Element (ESI) Q3 Earnings Surpass Estimates, Revenues Lag

Element Solutions Inc. ESI recorded a loss of 13 cents per share in third-quarter 2023 compared with earnings of 22 cents in the year-ago quarter.

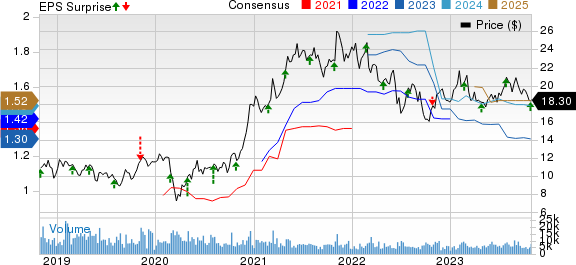

Adjusted earnings per share came in at 36 cents in the quarter, beating the Zacks Consensus Estimate of 34 cents.

The company generated net sales of $599.3 million, down 3% year over year. The figure missed the Zacks Consensus Estimate of $624.5 million. In the reported quarter, the company achieved robust sequential growth in adjusted EBITDA, primarily driven by a recovery in the electronics segment and expanding profit margins.

Element Solutions Inc. Price, Consensus and EPS Surprise

Element Solutions Inc. price-consensus-eps-surprise-chart | Element Solutions Inc. Quote

Segment Highlights

Net sales in the Electronics segment fell 6% year over year to $367 million in the reported quarter, with organic net sales down 5% from the previous year's reported figure. The figure fell short of our estimate of $388.8 million.

In the Industrial & Specialty segment, net sales declined 1% year over year to $232 million, with organic net sales dropping 1%. The figure was below our estimate of $245.2 million.

Financial Position

Element Solutions ended the quarter with cash and cash equivalents of $329.6 million, up 40.9% year over year. Long-term debt was $2,027.8 million at the end of the quarter, up 7.4% year over year.

Cash from operating activities was $87 million in the quarter. Free cash flow was $75 million.

Outlook

ESI revised its adjusted EBITDA guidance to nearly $485 million for 2023.

It estimates full-year 2023 adjusted earnings per share of around $1.30. ESI anticipates generating a free cash flow of about $265 million for 2023.

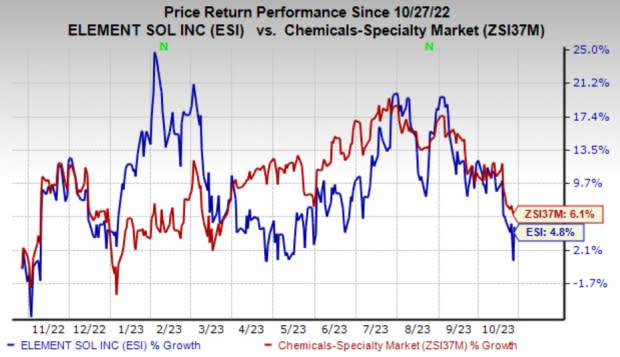

Price Performance

Shares of Element Solutions have gained 4.8% in a year compared with a 6.1% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Element Solutions currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are The Andersons Inc. ANDE, sporting a Zacks Rank #1 (Strong Buy) and WestRock Company WRK and Koppers Holdings Inc. KOP, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward in the past 90 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 43.4% in a year.

In the past 60 days, the Zacks Consensus Estimate for WestRock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have rallied 4.6% in the past year.

The consensus estimate for Koppers’ current fiscal year earnings is pegged at $4.45, indicating year-over-year growth of 7.5%. KOP beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 21.7%. The company’s shares have surged 46% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report