Editas (EDIT) Stock Gains 23% in the Past 6 Months: Here's Why

Editas Medicine EDIT is focused on developing medicines to treat serious diseases using its proprietary genome editing platform based on the unique CRISPR technology. The company is developing its lead candidate, EDIT-301, for treating severe sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT) in separate early-mid-stage studies, RUBY and EdiTHAL, respectively. Editas currently has no marketed products in its portfolio.

EDIT-301, now known as renizgamglogene autogedtemcel (reni-cel), is Editas’ experimental one-time, durable gene editing medicine. SCD and TDT are inherited blood disorders that lead to anemia and early death.

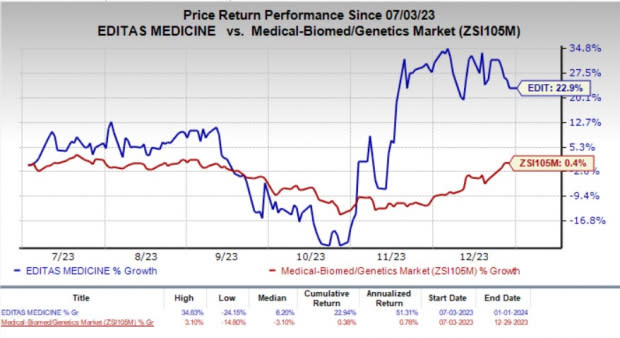

In the past six months, shares of the clinical-stage genome editing biotech have grown 22.9% compared with the industry’s brisk 0.4% rise. The uptick in the stock price has been mainly fueled by new data from the RUBY and EdiTHAL studies of EDIT-301, coupled with a collaboration agreement announced with Vertex Pharmaceuticals VRTX.

Image Source: Zacks Investment Research

In December 2023, Editas announced new safety and efficacy data in 17 patients treated with reni-cel in the RUBY and EdiTHAL studies for the treatment of SCD and TDT, respectively. Out of these 17 patients, 11 were treated in the RUBY study and the remaining six in the EdiTHAL study. Per the company, these 17 treated patients include 12 additional patients since the last data readout from these studies in June 2023.

It was observed that all patients in the RUBY study, since treatment with reni-cel, were free of vaso-occlusive events. Furthermore, all RUBY patients with a follow-up period of five months or moreafter dosinghave maintained a normal hemoglobin level and a fetal hemoglobin level (>40%). In the EdiTHAL study, all patients had an early and robust increase of total hemoglobin, above the transfusion independence threshold (9 g/dl).

Reni-cel was overall well-tolerated and continues to demonstrate a consistent safety profile by all 17 patients in both the RUBY and EdiTHAL studies, to date. These new findings were also presented by Editas at a medical conference.

Reni-cel received the Regenerative Medicine Advanced Therapy (RMAT) designation from the FDA for the treatment of SCD in the fourth quarter of 2023. The RMAT designation is generally granted to therapies that are intended to treat or cure a serious or life-threatening disease and have the potential to address unmet medical needs. It opens up early interactions between the FDA and sponsors to facilitate accelerated approval and potential priority review of a product’s biologics license application. This has also likely contributed to the soaring of Editas’ stock price.

Reni-cel already enjoys the Orphan Drug and Rare Pediatric Disease designations for the treatment of SCD and TDT in the United States. The FDA’s Orphan Drug designation for both indications will grant reni-cel market exclusivity in the United States upon potential approval.

Last month, Editas also announced that it entered a licensing agreement with Vertex for the development of the latter’s new and approved SCD gene therapy, Casgevy (exagamglogene autotemcel [exa-cel]).

Per the terms of the agreement, Vertex will receive a non-exclusive license to utilize Editas’ Cas9 gene editing technology for ex vivo gene editing medicines targeting the BCL11A gene in the fields of sickle cell disease and beta thalassemia, including Casgevy.

Although no financial considerations for the transaction were stated by either company, Editas announced that the deal with Vertex extends its cash runway into 2026. The investors cheered the collaboration agreement.

Editas Medicine, Inc. Price and Consensus

Editas Medicine, Inc. price-consensus-chart | Editas Medicine, Inc. Quote

December 2023 also witnessed the achievement of a milestone by the FDA when it approved two one-shot cell-based gene therapies, namely Casgevy and Lyfgenia (lovo-cel), for treating SCD in patients aged 12 years and older.

Lyfgenia has been developed by bluebird bio BLUE, and Casgevy has been jointly developed by CRISPR Therapeutics CRSP and Vertex.

Among the two gene therapies, the approval of CRISPR Therapeutics/Vertex’s Casgevy was more impressive since it marks the first time that the FDA approved a gene therapy utilizing the Nobel prize-winning CRISPR technology. Per the FDA, the Casgevy approval marks an important “innovative advancement” in the world of gene therapies. Lyfgenia uses a lentiviral vector (gene delivery vehicle) for genetic modifications.

The gene therapy drugs, however, come with a hefty price tag. Vertex and CRISPR Therapeutics disclosed that they would commercially launch Casgevy at $2.1 million. In a separate press release, bluebird bio announced that it will launch Lyfgenia at $3.1 million.

It is also important to note that treatment with either the CRISPR Therapeutics/Vertex or bluebird bio gene therapies has its fair share of side effects, which include low levels of platelets, white blood cells and fertility problems.

bluebird bio’s Lyfgenia label includes a black box warning for hematologic malignancy (blood cancer). Patients infused with BLUE’s therapy are required to be monitored for this malignancy for life.

Zacks Rank

Editas currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

Editas Medicine, Inc. (EDIT) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report