Element Solutions (ESI) Earnings and Sales Beat Estimates in Q4

Element Solutions Inc. ESI recorded earnings (as reported) from continuing operations of 5 cents per share in fourth-quarter 2022 compared with 2 cents in the year-ago quarter.

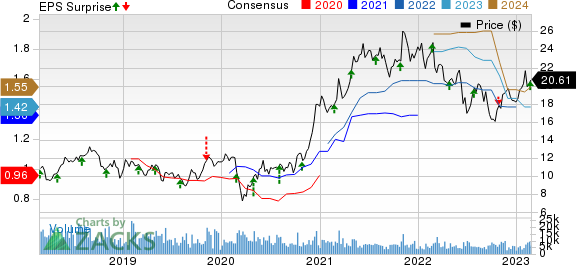

Adjusted earnings per share came in at 29 cents in the quarter, which beat the Zacks Consensus Estimate of 28 cents.

The company generated net sales of $573.8 million, down around 11% year over year. The figure surpassed the Zacks Consensus Estimate of $558.8 million. Organic net sales rose 3%. The company faced headwinds from the weakening of demand in high-end electronics markets due to the slowdown of industrial activities in China resulting from lockdowns.

Element Solutions Inc. Price, Consensus and EPS Surprise

Element Solutions Inc. price-consensus-eps-surprise-chart | Element Solutions Inc. Quote

Segment Highlights

Net sales in the Electronics segment fell 18% year over year to $338 million in the reported quarter. Organic net sales were flat compared with the year-ago quarter’s reported figure.

Net sales in the Industrial & Specialty were flat year over year at $236 million. Organic net sales moved up 7% year over year.

FY22 Results

Earnings for full-year 2022 were 75 cents per share compared with 82 cents per share a year ago. Net sales rose around 6% year over year to $2,549.4 million.

Financial Position

Element Solutions ended 2022 with cash and cash equivalents of $265.6 million, down around 20% year over year. Long-term debt was $1,883.8 million at the end of the quarter, essentially flat year over year.

Cash from operating activities was $296 million for 2022. Free cash flow was $253 million for the year.

The company repurchased 8 million shares of its common stock during 2022.

Outlook

The company expects adjusted EBITDA for 2023 in the range of $510-$530 million. It sees full-year 2023 adjusted earnings per share in the range of $1.40-$1.43. ESI anticipates generating free cash flow of roughly $275 million for 2023.

The company also forecasts adjusted EBITDA to rise 1-3% sequentially in first-quarter 2023.

Price Performance

Shares of Element Solutions have lost 16.8% in a year against a 14.8% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Element Solutions currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Commercial Metals Company CMC and Nucor Corporation NUE.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 22.3% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has rallied around 73% in a year.

Commercial Metals currently carries a Zacks Rank #1. The consensus estimate for CMC's current-year earnings has been revised 10% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 16.7%, on average. CMC has gained around 39% in a year.

Nucor currently carries a Zacks Rank #1. The Zacks Consensus Estimate for NUE’s current-year earnings has been revised 12.5% upward in the past 60 days.

Nucor beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 7.7% on average. NUE’s shares have gained roughly 26% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report