Edgewell Personal Care Co Reports Mixed Q1 Fiscal 2024 Results

Net Sales: Increased by 4.2% to $488.9 million.

Organic Net Sales: Grew by 3.1%, primarily driven by international market performance.

GAAP EPS: Declined to $0.09 from $0.24 in the prior year quarter.

Adjusted EPS: Decreased to $0.24 from $0.32 in the prior year quarter.

Gross Margin: Remained flat at 40.4%, with adjusted gross margin up by 30 basis points.

Dividends and Share Repurchases: Returned $22.6 million to shareholders through repurchases and dividends.

Full-Year Outlook: Maintains expected net sales growth of 1% to 3% and adjusted EPS of $2.65 to $2.85.

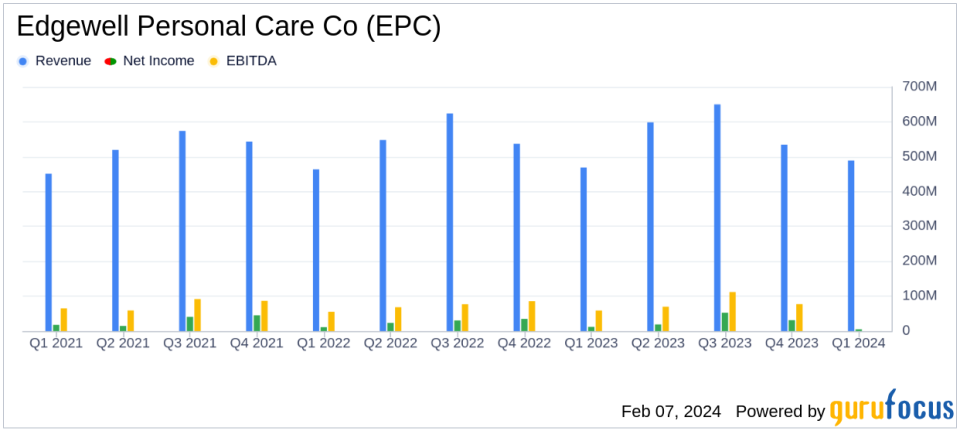

On February 7, 2024, Edgewell Personal Care Co (NYSE:EPC) released its 8-K filing, detailing the financial results for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, known for its portfolio of personal care products including brands such as Schick, Edge, and Banana Boat, reported a 4.2% increase in net sales, amounting to $488.9 million, and a 3.1% increase in organic net sales. However, GAAP diluted EPS saw a decrease to $0.09, down from $0.24 in the prior year quarter, while adjusted EPS also fell to $0.24 from $0.32.

Financial Performance and Challenges

Edgewell's performance was marked by strong international sales, particularly in the Wet Shave and Grooming segments, which offset lower sales in North America. The company's gross margin remained steady at 40.4%, with an adjusted gross margin increase of 30 basis points. This was attributed to productivity savings and improved revenue management. Despite these gains, the company faced challenges, including a decline in GAAP EPS and adjusted EPS, which were impacted by higher marketing, selling, general, and administrative expenses (SG&A), as well as currency movements.

Financial Achievements and Industry Significance

The company's ability to maintain a stable gross margin in a competitive Consumer Packaged Goods industry is noteworthy. Edgewell's focus on productivity and pricing strategies has helped mitigate the impact of inflationary pressures, which is crucial for maintaining profitability. Additionally, the company's capital allocation strategy, including share repurchases and dividends, demonstrates a commitment to delivering shareholder value.

Key Financial Metrics

Edgewell ended the quarter with $214.2 million in cash on hand and access to an additional $206.6 million revolving credit facility, maintaining a net debt leverage ratio of 3.8x. The company's adjusted EBITDA was $57.2 million, and it used $72.9 million in net cash for operating activities, an improvement from $86.3 million used in the prior year period. This decrease in cash used was largely driven by a lower net working capital build.

"We had a good start to the fiscal year, with 3% organic net sales growth, and notably strong performance across our international markets, reflective of underlying volume growth and further price execution," said Rod Little, Edgewells President and Chief Executive Officer. "With this good start and strong fundamentals in place, we are on track to meet our previous outlook for both top and bottom line."

Analysis of Company's Performance

Edgewell's mixed results reflect a company navigating through a challenging economic environment. While the increase in net and organic sales is a positive indicator of the company's market resilience and effective strategic initiatives, the decline in EPS points to the cost pressures and investment increases that are affecting profitability. The company's maintenance of its full-year outlook suggests confidence in its ability to manage these challenges and continue delivering growth.

For a detailed breakdown of Edgewell's financials and management commentary, investors and interested parties can access the full 8-K filing.

As Edgewell continues to execute its strategy in the coming quarters, investors will be watching closely to see if the company can sustain its sales momentum and improve its earnings trajectory, thereby creating significant value for its shareholders.

Explore the complete 8-K earnings release (here) from Edgewell Personal Care Co for further details.

This article first appeared on GuruFocus.