Edenbrook Capital, LLC Increases Stake in Brightcove Inc

Edenbrook Capital, LLC (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio by acquiring additional shares in Brightcove Inc. This article will delve into the details of this transaction, provide an overview of both Edenbrook Capital and Brightcove Inc, and analyze the potential implications of this investment.

Details of the Transaction

On September 26, 2023, Edenbrook Capital, LLC (Trades, Portfolio) added 2,764 shares of Brightcove Inc to its portfolio at a trade price of $3.27 per share. This transaction increased the firm's total holdings in Brightcove Inc to 6,290,746 shares, representing 14.55% of the company's outstanding shares and 3.83% of Edenbrook's portfolio. Despite the relatively small share change, this transaction signifies the firm's continued confidence in Brightcove Inc.

About Edenbrook Capital, LLC (Trades, Portfolio)

Edenbrook Capital, LLC (Trades, Portfolio) is an investment firm based in Mt. Kisco, New York. The firm manages a portfolio of 12 stocks, with a total equity of $537 million. Its top holdings include Haynes International Inc, Marchex Inc, Magnite Inc, Absolute Software Corp, and Cognyte Software Ltd. The firm primarily invests in the technology and communication services sectors.

Overview of Brightcove Inc

Brightcove Inc, a US-based company, is a leading provider of cloud-based services for the video ecosystem. The company's flagship product, Brightcove Video Cloud, enables customers to publish and distribute video to Internet-connected devices. Brightcove Inc operates in the software industry and has a market capitalization of $141.43 million. The company's stock price stands at $3.27 as of September 29, 2023. However, with a GF Value of $8.11, the stock is potentially undervalued, indicating a possible value trap.

Financial Performance of Brightcove Inc

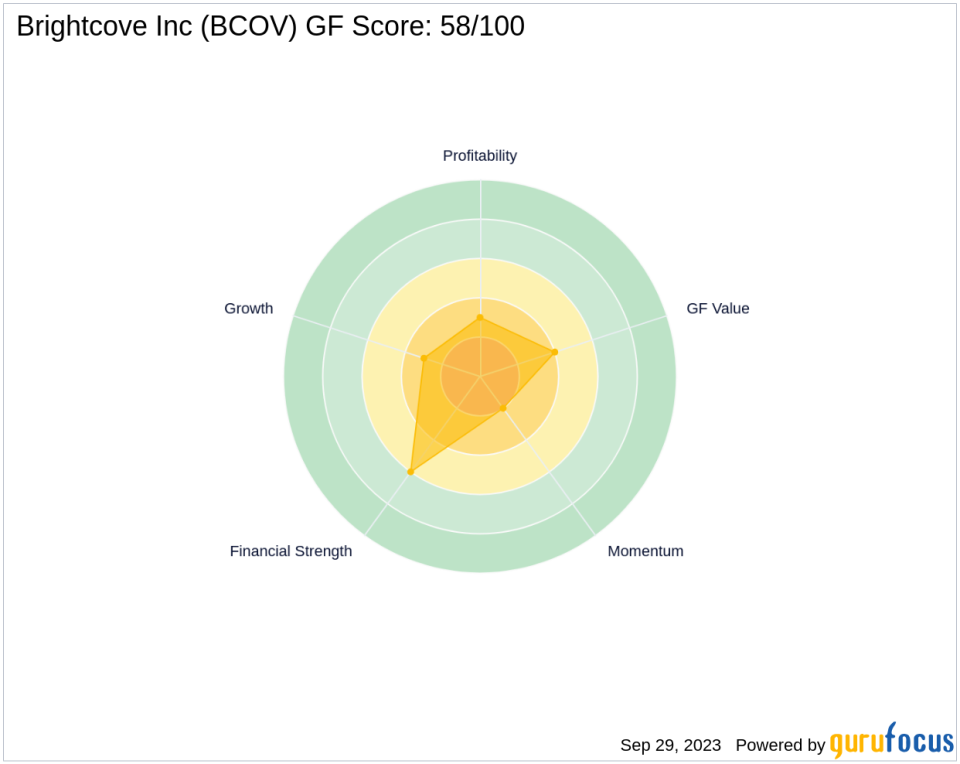

Brightcove Inc's financial performance is a mixed bag. The company has a GF Score of 58/100, indicating poor future performance potential. Its financial strength is ranked 6/10, while its profitability rank and growth rank are both 3/10. The company's GF Value Rank is 4/10, suggesting that the stock is undervalued.

Brightcove Inc's Stock Performance

Since its IPO in 2012, Brightcove Inc's stock has declined by 77.45%. The year-to-date performance is also negative, with a decrease of 37.36%. The company's momentum rank is 2/10, and its Piotroski F-Score is 3, indicating poor business operations.

Financial Health of Brightcove Inc

Brightcove Inc's financial health is a concern. The company's cash to debt ratio is 0.81, ranking 1884th in the industry. Its ROE and ROA are -25.32 and -11.05 respectively, ranking 2059th and 2028th. These figures suggest that the company is struggling with profitability and asset utilization.

Conclusion

In conclusion, Edenbrook Capital, LLC (Trades, Portfolio)'s recent addition of Brightcove Inc shares to its portfolio is a noteworthy move. Despite Brightcove Inc's underwhelming financial performance and stock performance, the firm's continued investment suggests a belief in the company's potential. However, given the company's current financial health and the potential value trap, investors should exercise caution and conduct thorough research before following suit.

This article first appeared on GuruFocus.