Edenbrook Capital, LLC Increases Stake in Brightcove Inc

Edenbrook Capital, LLC (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio by acquiring additional shares in Brightcove Inc. This article will delve into the details of this transaction, provide an overview of both Edenbrook Capital and Brightcove Inc, and analyze the potential implications of this investment.

Details of the Transaction

The transaction took place on August 17, 2023, with Edenbrook Capital adding 25,000 shares of Brightcove Inc to its portfolio. The shares were purchased at a price of $3.86 each. This acquisition has increased Edenbrook Capital's total holdings in Brightcove Inc to 6,248,036 shares, representing 14.45% of the company's shares and 4.49% of Edenbrook's portfolio. The transaction had a 0.02% impact on the firm's portfolio.

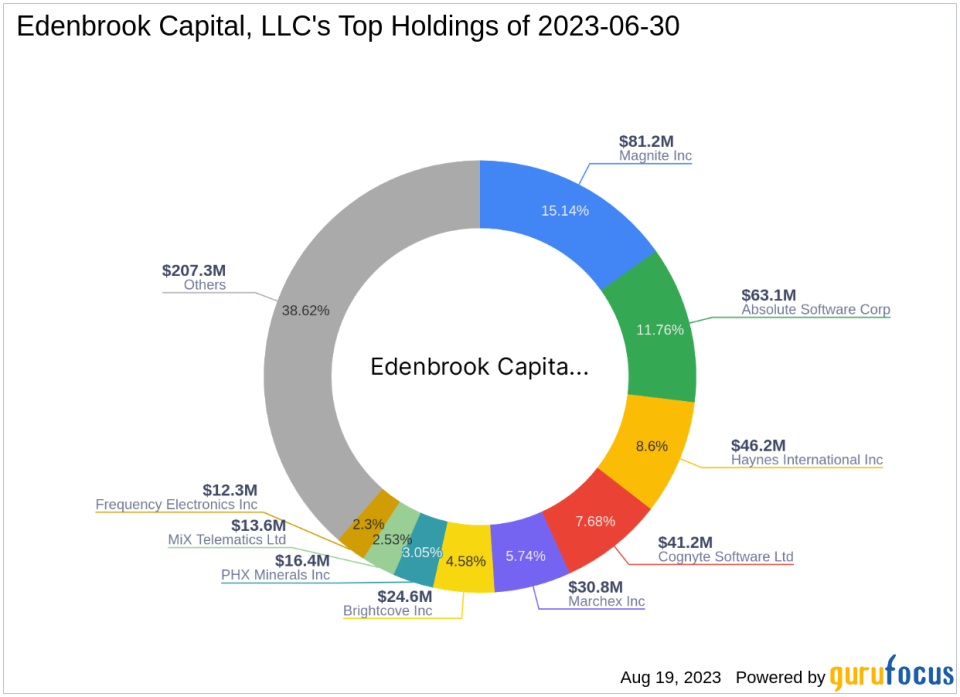

Profile of Edenbrook Capital, LLC (Trades, Portfolio)

Edenbrook Capital, LLC (Trades, Portfolio) is an investment firm based in Mt. Kisco, New York. The firm holds a diversified portfolio of 12 stocks, with a total equity of $537 million. Its top holdings include Haynes International Inc(NASDAQ:HAYN), Marchex Inc(NASDAQ:MCHX), Magnite Inc(NASDAQ:MGNI), Absolute Software Corp(NASDAQ:ABST), and Cognyte Software Ltd(NASDAQ:CGNT). The firm primarily invests in the Technology and Communication Services sectors.

