Editas Medicine Inc (EDIT) Reports Improved Financials and Advances in Gene Editing Trials

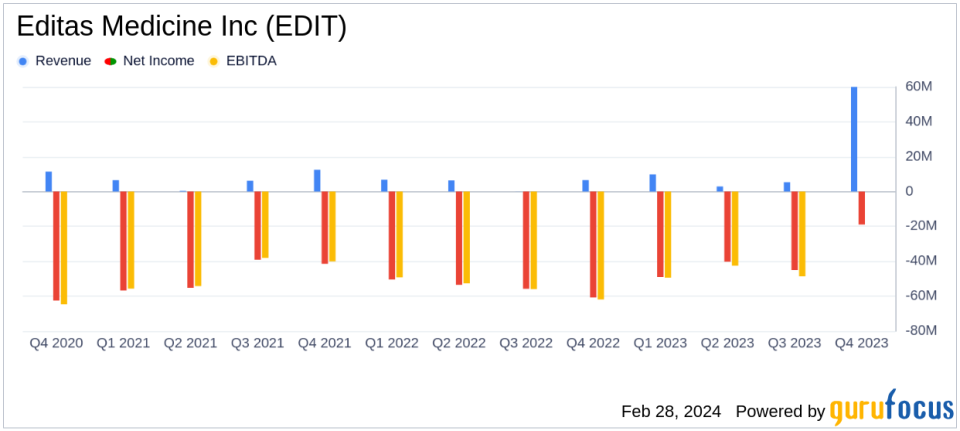

Revenue Growth: Collaboration and other R&D revenues surged to $60.0 million in Q4 2023, a significant increase from $6.5 million in the same period last year.

Reduced Net Loss: Q4 net loss narrowed to $18.9 million ($0.23 per share), improving from a net loss of $60.7 million ($0.88 per share) in Q4 2022.

Strong Cash Position: Cash, cash equivalents, and marketable securities stood at $427.1 million as of December 31, 2023, with an operational runway into 2026.

Strategic Licensing: Entered a license agreement with Vertex Pharmaceuticals for non-exclusive rights to Cas9 technology, with potential for additional revenue through 2034.

Research and Development: R&D expenses increased to $69.6 million in Q4 due to sublicense payments, while G&A expenses decreased to $14.5 million.

Editas Medicine Inc (NASDAQ:EDIT) released its 8-K filing on February 28, 2024, detailing its financial results for the fourth quarter and full year of 2023, along with significant business updates. As a leader in the field of genome editing, Editas Medicine is at the forefront of developing treatments for genetically defined diseases through its proprietary CRISPR/Cas9 technology.

Financial Performance and Business Highlights

Editas Medicine's financial results for the fourth quarter show a substantial increase in collaboration and other research and development revenues, primarily due to payments received under a license agreement with Vertex Pharmaceuticals. This agreement not only provided an immediate financial boost but also sets the stage for potential future revenues.

The company's net loss for the quarter saw a remarkable improvement, decreasing from $60.7 million in Q4 2022 to $18.9 million in Q4 2023. This reduction in net loss is a positive indicator of the company's growing efficiency and the impact of its strategic initiatives.

Research and development expenses increased due to sublicense payments related to the Vertex agreement, highlighting the company's commitment to advancing its gene editing programs. Conversely, general and administrative expenses saw a decrease, reflecting cost-saving measures and a more streamlined operational approach.

Advancements in Gene Editing Trials

Editas Medicine has reported progress in its clinical trials, particularly with the RUBY trial for Severe Sickle Cell Disease (SCD) and the EdiTHAL trial for Transfusion-dependent Beta Thalassemia (TDT). The company has aligned with the FDA, viewing RUBY as a single Phase 1/2/3 trial to support a Biologics License Application (BLA) filing. Enrollment and dosing of patients continue, with significant clinical data expected to be presented in mid-2024.

The company's in vivo medicines program is also on track, with preclinical proof-of-concept for an undisclosed indication expected by year-end. This progress in both ex vivo and in vivo therapies underscores Editas Medicine's dedication to innovation and its potential to revolutionize treatment for serious diseases.

Financial Stability and Outlook

With a strong cash position of $427.1 million, Editas Medicine is well-capitalized to fund its operations and capital expenditures into 2026. This financial stability is crucial for the company's long-term strategy and its ability to continue investing in research and development without the immediate pressure of fundraising.

The company's active engagement in business development, as evidenced by the licensing agreement with Vertex Pharmaceuticals, demonstrates a proactive approach to leveraging its intellectual property and technology to create additional revenue streams.

Editas Medicine's financial results and business updates reflect a company that is not only advancing its clinical programs but also strategically positioning itself for future growth and success in the biotechnology industry. Investors and stakeholders can look forward to further updates and potential milestones in the coming year.

For more detailed information on Editas Medicine's financials and business progress, please refer to the full 8-K filing.

Media and investor inquiries can be directed to Cristi Barnett at (617) 401-0113 or cristi.barnett@editasmed.com.

Explore the complete 8-K earnings release (here) from Editas Medicine Inc for further details.

This article first appeared on GuruFocus.