-time items, earnings were $1.47 per share, down from $2.05 in the year-ago quarter. Earnings surpassed the Zacks Consensus Estimate of $1.45.

Revenues declined around 16.3% year over year to $2,267 million in the quarter. The figure beat the Zacks Consensus Estimate of $2,260.8 million. The top line was hurt by lower sales volumes and selling prices.

Eastman Chemical Company Price, Consensus and EPS Surprise

Eastman Chemical Company price-consensus-eps-surprise-chart | Eastman Chemical Company Quote

Segment Review

Revenues from the Additives and Functional Products division declined 26% year over year to $670 million in the reported quarter, primarily due to lower sales volume and lower selling prices. Sales volume declined across the segment due to weak demand, notably in the building and construction, as well as aggressive customer inventory destocking in the agriculture market. Selling prices fell mainly due to cost-pass-through contracts. The figure was lower than our estimate of $736.1 million.

Revenues from the Advanced Materials unit declined 16% year over year to $746 million in the reported quarter due to lower sales volume. While specialty plastics end-market demand improved from the prior quarter, sales volume was lower as the business recovered from weak demand and aggressive customer inventory destocking, especially in consumer durables, medical and consumables end markets. The figure was higher than our estimate of $741.5 million.

Chemical Intermediates sales fell 20.8% year over year to $527 million due to lower selling prices and a fall in sales volume. Lower selling prices and sales volume, especially for olefins, were mainly due to soft end-market demand. The figure was higher than our estimate of $470.5 million.

Fibers segment sales increased 29.2% year over year to $323 million due to higher selling prices. Selling prices for acetate tow rose significantly due to an increase in industry capacity utilization and higher raw material, energy and distribution prices throughout 2022. This was higher than our estimate of $318.1 million.

Financials

Eastman Chemical ended the quarter with cash and cash equivalents of $439 million, a roughly 4.8% year-over-year decline. Net debt at the end of the quarter was $4,781 million.

Operating cash flow was $514 million, up from $256 million in the third quarter of 2022. The company returned $94 million to shareholders in the third quarter of 2023 through dividends and share repurchases.

Guidance

The company stated that it is seeing muted demand heading into the fourth quarter as customers are cautious in the prevailing challenging environment. In addition, it anticipates regular seasonality in key end markets, including building and construction, consumer durables and performance films for automotive applications. It expects EPS for 2023 to be between $6.30 and $6.50. Furthermore, EMN expects to deliver $1.4 billion in operating cash flow in 2023.

Price Performance

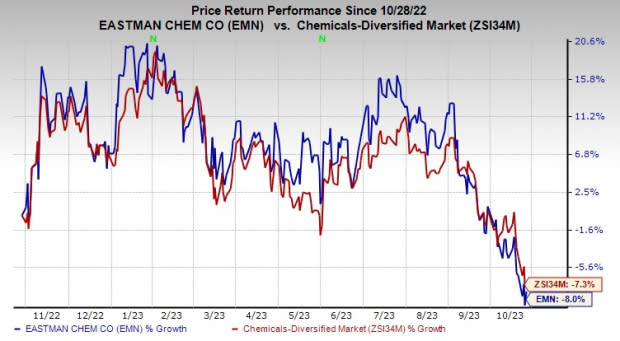

Eastman Chemical’s shares have lost 8% over a year compared with a 7.3% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eastman currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Equinox Gold Corp. EQX, Koppers Holdings Inc. KOP and The Andersons Inc. ANDE.

Equinox has a projected earnings growth rate of 90% for the current year. It currently carries a Zacks Rank #1 (Strong Buy). Equinox delivered a trailing four-quarter earnings surprise of roughly 18.1%, on average. The stock is up around 33.5% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Koppers has a projected earnings growth rate of 7.5% for the current year. It currently carries a Zacks Rank #2 (Buy). Koppers delivered a trailing four-quarter earnings surprise of roughly 21.7%, on average. The stock is up around 46% in a year.

Andersons currently carries a Zacks Rank #2. The stock has gained roughly 43.4% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report