Ecolab Inc (ECL) Reports Strong Q4 Earnings and Positive 2024 Outlook

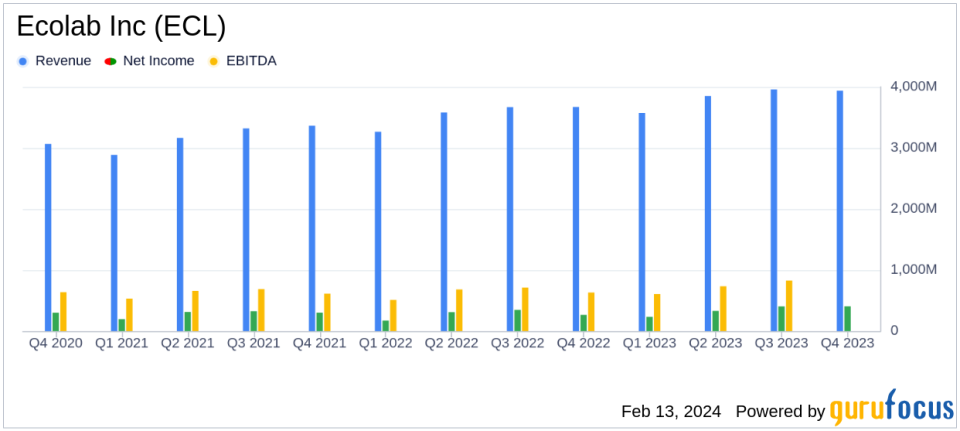

Net Sales: Increased by 7% to $3.94 billion in Q4 2023.

Operating Income: Grew 48% to $590 million on a reported basis and 24% to $624.5 million on an adjusted basis.

Net Income: Attributable to Ecolab rose by 53% to $405.2 million reported, and 22% to $444.7 million adjusted.

Diluted EPS: Reported at $1.41, a 52% increase, with adjusted diluted EPS at $1.55, up 22%.

2024 Outlook: Adjusted diluted EPS forecasted to be between $6.10 and $6.50, marking a 17% to 25% increase.

On February 13, 2024, Ecolab Inc (NYSE:ECL) released its 8-K filing, announcing a strong performance for the fourth quarter of 2023 and providing an optimistic outlook for 2024. Ecolab, a global leader in water, hygiene, and infection prevention solutions and services, reported significant growth in sales and earnings, reflecting robust demand across its diverse portfolio.

Company Overview

Ecolab is a powerhouse in the production and marketing of cleaning and sanitation products, catering to a broad range of industries including industrial manufacturing, hospitality, healthcare, and life sciences. With a strong foothold in the U.S. market and expanding global reach, Ecolab's comprehensive suite of products and services positions it as the market share leader in its category.

Financial Highlights and Challenges

The company's fourth quarter results were driven by a 7% increase in net sales, amounting to $3.94 billion. This growth was supported by a 6% rise in organic sales, indicating strong underlying business performance. Operating income surged, with reported figures showing a 48% increase and adjusted figures revealing a 24% rise. Net income attributable to Ecolab soared by 53% on a reported basis and 22% on an adjusted basis, while diluted earnings per share increased by 52% and 22% for reported and adjusted figures, respectively.

Despite these impressive results, Ecolab faces challenges such as unpredictable macroeconomic conditions and the need to continuously innovate and adapt to changing market demands. The company's ability to maintain its growth trajectory hinges on its strategic initiatives and operational efficiency.

Segment Performance

The Industrial segment reported a 3% increase in organic sales, with Water and Food & Beverage divisions driving growth despite a decline in Paper sales due to soft industry demand. The Institutional & Specialty segment saw a 12% rise in organic sales, with both divisions achieving double-digit growth. However, the Healthcare & Life Sciences segment experienced a 1% decrease in organic sales, with stable performance in Healthcare offset by a decline in Life Sciences.

Future Outlook

Looking ahead to 2024, Ecolab anticipates adjusted diluted earnings per share to be in the range of $6.10 to $6.50, representing a 17% to 25% increase from 2023. This forecast is based on expectations of stable macroeconomic demand and lower delivered product costs in the first half of the year.

"We are confident 2024 will be another strong year for Ecolab," said Christophe Beck, Ecolabs chairman and chief executive officer. "We expect another very strong year of operating margin expansion, building upon our success in 2023, and remain confident in our path to deliver on our 20% margin objective over the next few years to drive superior earnings growth and long-term returns for shareholders."

The company's strategic focus on new business gains, value-based pricing, and operational efficiency is expected to drive sales growth and margin expansion, aligning with Ecolab's long-term earnings growth target of 12-15%.

Conclusion

Ecolab's strong fourth quarter performance and positive outlook for 2024 reflect the company's resilience and strategic positioning in the market. With a robust product portfolio and a commitment to innovation and sustainability, Ecolab is well-equipped to navigate the challenges ahead and continue delivering value to its shareholders.

For more detailed information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ecolab Inc for further details.

This article first appeared on GuruFocus.