Electronic Arts Inc (EA) Delivers Solid Q3 FY24 Results with Record Live Services Net Bookings

Net Bookings: Q3 net bookings reached $2.366 billion, a 1% increase year-over-year.

Live Services Growth: Live services and other net bookings hit a record $1.712 billion, up 3% from the previous year.

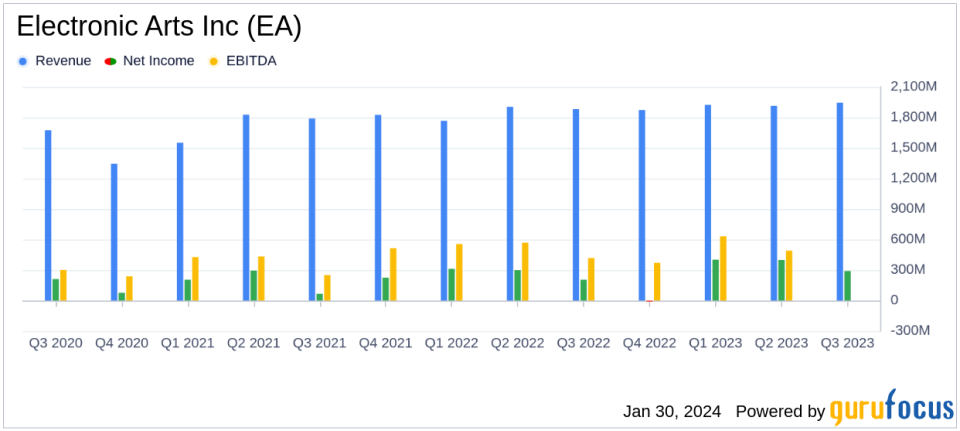

Net Revenue and Net Income: Net revenue for the quarter was $1.945 billion with net income rising to $290 million.

Earnings Per Share: Diluted earnings per share improved to $1.07, up from $0.73 year-over-year.

Operational Cash Flow: Cash provided by operating activities increased to $1.264 billion, a 13% year-over-year growth.

Share Repurchase and Dividend: EA repurchased 2.5 million shares for $325 million and declared a quarterly cash dividend of $0.19 per share.

On January 30, 2024, Electronic Arts Inc (NASDAQ:EA) released its 8-K filing, revealing the financial outcomes for the third quarter ended December 31, 2023. EA, a global leader in digital interactive entertainment, is known for its diverse portfolio of popular franchises such as EA SPORTS FC, Battlefield, Apex Legends, and The Sims.

EA's CEO, Andrew Wilson, highlighted the company's strong performance in Q3, attributing success to the teams' ability to engage millions through their portfolio, resulting in record live services. The CFO, Stuart Canfield, noted the 7% year-over-year net bookings growth for EA SPORTS FC, emphasizing the brand's continued momentum.

Financial Performance and Challenges

EA's financial achievements in Q3 FY24 are significant, with net bookings slightly increasing by 1% year-over-year to $2.366 billion. The growth in live services and other net bookings, which now constitute 73% of EA's business, underscores the company's successful pivot towards recurring revenue streamsa critical strategy in the interactive media industry.

Despite these achievements, challenges remain. The modest growth in net bookings suggests a competitive market landscape and the need for continuous innovation to sustain and enhance growth. Additionally, the reliance on live services indicates potential vulnerability to shifts in consumer engagement and spending patterns.

Income Statement and Balance Sheet Highlights

EA's net revenue for the quarter stood at $1.945 billion, with net income experiencing a notable increase to $290 million compared to $204 million in the previous year. The diluted earnings per share also saw a significant rise from $0.73 to $1.07. The balance sheet remains robust, with net cash from operating activities reaching $1.264 billion, marking a 13% increase year-over-year.

The company's commitment to shareholder returns is evident through its share repurchase program and dividend payments. During the quarter, EA repurchased 2.5 million shares for $325 million and declared a quarterly cash dividend of $0.19 per share.

Looking Ahead

Looking forward, EA anticipates net revenue for Q4 FY24 to be between $1.625 billion and $1.925 billion, with net income projected to be between $54 million and $183 million. The diluted earnings per share are expected to range from $0.20 to $0.68, based on an estimated share count of 271 million for calculating diluted earnings per share.

EA's operational outlook for net bookings is also projected to be in the range of $1.625 billion to $1.925 billion. These expectations reflect the company's confidence in its ability to maintain its growth trajectory and manage operational efficiency effectively.

Electronic Arts Inc (NASDAQ:EA) continues to navigate the dynamic gaming industry with a focus on its largest franchises and innovative offerings. The company's financial health and strategic investments position it well for sustained growth and shareholder value creation.

For a more detailed analysis of Electronic Arts Inc (NASDAQ:EA)'s financial results and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Electronic Arts Inc for further details.

This article first appeared on GuruFocus.