Edenbrook Capital, LLC Boosts Stake in Brightcove Inc

On November 6, 2023, Edenbrook Capital, LLC (Trades, Portfolio), a renowned investment firm, increased its stake in Brightcove Inc (NASDAQ:BCOV). The firm added 17,139 shares to its portfolio, marking a trade change of 0.27%. This transaction had a minor impact of 0.01% on the firm's portfolio.

About Edenbrook Capital, LLC (Trades, Portfolio)

Edenbrook Capital, LLC (Trades, Portfolio), located at 116 Radio Circle, Mt. Kisco, NY, is a firm that has made a name for itself in the investment world. The firm's portfolio consists of 12 stocks, with a total equity of $537 million. Its top holdings include Haynes International Inc(NASDAQ:HAYN), Marchex Inc(NASDAQ:MCHX), Magnite Inc(NASDAQ:MGNI), Absolute Software Corp(NASDAQ:ABST), and Cognyte Software Ltd(NASDAQ:CGNT). The firm's investments are primarily concentrated in the Technology and Communication Services sectors.

Details of the Transaction

The shares were acquired at a trade price of $2.53 per share, bringing Edenbrook Capital, LLC (Trades, Portfolio)'s total holdings in Brightcove Inc to 6,330,390 shares. This represents 2.98% of the firm's portfolio and 14.56% of the guru's holdings in the traded stock.

Overview of Brightcove Inc

Brightcove Inc, a US-based company, is a leading provider of cloud-based services for the video ecosystem. The company's solutions are primarily targeted at media companies, broadcasters, publishers, and corporations. Brightcove Video Cloud, the company's flagship product, enables customers to publish and distribute video to Internet-connected devices. The company operates in two segments: Premium and Volume, and has a market capitalization of $110.419 million. The stock's current price is $2.54, and its GF Value is $6.69, indicating a possible value trap.

Performance and Financial Health of Brightcove Inc

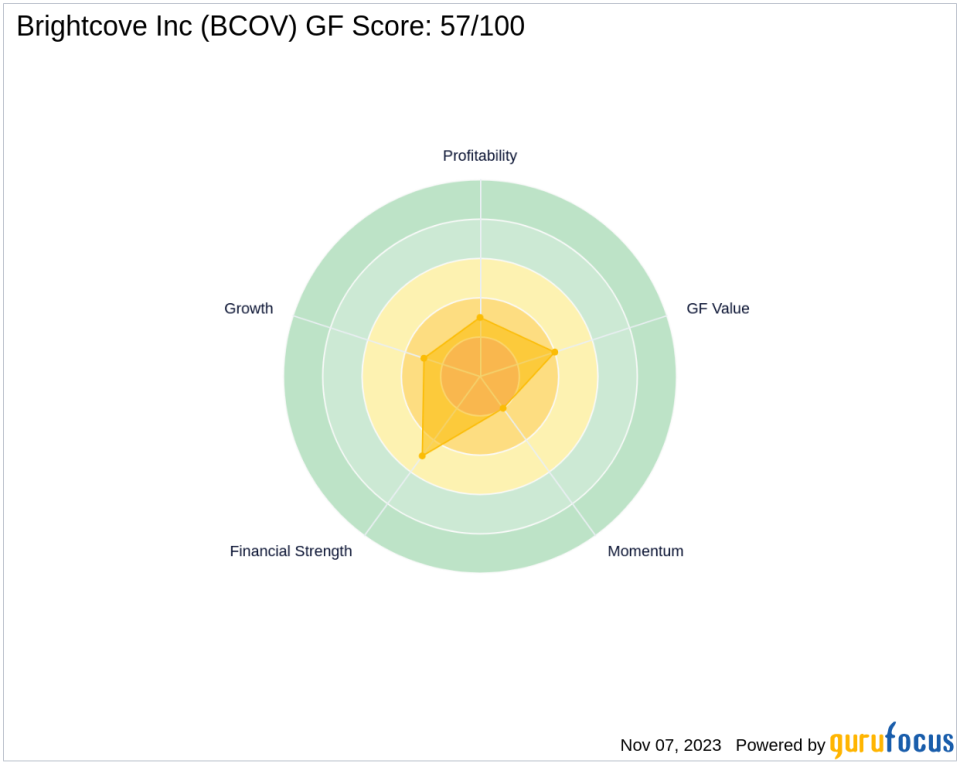

Since the transaction, the stock has gained 0.4%, but it has lost 82.48% since its IPO in 2012. The stock's year-to-date performance is down by 51.34%. Brightcove Inc has a GF Score of 57/100, indicating poor future performance potential. The company's financial strength is ranked 5/10, while its profitability rank and growth rank are both 3/10. The company's Piotroski F-Score is 3, and its Altman Z score is -0.61, indicating financial distress.

Growth and Momentum of Brightcove Inc

Brightcove Inc has shown a gross margin growth of 2.10% and a 3-year revenue growth of 1.30%. However, its operating margin growth and EBITDA growth over the past three years have been stagnant. The company's RSI 5-day, RSI 9-day, and RSI 14-day are 19.02, 24.07, and 26.65, respectively. The stock's momentum index for 6 - 1 month is -18.83, and for 12 - 1 month is -48.40.

Conclusion

In conclusion, Edenbrook Capital, LLC (Trades, Portfolio)'s recent acquisition of Brightcove Inc shares is a noteworthy move. Despite the stock's poor performance and financial health, the firm's increased stake could indicate a belief in the company's long-term potential. However, value investors should exercise caution due to the stock's low GF Score and potential value trap status. As always, thorough research and careful consideration are advised before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.