Overview of Brightcove Inc

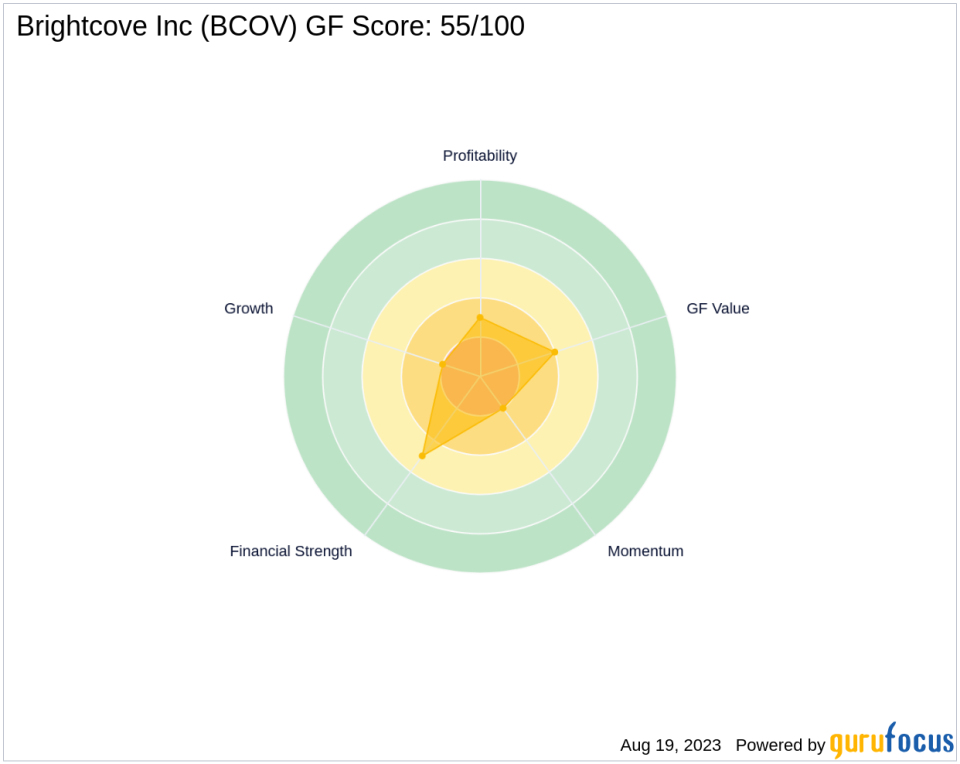

Brightcove Inc, listed under the symbol BCOV, is a US-based company that provides cloud-based services for the video ecosystem. Its flagship product, Brightcove Video Cloud, enables customers to publish and distribute video to Internet-connected devices. The company operates in the Software industry and has a market capitalization of $170.841 million. As of the date of this article, the stock price stands at $3.95. However, according to GuruFocus's GF Value, the stock is potentially overvalued, with a GF Value of 8.57 and a Price to GF Value ratio of 0.46. GF-Score of Brightcove Inc is 55/100, indicating a poor future performance potential.

Brightcove Inc's Performance Metrics

Brightcove Inc's performance metrics reveal a mixed picture. The company has a Financial Strength rank of 5/10 and a Profitability Rank of 3/10. Its Growth Rank is 2/10, while its GF Value Rank and Momentum Rank are 4/10 and 2/10, respectively. The company's Piotroski F-Score is 3, and its Altman Z score is -0.32, indicating potential financial distress.

Growth and Momentum Metrics of Brightcove Inc

Brightcove Inc's growth metrics show a Gross Margin Growth of 2.10 and a Revenue Growth of 1.30 over the past three years. However, its Operating Margin Growth and EBITDA Growth over the same period are both 0.00. The company's Earning Growth over the past three years is 27.60. In terms of momentum, the company's RSI 14 Day is 47.06, and its Momentum Index 6 - 1 Month is -43.28.

Implications of the Transaction

The acquisition of additional shares in Brightcove Inc by Edenbrook Capital, LLC (Trades, Portfolio) signifies the firm's confidence in the company's potential despite its current performance metrics. The transaction has increased Edenbrook's stake in Brightcove Inc, making it a significant part of its portfolio. However, given Brightcove's current GF Value and performance metrics, the investment carries a certain level of risk. It will be interesting to observe how this transaction impacts both Edenbrook's portfolio and Brightcove's stock performance in the future.

This article first appeared on GuruFocus.