Eli Lilly (LLY) Stock Up 57% in 2023: Will the Uptrend Continue?

Eli Lilly and Company LLY made rapid pipeline progress in areas like obesity, diabetes and Alzheimer’s, thus attracting investors to the stock in 2023.

Lilly, with a market cap of more than $550 billion, boasts a wide range of products that serve a vast number of therapeutic areas. The company focuses primarily on diabetes, neuroscience, oncology and immunology, which are all high growth areas and represent significant commercial potential. In 2023, it saw new drugs generating impressive sales, received approvals for more new drugs and witnessed pipeline and regulatory success.

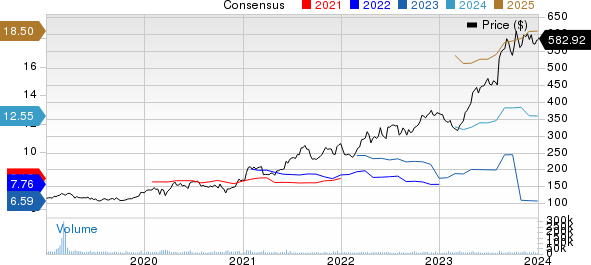

The stock rose 57.4% in 2023 compared with an increase of 8.4% for the industry.

Image Source: Zacks Investment Research

With such an impressive return in 2023, investors may be skeptical of the stock’s growth potential in 2024. We believe the stock has the potential to rise further in 2024

Mounjaro/tirzepatide, Lilly’s new dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA), was approved for treating type II diabetes in May 2022 and generated impressive sales of $2.96 billion in the first nine months of 2023, benefiting from strong demand trends in the popular GLP-1 segment of the diabetes market. Tirzepatide is expected to be a key long-term top-line driver for Lilly as it has the potential to be approved for obesity and other diabetes-related diseases.

Tirzepatide showed superior weight-loss reduction in clinical studies for obesity indication. It was approved for the said indication in the United States in November by the name of Zepbound. Mounjaro and Zepbound are expected to be key top-line drivers for Lilly in 2024, with demand for weight loss drugs rising rapidly.

However, there is much more to Lilly beyond Mounjaro and Zepbound. Lilly gained approvals for some other new drugs in 2023. Omvoh/mirikizumab was approved for its first inflammatory bowel disease (IBD) indication, ulcerative colitis, in the United States, Europe and Japan in 2023. Lilly expects to file a regulatory application seeking approval for Omvoh/mirikizumab for its second IBD indication, Crohn's disease, in 2024. Lilly’s BTK inhibitor Jaypirca was approved for mantle cell lymphoma in the United States in January 2023 and for the second indication, chronic lymphocytic leukemia, in December.

Lilly will file the U.S. regulatory application for donanemab for early Alzheimer’s disease in the first quarter of 2024 while an application is under review in the EU. Donanemab is an important asset in Lilly’s pipeline. Data from studies have shown that donanemab produced a significant reduction of amyloid buildup in the brain and plasma phosphorylated tau (P-tau) in the blood. Amyloid plaque and P-tau are key biomarkers of Alzheimer's disease and their reduction is likely to predict clinical benefit in the treatment of early Alzheimer's disease.

All these potential new product launches are expected to drive the growth of the company.

Lilly also acquired a couple of clinical-stage biotechs in 2023 like POINT Biopharma, a maker of next-generation radioligand therapies for treating cancers, and DICE Therapeutics, a maker of IL-17 inhibitors to treat chronic diseases in immunology. The acquisitions strengthened its pipeline.

Continued strong sales of key drugs Verzenio, Jardiance and Taltz, coupled with contributions from new products like Zepbound and Mounjaro, are expected to drive top-line growth in 2024.

Zacks Rank & Stocks to Consider

Lilly currently has a Zacks Rank #3 (Hold).

Eli Lilly and Company Price and Consensus

Eli Lilly and Company price-consensus-chart | Eli Lilly and Company Quote

Some better-ranked drug/biotech companies worth considering are Novo Nordisk NVO, Rigel Pharmaceuticals RIGL and Aquestive Therapeutics AQST, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Novo Nordisk’s 2024 earnings per share have increased from $2.99 to $3.14 over the past 60 days. NVO’s stock has surged 51.1% in the past year.

Earnings of Novo Nordisk beat estimates in two of the last four quarters, missed in one and matched estimates in one, delivering an earnings surprise of 0.58% on average.

In the past 60 days, the loss per share estimate for Rigel Pharmaceuticals for 2024 has narrowed from 15 cents per share to 8 cents per share. RIGL’s stock has risen 8.2% in the past year.

Earnings of Rigel Pharmaceuticals beat estimates in each of the last four quarters, delivering an average surprise of 58.14%.

In the past 60 days, the consensus estimate for Aquestive Therapeutics’ 2024 loss has narrowed from 56 cents per share to 34 cents per share. AQST’s stock has surged 124.5% in the past year.

Aquestive Therapeutics beat estimates in three of the trailing four quarters and missed the mark once, delivering an average earnings surprise of 70.58%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Rigel Pharmaceuticals, Inc. (RIGL) : Free Stock Analysis Report

Aquestive Therapeutics, Inc. (AQST) : Free Stock Analysis Report