Edgewise Therapeutics Inc Director Jonathan Fox Acquires 10,857 Shares

On December 26, 2023, Jonathan Fox, a director at Edgewise Therapeutics Inc (NASDAQ:EWTX), executed a purchase of 10,857 shares of the company's stock, according to a recent SEC Filing. The transaction was carried out at a price of $9.3 per share, which places the total amount invested by the insider at approximately $100,970.10.

Edgewise Therapeutics Inc is a biopharmaceutical company focused on the discovery, development, and commercialization of innovative treatments for severe, rare muscle disorders. The company's proprietary platform is designed to modulate muscle function with the aim of addressing the underlying causes of these diseases and improving the quality of life for affected patients.

Insider buying and selling activities are closely monitored by investors as they can provide insights into a company's internal perspective. An insider purchase can suggest that the company's executives or directors are confident in the firm's future prospects and believe that the current share price represents an attractive investment opportunity. Conversely, insider selling might indicate that those with intimate knowledge of the company's operations are seeking to reduce their holdings, potentially signaling a lack of confidence in future performance.

Over the past year, Jonathan Fox has been active in the market, purchasing a total of 10,857 shares and not selling any shares. This latest acquisition by the insider further reinforces the trend of insider confidence in Edgewise Therapeutics Inc.

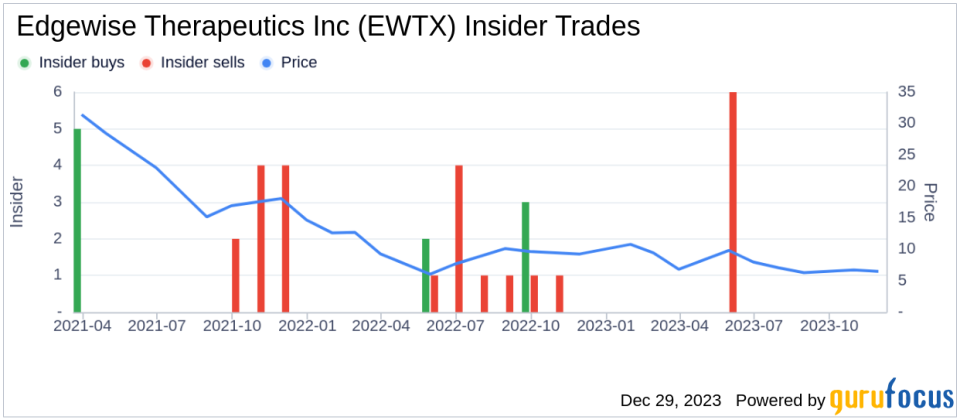

The insider transaction history for Edgewise Therapeutics Inc shows a pattern of 1 insider buy and 6 insider sells over the past year. This activity can be visualized in the following insider trend image:

On the valuation front, Edgewise Therapeutics Inc's shares were trading at $9.3 on the day of the insider's purchase, giving the company a market capitalization of $694.27 million. This valuation reflects the market's current assessment of the company's worth based on its financial performance and future growth prospects.

Investors and analysts often look at insider trading patterns as one of many indicators to gauge the potential direction of a stock. While insider transactions should not be used in isolation to make investment decisions, they can provide a piece of the puzzle when analyzing a company's financial health and future outlook.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.