Ecolab (ECL) to Report Q3 Earnings: What's in the Offing?

Ecolab, Inc. ECL is scheduled to report third-quarter 2023 results on Oct 31, before the opening bell.

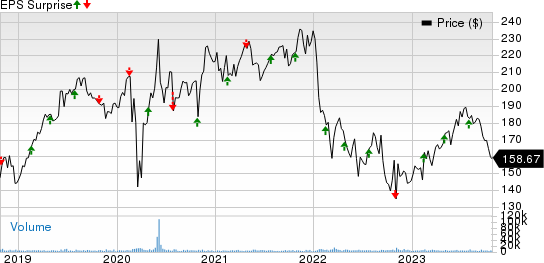

In the last reported quarter, the company’s earnings per share (EPS) of $1.24 surpassed the Zacks Consensus Estimate by 2.5%. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on three occasions and missed once, delivering an earnings surprise of 1%, on average.

Let’s see how things have shaped up for Ecolab prior to this announcement.

Global Industrial

The Global Industrial segment, comprising the Water, Food & Beverage, Paper and Downstream units, witnessed a sales uptick in the second quarter of 2023. Per the company’s second-quarter earnings call in August, the water business has been performing well for the past few months. Per management, volume has been positive as it has been helping its customers to produce better and more products while reducing their water usage. With a reduction in water usage, customers can reduce their energy usage, carbon footprint and, in turn, their costs. This will likely make them invest in Ecolab. This is likely to have significantly boosted the company’s third-quarter revenues.

However, management was not encouraged with the performance of the Paper business, which was due to Ecolab’s customers reducing inventories on the back of disruptions that they had over the past few years. On a positive note, management expected the business to have performed well in the third quarter of 2023, driven by new business. Management is also optimistic about the improvement in the inventory meltdown of its customers over the next few quarters. This is likely to have driven up the segmental revenues in the to-be-reported quarter.

The Zacks Consensus Estimate for the third-quarter Global Industrial segment revenues is currently pegged at $1.88 billion, suggesting an uptick of 3.5% from the year-ago quarter’s reported figure.

Ecolab Inc. Price and EPS Surprise

Ecolab Inc. price-eps-surprise | Ecolab Inc. Quote

Global Institutional & Specialty

Ecolab’s Global Institutional & Specialty segment recorded strong growth in the last reported quarter, courtesy of the company’s performance in the Institutional and Specialty divisions. Specialty sales showed robust growth on the back of strong quickservice sales growth, a trend which is likely to have continued in the third quarter on the back of the increased use dish machines to automate the labor in restaurants.

On second-quarter 2023 earnings call, Ecolab’s management confirmed that the Institutional unit continued its very strong recovery, focused on new business and penetration, and drove share gains in units served, solutions sold and sales delivered. Growth, value pricing and productivity also drove strong margin improvements, which management expects to continue in the second half. Additionally, innovation in labor automation is expected to position Institutional as a key player in the market undergoing a foundational transformation driven by evolving consumer habits and increased use of digital technology. This is likely to have significantly contributed to the segment’s revenues in the third quarter.

Per management, people order online and use takeout much more than before, translating to lower dine-in traffic. However, on the same call, Ecolab confirmed that its sales in the segment in the United States significantly increased in the second quarter. Management also expects this momentum to continue in the quarters to come. This is likely to be another contributor to the segmental revenues in the third quarter of 2023.

The Zacks Consensus Estimate for the third-quarter Global Institutional & Specialty segment revenues is currently pegged at $1.29 billion, suggesting an uptick of 8.8% from the year-ago quarter’s reported figure.

Other Factors at Work

Sustained strong demand for Pest Elimination (a component of Ecolab’s broader Other segment) in commercial businesses is likely to have driven the segment’s revenues in the to-be-reported quarter. Ecolab has also started to provide disinfection services for its customers, which is also likely to have driven quarterly revenues.

Ecolab ramping up its investments in digital technology and having a stronger foothold with Ecolab 3D to provide improved field productivity to its customers also raise our optimism about the company’s third-quarter 2023 performance.

However, management sounded cautious regarding continued high delivered product costs and softened global demand. Also, continued higher energy surcharges impacting demand and global energy costs are likely to have weighed on the third-quarter segmental revenues.

The Estimate Picture

For third-quarter 2023, the Zacks Consensus Estimate of $3.99 billion for total revenues implies an improvement of 8.7% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $1.52, implying an improvement of 16.9% from the prior-year period’s reported number.

What Our Model Suggests

Our proven model predicts an earnings beat for Ecolab this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Earnings ESP: Ecolab has an Earnings ESP of +0.12%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Other Stocks Worth a Look

Here are a few other medical stocks worth considering, as these also have the right combination of elements to beat on earnings this reporting cycle.

Zimmer Biomet Holdings, Inc. ZBH has an Earnings ESP of +0.56% and a Zacks Rank of 2. ZBH has an estimated long-term growth rate of 6.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zimmer Biomet’s earnings surpassed estimates in three of the trailing four quarters and broke even once, with the average surprise being 4.5%.

Shockwave Medical, Inc. SWAV has an Earnings ESP of +6.07% and is a Zacks #1 Rank stock. SWAV has an estimated long-term growth rate of 4.6%.

Shockwave Medical’s earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 81.1%.

DENTSPLY SIRONA Inc. XRAY has an Earnings ESP of +1.85% and a Zacks Rank of 2. XRAY has an estimated long-term growth rate of 8.9%.

DENTSPLY SIRONA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 12.5%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report