eHealth Inc (EHTH) Reports Strong Q4 and Fiscal Year 2023 Results with Significant Medicare ...

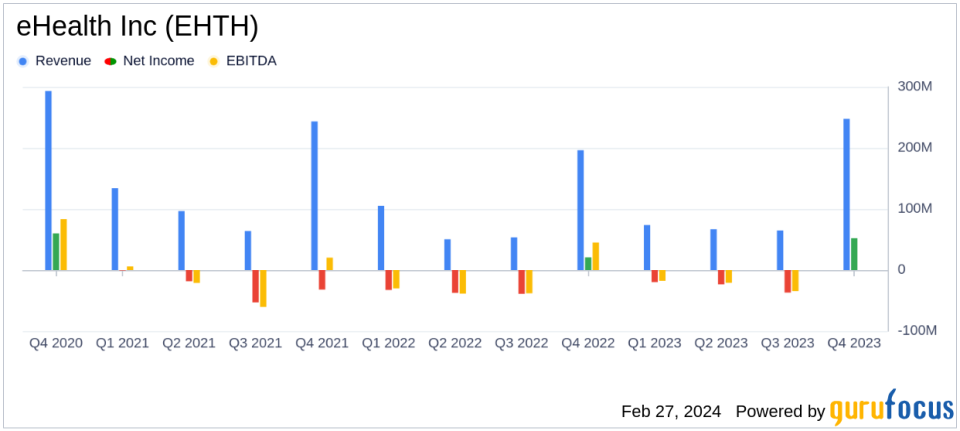

Revenue Growth: Q4 revenue increased by 26% year-over-year to $247.7 million, including a $15.6 million positive net adjustment.

Medicare Advantage Growth: Medicare Advantage approved members rose by 22% year-over-year in Q4.

Profitability: GAAP net income improved by $31.5 million to $52.2 million in Q4 compared to the previous year.

Adjusted EBITDA: Q4 adjusted EBITDA increased by $20.1 million year-over-year to $69.6 million.

Operating Cash Flow: Operating cash flow for the twelve months ended December 31, 2023, was $(6.7) million, a significant improvement from the prior year.

Financial Position: Cash, cash equivalents, and marketable securities stood at $121.7 million as of December 31, 2023.

On February 27, 2024, eHealth Inc (NASDAQ:EHTH), a leading private online health insurance marketplace, announced its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, known for offering a comprehensive health insurance exchange for individuals and small businesses, has reported a robust quarter with a 26% year-over-year increase in revenue, amounting to $247.7 million. This performance was bolstered by a $15.6 million positive net adjustment in revenue. eHealth's platform, which includes Medicare options, has seen a significant uptick in Medicare Advantage approved members, growing by 22% compared to the same quarter last year. The full details of the earnings report can be found in the company's 8-K filing.

Financial Highlights and Challenges

eHealth's performance in the fourth quarter is indicative of the success of its transformation program and preparedness efforts for the Annual Enrollment Period (AEP). The company's focus on Medicare enrollment has paid off, with a substantial increase in lifetime value (LTV) of Medicare Advantage members, which rose by 11% to $1,151. This growth is attributed to favorable member retention and carrier mix, among other factors. However, the company faces challenges, including navigating a competitive landscape and managing the complexities of healthcare regulations.

Importance of Financial Achievements

The company's financial achievements, particularly in the Medicare segment, are critical as they reflect eHealth's ability to capitalize on the growing demand for Medicare services. The improved profitability metrics, including a significant increase in GAAP net income and adjusted EBITDA, demonstrate eHealth's effective cost management and operational efficiency. These achievements are particularly important in the insurance industry, where margins can be tight, and profitability is closely tied to customer acquisition and retention.

Income Statement and Balance Sheet Analysis

From the income statement, eHealth's commission revenue, which constitutes the bulk of its revenue, saw a 28% increase in Q4, while other revenue grew by 13%. Operating costs and expenses increased by 14%, with marketing and advertising, and customer care and enrollment expenses contributing to the rise. The balance sheet shows a healthy financial position with $115.7 million in cash and cash equivalents and a significant commissions receivable balance of $918.2 million as of December 31, 2023.

Outlook and Guidance for 2024

Looking ahead, eHealth provided guidance for the full year ending December 31, 2024, with total revenue expected to be in the range of $450 million to $475 million. The company anticipates a GAAP net income (loss) in the range of $(40) million to $(20) million and adjusted EBITDA between $(5) million to $20 million. Operating cash flow is projected to be between $(15) million to $(5) million, including the expected impact of positive net adjustment revenue in the range of $0 to $15 million.

Conclusion

eHealth's strong Q4 and fiscal year 2023 performance underscore the company's strategic focus on the Medicare segment and its ability to drive profitable growth. The company's robust financial position and positive outlook for 2024 reflect its commitment to enhancing enrollment quality and customer experience. As eHealth continues to build its brand as a trusted Medicare matchmaker, investors and stakeholders can anticipate the company's sustained growth in the evolving health insurance marketplace.

Explore the complete 8-K earnings release (here) from eHealth Inc for further details.

This article first appeared on GuruFocus.