With EcoSynthetix Inc. (TSE:ECO) It Looks Like You'll Get What You Pay For

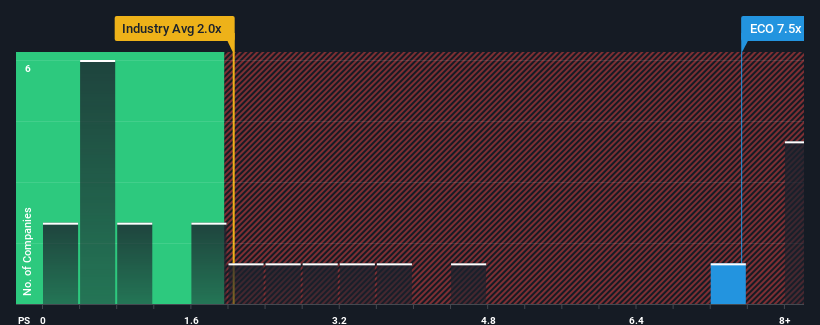

When you see that almost half of the companies in the Chemicals industry in Canada have price-to-sales ratios (or "P/S") below 2x, EcoSynthetix Inc. (TSE:ECO) looks to be giving off strong sell signals with its 7.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for EcoSynthetix

What Does EcoSynthetix's Recent Performance Look Like?

The recent revenue growth at EcoSynthetix would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying to much for the stock.

Although there are no analyst estimates available for EcoSynthetix, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as EcoSynthetix's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.8% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to decline by 14% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we can see why EcoSynthetix is trading at a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We see that EcoSynthetix justifiably maintains its high P/S on the merits of its recentthree-year revenue growth beating forecasts amidst struggling industry. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for EcoSynthetix with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here