Element Solutions (ESI) Unit to Open New Lab for Auto Industry

Element Solutions Inc's ESI business unit MacDermid Enthone Industrial Solutions, a leading manufacturer of chemical compounds used in surface coating applications, has announced its plans to establish a second facility in Japan to serve the local automotive industry better. This state-of-the-art laboratory will be situated in Nagoya and will cater to the technical needs of the region's Tier 1 and Tier 2 suppliers, as well as other essential companies within the automotive ecosystem.

Operating in Japan under the legal entity MacDermid Performance Solutions Japan K.K., the company currently provides technical services to customers in Nagoya from its Hiratsuka location in Kanagawa Prefecture. The new laboratory in Nagoya will significantly reduce response times for existing customers when making crucial decisions regarding their plating bath parameters. This is especially important for many customers who operate around the clock. Furthermore, this expansion into Nagoya aligns with all major automotive OEMs' business continuity planning requirements.

After a preliminary soft launch on October 1, the company is set to achieve full operational capability by April 2024. The remarkable growth experienced in its automotive sector has acted as a catalyst for this expansion into Japan. Given Japan's unwavering commitment to sustainability, the company eagerly anticipates broadening its product portfolio within the electric vehicle segment. This strategic investment in Aichi Prefecture allows the company to deepen its market presence among Japan-based manufacturers specializing in brake calipers, door handles, emblems, fasteners and other pivotal components.

The company is thrilled to establish a footprint in Nagoya, where it has been providing customers with specialized chemicals for over four decades. This strategic investment reaffirms its enduring dedication to Japan, a nation that deeply appreciates the worth of its eco-friendly products. Moreover, they anticipate this established trust will pave the way for new business prospects.

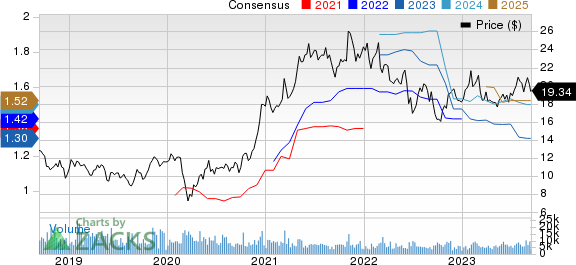

Shares of Element Solutions have gained 4.4% in a year compared with an 11.9% rise of the industry.

Image Source: Zacks Investment Research

In the second quarter, Element Solutions achieved adjusted earnings per share of 31 cents, meeting the Zacks Consensus Estimate, while experiencing a 13% decline in net sales at $586.1 million, falling short of the Zacks Consensus Estimate of $626.9 million due to challenges in the electronics market. The company expects adjusted EBITDA of approximately $125 million for the third quarter of 2023. It has revised its full-year 2023 adjusted EBITDA guidance to a range of $490-$500 million. They also estimate full-year 2023 adjusted earnings per share to be around $1.30 and anticipate generating approximately $265 million in free cash flow for 2023.

Element Solutions Inc. Price and Consensus

Element Solutions Inc. price-consensus-chart | Element Solutions Inc. Quote

Zacks Rank & Key Picks

Element Solutions currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the primary materials space are Carpenter Technology Corporation CRS and Akzo Nobel N.V. AKZOY, both sporting a Zacks Rank #1 (Strong Buy), and Alamos Gold Inc. AGI, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Carpenter Technology’s current year is pegged at $3.48, indicating a year-over-year growth of 205%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 75.2% in the past year.

The consensus estimate for Akzo Nobel’s current-year earnings is pegged at $1.44, indicating a year-over-year growth of 67.4%. In the past 60 days, AKZOY’s current-year earnings estimate has been revised upward by 2.9%. The company’s shares have rallied 25.3% in the past year.

The earnings estimate for Alamos’ current year is pegged at 43 cents, indicating a year-over-year growth of 53.6%. The Zacks Consensus Estimate for AGI current-year earnings has been revised 13.1% upward in the past 60 days. The company’s shares have risen roughly 61.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Akzo Nobel NV (AKZOY) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report