Electronic Arts (EA) Q1 Earnings and Revenues Increase Y/Y

Electronic Arts EA reported first-quarter fiscal 2024 earnings of $1.47 per share, which jumped 32.4% year over year.

Revenues increased 8.9% year over year to $1.92 billion, driven by new releases, continued live services growth, healthy engagement and new player acquisition

The Zacks Consensus Estimate for earnings was pegged at $1.01 per share. The consensus mark for revenues was pinned at $1.58 billion.

Net bookings for the first quarter were $1.578 billion, up 21% or 25% in constant currency (cc) year over year. It missed the Zacks Consensus Estimate for net bookings by 0.5%.

Live services net bookings were up 4% year over year, or up 7% in cc. Growth at constant currency was driven by strength in FIFA with rapid growth occurring in Star Wars Jedi: Survivor.

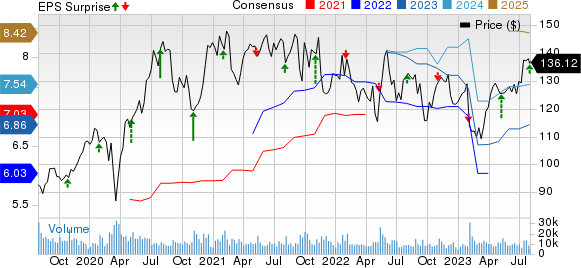

Electronic Arts Inc. Price, Consensus and EPS Surprise

Electronic Arts Inc. price-consensus-eps-surprise-chart | Electronic Arts Inc. Quote

Quarter Details

EA’s full-game revenues (23% of total revenues) increased 29.9% year over year to $443 million. The figure missed the Zacks Consensus Estimate by 9.32%.

Full-game download revenues increased 27% year over year to $301 million. The figure missed the Zacks Consensus Estimate by 5.57%.

Revenues from packaged goods increased 37% year over year to $142 million. The figure missed the Zacks Consensus Estimate by 16.36%.

Live services and other revenues (77% of total revenues) rose 3.9% year over year to $1.48 billion. The figure beat the Zacks Consensus Estimate by 6.28%.

Based on platforms, revenues from consoles increased 12% year over year to $1.16 billion in the reported quarter. The figure beat the Zacks Consensus Estimate by 3.67%.

Revenues from PC & Other increased 12% year over year to $451 million. The figure beat the consensus mark by 2.94%.

Revenues from the mobile platform decreased 5% year over year to $306 million. The figure missed the Zacks Consensus Estimate by 3.83%.

Gaming Metrics

EA rolled out five new high-quality releases, while providing more than 145 content updates across 37 titles during the quarter.

FIFA Ultimate Team engaged tens of millions of fans and daily average users grew 15 %. FIFA Mobile attracted more than 65 million new players in the quarter alone. FIFA Online produced double-digit growth across monthly, weekly and daily average users.

The Sims 4 community continues to reach a broader global audience, welcoming more than four million new players in the quarter.

Apex Legends is one of the strongest franchises and live services in the industry with 18 million active monthly players and an impressive retention rate of more than 70%. After a highly successful 16th season, the company launched Season 17 in May, with new variations of gameplay and monetization.

Operating Details

EA’s GAAP gross profit rose 7.1% from the year-ago quarter’s levels to $1.55 billion. Gross margin contracted 140 basis points (bps) on a year-over-year basis to 80.9%.

Operating expenses increased 0.2% year over year to $1.014 billion. As a percentage of revenues, operating expenses contracted 460 bps on a year-over-year basis to 52.7%.

Operating income on a GAAP basis increased 22.9% year over year to $542 million. The operating margin expanded 320 bps year over year to 28.2% in the reported quarter.

Balance Sheet and Cash Flow

As of Jun 30, 2023, EA had $2.6 billion in cash and short-term investments compared with $2.76 billion as of Mar 31, 2023.

Net cash provided by operating activities in the reported quarter was $359 million against negative net cash used in operating activities of $78 million in the previous quarter.

EA repurchased 2.6 million shares for $325 million during the quarter, bringing the total for the trailing 12 months to 10.5 million shares for $1.3 billion.

EA has declared a quarterly cash dividend of 19 cents per share of the company’s common stock. The dividend is payable on Sep 20, 2023 to shareholders of record as of the close of business on Aug 30, 2023.

Guidance

For second-quarter fiscal 2024, EA expects GAAP revenues between $1.825 billion and $1.925 billion and diluted earnings in the range of 72-89 cents per share. Net bookings are expected between $1.7 billion and $1.8 billion.

For fiscal 2024, EA expects revenues in the range of $7.3-$7.7 billion and diluted earnings of $3.42 to $3.92 per share.

The company expects net bookings guidance for the year between $7.3 billion and $7.7 billion.

Operating cash flow is estimated in the band of $1.7-$1.85 billion.

Zacks Rank & Other Stocks to Consider

EA currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Consumer Discretionary sector are PlayAGS AGS, DraftKings DKNG and Hasbro HAS. AGS currently sports a Zacks Rank #1 (Strong Buy), while DKNG and HAS carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

PlayAGS, DraftKings and Hasbro are scheduled to report their quarterly results on Aug 3.

The Zacks Consensus Estimate for AGS’ second-quarter 2023 loss per share is pegged at 1 cent, which has been unchanged over the past 30 days.

The Zacks Consensus Estimate for DKNG’s second-quarter 2023 loss is pegged at 25 cents per share, up from a loss of 29 cents per share over the past 30 days.

The Zacks Consensus Estimate for HAS’ second-quarter 2023 earnings is pegged at 58 cents per share, which has increased by a cent over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report