Edenbrook Capital, LLC Boosts Stake in Brightcove Inc

On October 3, 2023, Edenbrook Capital, LLC (Trades, Portfolio) increased its holdings in Brightcove Inc (NASDAQ:BCOV), adding 7,500 shares at a trade price of $3.1 per share. This transaction has raised Edenbrook's total shares in Brightcove to 6,298,246, representing 14.56% of the company's stock and 3.64% of Edenbrook's portfolio. Despite the addition, the stock's price has seen a slight decrease of 1.61% since the transaction.

About Edenbrook Capital, LLC (Trades, Portfolio)

Edenbrook Capital, LLC (Trades, Portfolio) is a private investment firm based in Mt. Kisco, New York. The firm manages an equity portfolio worth $537 million, with a primary focus on the Technology and Communication Services sectors. Edenbrook's top holdings include Haynes International Inc (NASDAQ:HAYN), Marchex Inc (NASDAQ:MCHX), Magnite Inc (NASDAQ:MGNI), Absolute Software Corp (NASDAQ:ABST), and Cognyte Software Ltd (NASDAQ:CGNT).

Overview of Brightcove Inc

Brightcove Inc (NASDAQ:BCOV), a US-based company, is a leading provider of cloud-based services for the video ecosystem. The company's flagship product, Brightcove Video Cloud, enables customers to publish and distribute video to Internet-connected devices. Brightcove's market capitalization stands at $131.915 million, with its stock currently priced at $3.05. Despite the company's potential, its GF Valuation indicates a possible value trap, with the stock's price to GF Value at 0.38.

Brightcove Inc's Financial Health

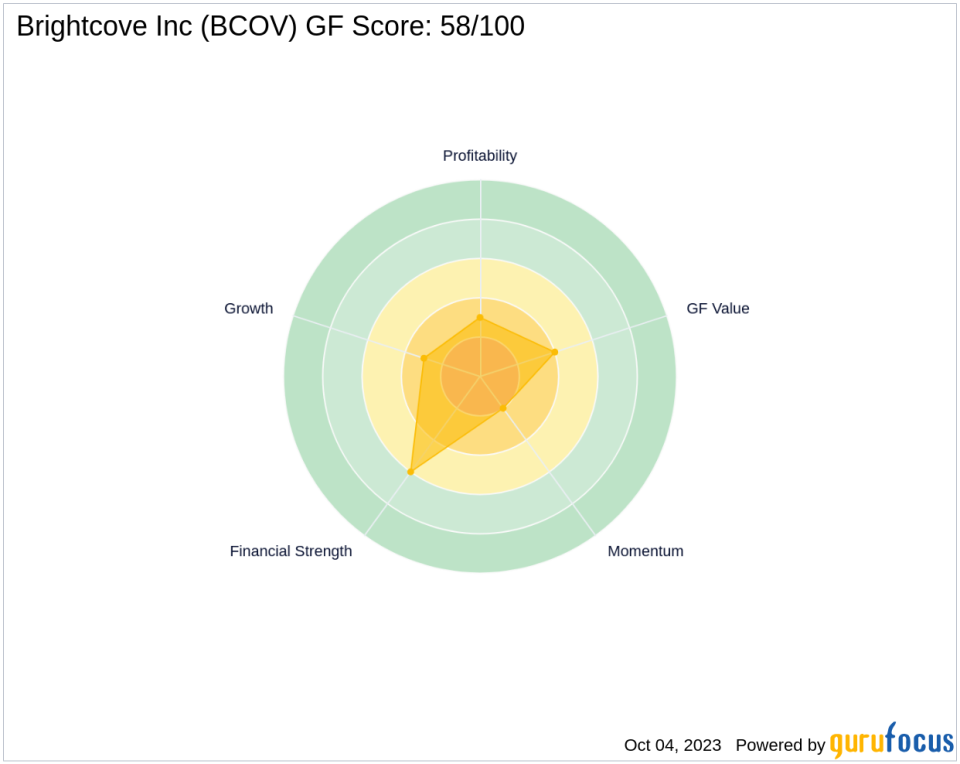

According to GuruFocus, Brightcove Inc's GF Score is 58/100, indicating a poor future performance potential. The company's financial strength is ranked 6/10, while its profitability rank and growth rank are both at 3/10. Brightcove's cash to debt ratio is 0.81, and its ROE and ROA stand at -25.32 and -11.05, respectively.

Brightcove Inc's Stock Performance

Since its IPO in 2012, Brightcove's stock has decreased by 78.97%. The stock's year-to-date performance shows a decline of 41.57%. The company's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 11.35, 17.14, and 22.88, respectively, indicating a bearish momentum.

Brightcove Inc's Growth and Predictability

Over the past three years, Brightcove has seen a revenue growth of 1.30%, while its EBITDA growth remains stagnant. The company's earning growth stands at 27.60%. However, the predictability rank is not applicable due to insufficient data.

Conclusion

In conclusion, Edenbrook Capital, LLC (Trades, Portfolio)'s recent acquisition of Brightcove Inc's shares has slightly increased its stake in the company. However, the transaction has not significantly impacted the stock's price. Brightcove's financial health and stock performance indicate potential risks, and investors should exercise caution. The company's growth over the past three years has been modest, and its predictability rank is currently unavailable. As of October 5, 2023, all data and rankings are accurate and based on the provided relative data.

This article first appeared on GuruFocus.