Eaton (ETN) Wins $15M Deal to Aid Wastewater Treatment Unit

Eaton Corporation ETN announced that it received a contract worth $15 million from the Miami-Dade Water and Sewer Department (“WASD”) to support its new electrical distribution facility at the South District Wastewater Treatment Plant.

Per the contract, Eaton will provide electrical distribution, control solutions and engineering services to support WASD’s new electrical distribution facility to improve the resilience of the wastewater treatment facility.

Eaton will be working on the project with local electrical contractor American Electric of Miami, Inc. and general contractor PCL Construction. The project is expected to be complete by 2025.

Eaton’s transformers, arc-resistant medium- and low-voltage switchgear, medium-voltage motor controls, motor control centers, switchboards and panelboards will be utilized to strengthen the electrical distribution facility. These upgrades and changes will enhance the facility and keep it operational even during severe storms.

Eaton’s consistent investment in research and development activities allows it to create and develop new power-efficient products, which helps the company provide efficient power management solutions to its customers.

Eaton’s Ongoing R&D Creates New Products

The company has laid out a 10-year plan that includes a $3 billion investment in R&D programs that will allow it to create sustainable products during this period. The products supplied by Eaton have been deemed to be a critical part of the global infrastructure and are essential in crises.

In 2022, Eaton invested $665 million in R&D programs, up 8% year over year. In the first nine months of 2023, it invested $553 million in R&D activities, up 11% from the year-ago period. ETN is expected to continue investing in R&D activities in the remaining portion of 2023 and develop new products.

Eaton’s new products enable it to provide advanced solutions to customers, which will continue to drive its overall performance. Its Electrical Americas segment is expected to register organic growth in the range of 16.5-18.5% in 2023.

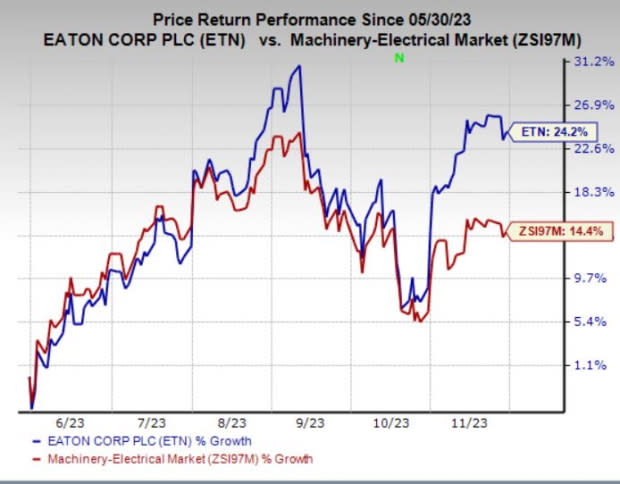

Price Performance

In the past six months, shares of Eaton have gained 24.2% compared with the industry’s 14.4% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Eaton currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the same industry are Emerson Electric Co. EMR, Energous Corporation WATT and A.O. Smith AOS. EMR sports a Zacks Rank #1 (Strong Buy), and WATT and AOS each carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

EMR’s long-term (three- to five-year) earnings growth rate is 11.05%. The Zacks Consensus Estimate of fiscal 2024 earnings has moved up by 6.3% in the past 60 days.

WATT delivered an average earnings surprise of 9.5% in the last four quarters. The Zacks Consensus Estimate of 2023 earnings has moved up by 58.7% in the past 60 days.

AOS’ long-term earnings growth rate is 9%. The Zacks Consensus Estimate of 2023 earnings has moved up by 5% in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Energous Corporation (WATT) : Free Stock Analysis Report