Edgewise (EWTX) Rallies 35% on Issue of New Common Stock

Edgewise Therapeutics EWTX announced that it is floating a secondary issue of around 21.8 million shares of its common stock to the public at an issue price of $11.00 per share, intending to raise around $240 million in gross proceeds.

The deal will also include participation from venture capital and investment management companies. New participants in the offering comprise RA Capital Management, TCGX and Venrock Healthcare Capital Partners. Existing investors, including Cormorant Asset Management, Frazier Life Sciences, and others, are also involved.

EWTXplans to use net proceeds from this new issue and its existing cash balance to support the clinical development of its lead pipeline candidate EDG-5506, which is being evaluated in multiple muscular dystrophy indications. Management also intends to use the proceeds to support the potential commercial launch of the candidate in the United States.

Shares of EWTX rose 34.6% on Jan 19 following the announcement. This uptick was likely due to the issue of shares at $11.00 per share, which is at a premium of 13.5% to the share price as of Jan 18. Though this new issuance constitutes a major issue to the outstanding share count of around 70.45 million (unaudited, as of Dec 31, 2023), the participation of existing investors adds to investors’ confidence and is likely to ensure that existing shareholder base dilution remains low.

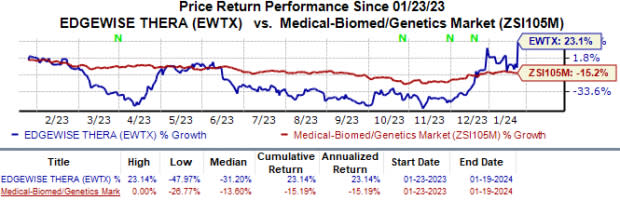

EWTX’s shares have risen 23.1% year to date against the industry’s 15.2% fall.

Image Source: Zacks Investment Research

The secondary offering is expected to close by Jan 23, 2024.

EDG-5506 is Edgewise’s most advanced pipeline candidate, being evaluated in the phase III GRAND CANYON study for Becker muscular dystrophy (BMD). The candidate is also being evaluated in separate mid-stage studies for Duchenne muscular dystrophy (DMD), Limb-Girdle muscular dystrophy (LGMD) and McArdle Disease. EWTX is also enrolling participants in an early-stage study evaluating EDG-7500 for hypertrophic cardiomyopathy (HCM).

Edgewise is currently devoid of a marketed product and is entirely dependent on the successful development of its pipeline candidates. This secondary stock offering will strengthen EWTX’s financial position. Earlier this month, management stated that its preliminary cash balance stood at $318.4 million as of the end of December 2023.

The new cash influx will enable management to accelerate its pipeline development, allowing it to complete the GRAND CANYON study so that it can file a regulatory filing for EDG-5506 in BMD. The increased cash balance will also help Edgewise to extend its existing cash runway.

Edgewise Therapeutics, Inc. Price

Edgewise Therapeutics, Inc. price | Edgewise Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Edgewise carries a Zacks Rank #3 (Hold) at present. Some better-ranked stocks in the overall healthcare sector include CytomX Therapeutics CTMX, Novo Nordisk NVO and Sarepta Therapeutics SRPT. While CytomX and Novo Nordisk sport a Zacks Rank #1 (Strong Buy), Sarepta carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics for 2023 have swung from a loss of 10 cents per share to earnings of 2 cents. During the same period, estimates for 2024 have narrowed from a loss of 22 cents to a loss of 6 cents. Shares of CytomX have lost 40.3% in the past year.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.62 to $2.67. During the same period, the earnings estimates for 2024 have risen from $3.15 to $3.29. Shares of NVO have surged 51.6% in the past year.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an average surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

In the past 60 days, Sarepta’s loss estimates for 2023 have improved from a loss of $6.90 per share to $6.57. During the same period, earnings estimates for 2024 have risen from 98 cents to $2.14. Sarepta’s shares have lost 9.9% in the past year.

Sarepta’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 48.67%. In the last reported quarter, Sarepta’s earnings beat estimates by 72.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Edgewise Therapeutics, Inc. (EWTX) : Free Stock Analysis Report