ElringKlinger AG's (ETR:ZIL2) P/S Is On The Mark

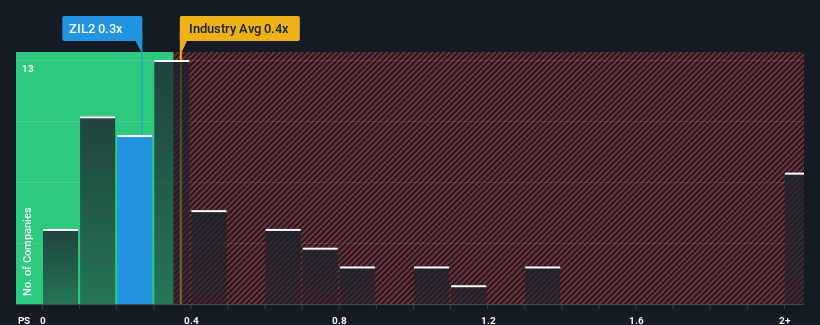

There wouldn't be many who think ElringKlinger AG's (ETR:ZIL2) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Auto Components industry in Germany is very similar. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for ElringKlinger

What Does ElringKlinger's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, ElringKlinger has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think ElringKlinger's future stacks up against the industry? In that case, our free report is a great place to start.

Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, ElringKlinger would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. Revenue has also lifted 10% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 6.7% per annum as estimated by the five analysts watching the company. With the industry predicted to deliver 5.5% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's understandable that ElringKlinger's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that ElringKlinger maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with ElringKlinger, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on ElringKlinger, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here