Elanco Animal Health Inc (ELAN) Reports Mixed 2023 Financial Results and Announces Strategic ...

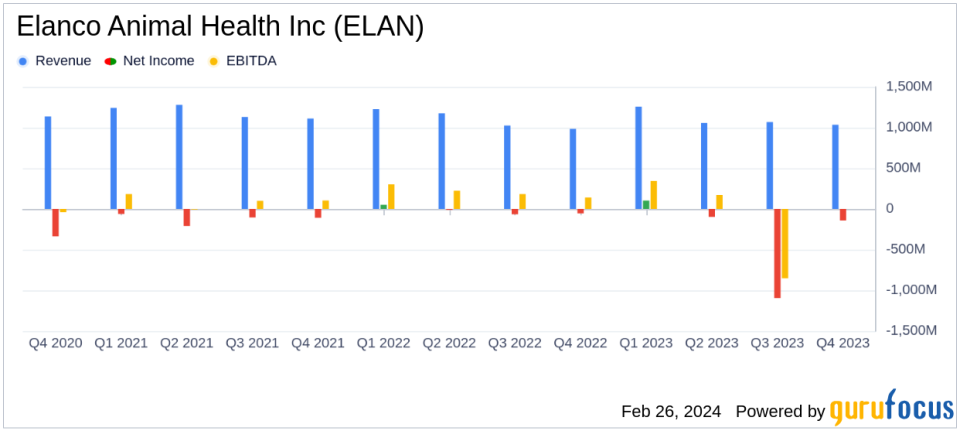

Revenue: Reported a 5% increase in Q4 2023 to $1,035 million and a stable full-year revenue at $4,417 million.

Net Loss: A reported net loss of $141 million in Q4 and $1,231 million for the full year, with adjusted net income at $39 million and $439 million respectively.

Adjusted EBITDA: Q4 adjusted EBITDA at $165 million, representing 15.9% of revenue, and $979 million for the full year or 22.2% of revenue.

Earnings Per Share (EPS): Reported EPS of $(0.29) in Q4 and $(2.50) for the full year, with adjusted EPS at $0.08 and $0.89 respectively.

Debt Reduction: Net leverage ratio improved slightly to 5.6x adjusted EBITDA.

2024 Guidance: Revenue projected to be between $4,450 to $4,540 million with an anticipated net loss of $17 to $62 million.

Strategic Restructuring: Announced plans impacting approximately 420 personnel, aiming for $30 to $35 million in annualized savings.

On February 26, 2024, Elanco Animal Health Inc (NYSE:ELAN) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. Elanco, a global animal health company, operates in over 90 countries, providing products for both companion and food animals.

Performance and Challenges

Elanco's revenue saw a 5% increase in Q4, driven by its farm animal business, innovation revenue, and price growth. However, the company faced a reported net loss of $141 million in Q4, significantly higher than the previous year's $55 million. This loss was attributed to unexpected items, including the devaluation of the Argentinian peso. Despite these challenges, Elanco's full-year revenue remained stable at $4,417 million, with a reported net loss of $1,231 million, primarily due to asset impairments and restructuring charges.

Financial Achievements and Importance

Elanco's adjusted net income and EBITDA reflect the company's ability to generate profit from its core operations, despite external challenges. The adjusted EBITDA margin of 22.2% for the full year indicates a strong underlying business performance. The net leverage ratio improvement demonstrates progress in debt management, which is crucial for the company's financial health and investor confidence.

Key Financial Metrics

Elanco's financial achievements are underscored by key metrics such as a stable revenue stream and a disciplined approach to expense management. The company's gross profit margin experienced a decline, primarily due to manufacturing and inflation pressures. Operating expenses saw a decrease, reflecting effective cost control measures. The net interest expense increased due to higher interest rates, and the effective tax rate showed a negative figure due to valuation allowances on deferred tax assets.

"Elanco ended 2023 with momentum, returning to constant currency revenue growth for the full year and delivering 5% growth in the fourth quarter," said Jeff Simmons, President and CEO of Elanco Animal Health. "We are investing to enhance our launch efforts, prioritizing cash flow improvements and meaningfully reducing leverage, from both our improving free cash flow and the expected sale of our aqua business."

Analysis of Company's Performance

Elanco's performance in 2023 was a mix of growth and setbacks. The company's revenue growth in Q4 and stable full-year revenue are positive signs, but the significant net losses indicate the impact of non-recurring charges and market challenges. The strategic restructuring and focus on debt reduction are steps towards improving operational efficiency and financial stability. The company's guidance for 2024 suggests cautious optimism, with expected revenue growth and a narrowed net loss range.

Elanco's strategic restructuring, which impacts approximately 420 personnel, is expected to generate significant annualized savings that the company plans to reinvest in value creation opportunities. This move aligns with Elanco's focus on enhancing its launch efforts and reducing leverage, which is critical for its long-term growth and market position.

For investors and stakeholders, Elanco's mixed financial results underscore the importance of monitoring the company's strategic initiatives and operational efficiencies. The company's efforts to navigate market challenges and invest in growth opportunities will be key factors in its future performance.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the implications for Elanco's future prospects.

Explore the complete 8-K earnings release (here) from Elanco Animal Health Inc for further details.

This article first appeared on GuruFocus.