Electronic Arts' (EA) Q2 Earnings and Revenues Rise Y/Y

Electronic Arts EA reported second-quarter fiscal 2024 earnings of $1.47 per share, which jumped 37.4% year over year.

Revenues increased 0.5% year over year to $1.91 billion, driven by new releases, continued live services growth and healthy engagement.

The Zacks Consensus Estimate for earnings was pegged at $1.27 per share. The consensus mark for revenues was pinned at $1.78 billion.

Net bookings for the second quarter were $1.82 billion, up 3.8% year over year or 5% in constant currency (cc). It beat the Zacks Consensus Estimate for net bookings by 3.03%.

Live services net bookings were $1.129 billion, up 1% year over year or up 2% in cc.

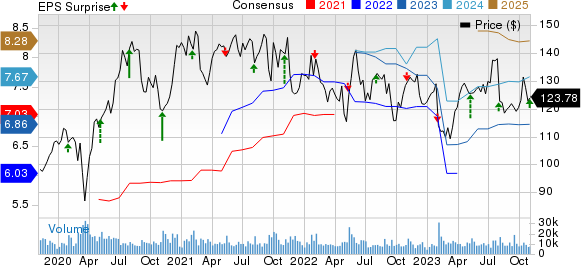

Electronic Arts Inc. Price, Consensus and EPS Surprise

Electronic Arts Inc. price-consensus-eps-surprise-chart | Electronic Arts Inc. Quote

Quarter Details

EA’s full-game revenues (32.4% of total revenues) increased 3.2% year over year to $621 million. The figure beat the Zacks Consensus Estimate by 16.89%.

Full-game download revenues increased 5% year over year to $346 million. The figure beat the Zacks Consensus Estimate by 2.75%.

Revenues from packaged goods remained flat year over year at $275 million. The figure beat the Zacks Consensus Estimate by 41.37%.

Live services and other revenues (67.6% of total revenues) declined 0.7% year over year to $1.29 billion. The figure missed the Zacks Consensus Estimate by 3.51%.

Based on platforms, revenues from consoles increased 2% year over year to $1.18 billion in the reported quarter. The figure beat the Zacks Consensus Estimate by 5.31%.

Revenues from PC & Other remained flat year over year at $423 million. The figure missed the consensus mark by 3.62%.

Revenues from the mobile platform decreased 5% year over year to $304 million. The figure missed the Zacks Consensus Estimate by 0.43%.

Gaming Metrics

EA SPORTS Madden NFL 24 delivered a strong launch in the quarter, with net bookings up 6% year over year, as exciting new in-game innovations continued to drive growth across player acquisition and engagement.

EA SPORTS FC was a huge achievement for EA. In the second quarter, the total global football business significantly exceeded expectations. Net bookings grew 41% year over year, driven by the continued momentum of FIFA 23, including triple-digit mobile net bookings growth and strong demand for the release of EA SPORTS FC 24.

EA SPORTS FC 24, within the first four weeks of global launch, had more than 14.5 million active accounts.

Apex Legends, though down on a year-over-year basis, delivered net bookings above the company’s expectations, with Season 18 driving greater-than-anticipated player acquisition and monetization. Apex Legends remains one of the strongest franchises in the industry. The company is already working on Season 19.

Operating Details

EA’s GAAP gross profit rose 1.1% from the year-ago quarter’s levels to $1.46 billion. Gross margin expanded 40 basis points (bps) on a year-over-year basis to 76.2%.

Operating expenses increased 6.5% year over year to $1.081 billion. As a percentage of revenues, operating expenses expanded 320 bps on a year-over-year basis to 56.5%.

Operating income on a GAAP basis decreased 11.7% year over year to $377 million. The operating margin contracted 270 bps year over year to 28.2% in the reported quarter.

Balance Sheet and Cash Flow

As of Sep 30, 2023, EA had $2.55 billion in cash and short-term investments compared with $1.87 billion as of Jun 30, 2023.

Net cash provided by operating activities in the reported quarter was $112 million against net cash used in operating activities of $359 million in the previous quarter.

EA repurchased 2.6 million shares for $325 million during the quarter, bringing the total for the trailing 12 months to 10.5 million shares for $1.3 billion.

EA has declared a quarterly cash dividend of 19 cents per share of the company’s common stock. The dividend is payable on Dec 20, 2023 to shareholders of record as of the close of business on Nov 29, 2023.

Guidance

For third-quarter fiscal 2024, EA expects GAAP revenues between $1.825 billion and $2.025 billion and diluted earnings in the range of $0.75-$1.01 per share. Net bookings are expected between $2.25 billion and $2.45 billion.

For fiscal 2024, EA expects revenues in the range of $7.3-$7.7 billion and diluted earnings of $4.1-$4.66 per share.

The company expects net bookings guidance for the year between $7.3 billion and $7.7 billion.

Operating cash flow is estimated in the band of $1.95-$2.1 billion.

Zacks Rank & Stocks to Consider

EA currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Consumer Discretionary sector are PlayAGS AGS, AMark Precious Metals AMRK and American Public Education APEI. American Public Education sports a Zacks Rank #1 (Strong Buy), while PlayAGS and AMark Precious Metals carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

PlayAGS, AMark Precious Metals and American Public Education are each scheduled to report the quarterly results on Nov 7.

The Zacks Consensus Estimate for AGS’ third-quarter 2023 earnings per share is pegged at 1 cent, up from a loss of 1 cent over the past 30 days.

The Zacks Consensus Estimate for AMRK’s third-quarter 2023 earnings is pegged at $1.88 per share, up 1.1% over the past 30 days.

The Zacks Consensus Estimate for APEI’s third-quarter 2023 loss is pegged at 25 cents per share, which has remained unchanged over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

A-Mark Precious Metals, Inc. (AMRK) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report