Edison International (EIX) to Post Q3 Earnings: What's in Store?

Edison International EIX is slated to report third-quarter 2023 results on Nov 1, after market close.

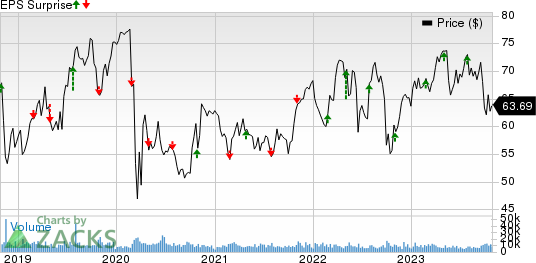

In the last reported quarter, the company delivered an earnings surprise of 8.60%. EIX has a trailing four-quarter average earnings surprise of 4.74%.

Factors to Note

In the to-be-reported quarter, EIX’s service territories witnessed a mixed weather pattern. While the company’s service territories experienced warmer-than-normal temperatures at the onset of the July-September period, accompanied with moderate precipitation in the latter part, an average-to-below-normal temperature prevailed. Such a weather pattern is likely to have a mixed impact on the company’s overall revenues.

Edison International Price and EPS Surprise

Edison International price-eps-surprise | Edison International Quote

Additionally, the positive impact of the general rate case might have boosted Edison International’s top-line performance.

The Zacks Consensus Estimate for third-quarter revenues is pegged at $5.38 billion, indicating an increase of 2.8% from the year-ago quarter’s reported figure.

Higher interest rates associated with the 2017 and 2018 wildfire claim payment funding are expected to have consistently resulted in higher net interest rate expense during the quarter. This, in turn, might have adversely impacted EIX's bottom-line performance, outweighing the solid sales growth benefits.

A few wildfires impacted the company’s service territories this summer, which might have raised its operating expenses for restoration work. This, in turn, must have affected its quarterly earnings.

The Zacks Consensus Estimate for third-quarter earnings is pegged at $1.46 per share, indicating a decline of 1.4% from the prior-year quarter’s reported number.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for EIX this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here.

Earnings ESP: EIX has an Earnings ESP of -2.18%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Edison carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are three Utility players that you may want to consider as these have the right combination of elements to come up with an earnings beat this reporting cycle.

Entergy ETR has an Earnings ESP of +0.36% and a Zacks Rank #3 at present. The company delivered a four-quarter average earnings surprise of 3.41%.

Entergy boasts a long-term earnings growth rate of 5.8%. The Zacks Consensus Estimate for ETR’s third-quarter earnings and sales is pegged at $2.99 per share and $4.05 billion, respectively.

NiSource NI has an Earnings ESP of +18.52% and a Zacks Rank #2 at present. The Zacks Consensus Estimate for third-quarter earnings is pegged at 14 cents per share, implying a 40% increase from that reported in the prior-year quarter.

The consensus mark for NI’s sales is pinned at $1.06 billion. The company has a trailing four-quarter average negative earnings surprise of 5.61%.

Ameren AEE has an Earnings ESP of +0.22% and a Zacks Rank #3 at present. The consensus estimate for third-quarter earnings is pinned at $1.80 per share, indicating a 3.5% increase year over year.

Ameren boasts a four-quarter average earnings surprise of 8.86%. The consensus mark for third-quarter sales is pegged at $2.37 billion, indicating growth of 2.8% from that recorded in the prior-year quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

NiSource, Inc (NI) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Edison International (EIX) : Free Stock Analysis Report