Eastman (EMN) Exploring Expansion of Interlayers in Europe

Eastman Chemical Company EMN recently said it is committed to addressing the expanding global demand for specialty interlayer products by strengthening its regional service capabilities and investing in asset capacities to meet the high-performance product needs of glass laminators. Eastman announced a feasibility study to upgrade and extend extrusion capability for interlayer production in Europe to meet regional and global demand for Saflex polyvinyl butyral (PVB) products.

Eastman is exploring ways to expand its asset footprint in order to maintain high quality, dependability and services for its automotive and architectural customers.

Furthermore, the company intends to use its innovation strengths to assist its partners in enabling their growth objectives and driving sustainable solutions in response to quickly evolving trends in automotive and building and construction.

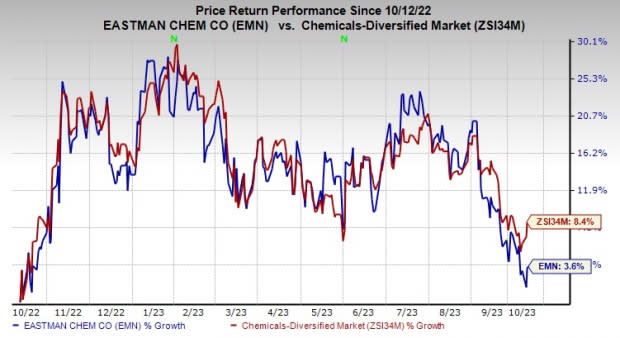

Shares of EMN have gained 3.6% over the past year compared with an 8.4% rise of its industry.

Image Source: Zacks Investment Research

The company, on its second-quarter call, stated that it has lowered its demand growth forecast and expects primary demand in several of its end markets to be stable compared with the first half. The company anticipates that second-half adjusted EPS will be lower than first-half EPS. It expects EPS for 2023 to be between $6.50 and $7.00. Furthermore, EMN expects to deliver $1.4 billion in operating cash flow in 2023.

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Zacks Rank & Key Picks

EMN currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Koppers Holdings Inc. KOP, Carpenter Technology Corporation CRS and The Andersons Inc. ANDE.

Koppers has a projected earnings growth rate of 7.5% for the current year. It currently carries a Zacks Rank #2 (Buy). Koppers has a trailing four-quarter earnings surprise of roughly 21.7%, on average. The stock is up around 80% in a year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Carpenter Technology currently carries a Zacks Rank #2. The stock has rallied roughly 105.3% in the past year. CRS beat the Zacks Consensus Estimate in three of the last four quarters while meeting in one. It delivered a trailing four-quarter earnings surprise of 9.8%, on average.

Andersons currently carries a Zacks Rank #2. The stock has gained roughly 58.9% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report