Element (ESI) Q2 Earnings In Line With Estimates, Revenues Lag

Element Solutions Inc. ESI recorded second-quarter 2023 earnings of 11 cents per share compared with 25 cents in the year-ago quarter.

Adjusted earnings per share came in at 31 cents in the quarter, which matched the Zacks Consensus Estimate.

The company generated net sales of $586.1 million, down 13% year over year. The figure also missed the Zacks Consensus Estimate of $626.9 million. The company faced headwinds from the weakening of the electronics market in the quarter.

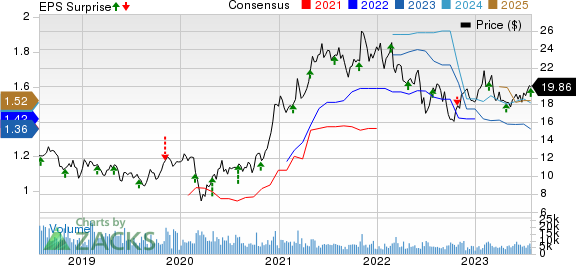

Element Solutions Inc. Price, Consensus and EPS Surprise

Element Solutions Inc. price-consensus-eps-surprise-chart | Element Solutions Inc. Quote

Segment Highlights

Net sales in the Electronics segment fell 19% year over year to $356 million in the reported quarter, with organic net sales down 9% from the previous year's reported figure. The figure fell short of our estimate of $362.7 million.

In the Industrial & Specialty segment, net sales declined 2% year over year to $230 million, with organic net sales also down 2%. The figure was below our estimate of $256.2 million.

Financial Position

Element Solutions ended the quarter with cash and cash equivalents of $282.4 million, up 30.7% year over year. Long-term debt was $2,029.4 million at the end of the quarter, up 7.4% year over year.

Cash from operating activities was $81 million in the quarter. Free cash flow was $67 million.

Outlook

The company expects adjusted EBITDA for third-quarter 2023 of roughly $125 million. ESI revised its adjusted EBITDA guidance to the range of $490 million to $500 million for 2023.

It estimates full-year 2023 adjusted earnings per share of around $1.30. ESI anticipates generating a free cash flow of roughly $265 million for 2023.

Price Performance

Shares of Element Solutions have gained 1.2% in a year compared with a 13.1% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Element Solutions currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space include Livent Corporation LTHM,and Carpenter Technology Corporation CRS, both sporting a Zacks Rank #1 (Strong Buy), and United States Steel Corporation X, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LTHM’s current-year earnings has been revised 14% upward in the past 90 days. LTHM beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 22%. The company’s shares have gained 5% in the past year.

The earnings estimate for CRS’s current year is pegged at $1.04, indicating year-over-year growth of 198%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 30.9%. The company’s shares have rallied 92.7% in the past year.

The Zacks Consensus Estimate for X’s current-year earnings has been revised 5.4% upward in the past 60 days. U.S. Steel beat the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 18.1% on average. The company’s shares have risen roughly 20.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Steel Corporation (X) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Livent Corporation (LTHM) : Free Stock Analysis Report