eBay Inc (EBAY) Posts Modest Revenue Growth Amid Economic Headwinds

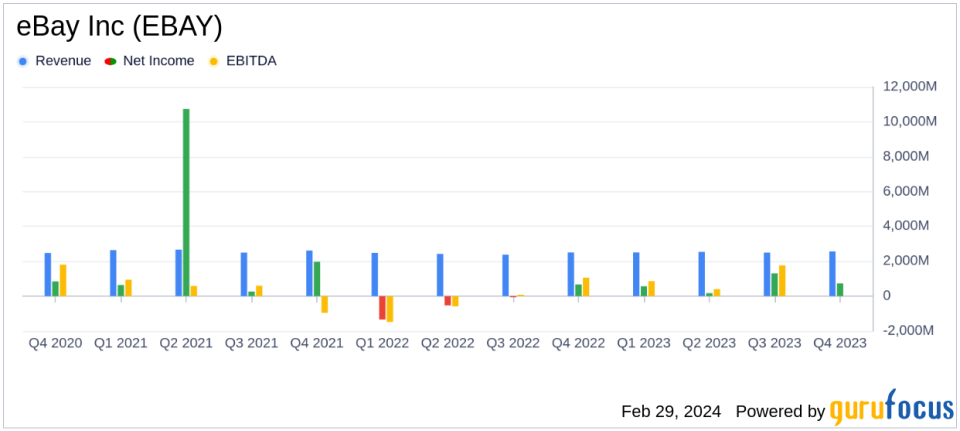

Revenue: Q4 revenue increased to $2.6 billion, marking a 2% year-over-year growth.

Net Income: GAAP net income from continuing operations reached $728 million in Q4.

Earnings Per Share: GAAP EPS from continuing operations was $1.40, and Non-GAAP EPS was $1.07.

Gross Merchandise Volume: GMV for Q4 stood at $18.6 billion, a 2% increase on an as-reported basis.

Operating Margin: GAAP and Non-GAAP operating margins were 16.0% and 26.7%, respectively.

Capital Return: eBay returned $379 million to shareholders in Q4, including share repurchases and dividends.

On February 27, 2024, eBay Inc (NASDAQ:EBAY) released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. eBay, a leading e-commerce marketplace, reported a revenue increase to $2.6 billion in the fourth quarter, up 2% on an as-reported basis and 3% on an FX-Neutral basis. The company's Gross Merchandise Volume (GMV) also saw a modest increase of 2% to $18.6 billion. Despite a challenging macroeconomic environment, eBay's strategic initiatives and focus on innovation have contributed to its financial resilience.

eBay's financial achievements in the fourth quarter, including a GAAP net income from continuing operations of $728 million, reflect the company's ability to navigate economic headwinds effectively. The reported GAAP earnings per diluted share of $1.40 and Non-GAAP earnings per diluted share of $1.07 underscore the company's operational efficiency and disciplined cost management. These results are particularly significant for eBay and the broader Retail - Cyclical industry, as they demonstrate the company's capacity to maintain profitability and shareholder value in uncertain times.

Financial Performance Analysis

eBay's balance sheet remains robust, with total assets amounting to $21.62 billion as of December 31, 2023. The company's cash and cash equivalents stood at $1.985 billion, indicating a strong liquidity position. eBay's commitment to returning value to shareholders is evident through its capital return activities, which included $250 million in share repurchases and $129 million in cash dividends paid during the fourth quarter.

Key metrics such as operating cash flow, which amounted to $123 million, and free cash flow, reported at $(3) million, are critical indicators of eBay's operational efficiency and its ability to generate cash from its core business activities. The company's operating margin, both GAAP and Non-GAAP, highlight its profitability levels and operational leverage.

"Our results demonstrate the strength of our strategy, and Im proud of our accelerated pace of innovation as we work to fundamentally enhance the customer experience on eBay," said Jamie Iannone, Chief Executive Officer at eBay.

"Our fortress balance sheet and durable financial model enabled us to invest in our strategic pillars while protecting earnings growth and delivering robust capital returns," added Steve Priest, Chief Financial Officer at eBay.

These commentaries from eBay's leadership emphasize the company's strategic focus and financial discipline, which are essential for long-term growth and stability.

Looking Ahead

For the first quarter of 2024, eBay forecasts revenue between $2.50 billion and $2.54 billion, with an FX-Neutral year-over-year growth of 0% to 2%. The company anticipates diluted GAAP EPS to be in the range of $0.86 to $0.90 and diluted Non-GAAP EPS between $1.19 and $1.23. Additionally, eBay's Board of Directors declared a cash dividend of $0.27 per share for the first quarter of 2024, representing an 8% increase from the prior quarterly dividend.

eBay's strategic initiatives, such as the expansion of its authentication centers, the rollout of shipping optimization APIs, and investments in AI-driven tools, are poised to enhance the user experience and drive future growth. The company's focus on sustainability and community impact, as demonstrated by its charitable contributions and inclusion in sustainability indices, further solidifies eBay's commitment to responsible business practices.

Value investors and potential GuruFocus.com members may find eBay's steady performance and strategic direction appealing, as the company continues to navigate the evolving e-commerce landscape with resilience and innovation.

Explore the complete 8-K earnings release (here) from eBay Inc for further details.

This article first appeared on GuruFocus.