Eltek Ltd. (NASDAQ:ELTK) Q4 2022 Earnings Call Transcript

Eltek Ltd. (NASDAQ:ELTK) Q4 2022 Earnings Call Transcript March 9, 2023

Operator: Ladies and gentlemen, thank you for standing by. Welcome to the Eltek Ltd. 2022 Full Year and Fourth Quarter Financial Results Conference Call. All participants are at present in a listen-only mode. Following management's formal presentation, instructions will be given for the question-and-answer session. As a reminder, this conference is being recorded. Before I turn the call over to Mr. Eli Yaffe, Chief Executive Officer; and Ron Freund, Chief Financial Officer, I would like to remind you that they will be referring to forward-looking information in today's presentation and in the Q&A. By its nature, this information contains forecasts, assumptions and expectations about future outcomes, which are subject to the risks and uncertainties outlined here and discussed more fully in Eltek's public disclosure filings.

These forward-looking statements are projections and reflect the current beliefs and expectations of the company. Actual events or results may differ materially. We will also be referring to non-GAAP measures. Eltek undertakes no obligation to publicly release revisions to such forward-looking statements to reflect events or circumstances occurring subsequent to this date. I will now turn the call over to Mr. Eli Yaffe. Mr. Yaffe, please go ahead.

Eli Yaffe : Thank you. Good morning, everyone. Thank you for joining us, and welcome to Eltek's 2020 full year and fourth quarter earnings call. With me is Ron Freund, our Chief Financial Officer. We will begin by providing you with an overview of our business and summary of the principal factors that affected our results during 2022, followed by the details of our financial results. After our prepared remarks, we will be happy to answer any of your questions. By now, everyone should have access to our press release, which was released earlier today. The release will be also available on our website at www.nisteceltek.com. 2022 was a year of great growth in the company activities. This year, thanks to the growing demand for our products and the execution of our dedicated team of employees, we were able to achieve sales of almost $40 million.

In the last two quarters of 2022, we achieved sales of over $10 million per quarter. These results are the result of our successful plan to keep pace with the increased demand for our products. We ended 2022 with a backlog of 70% higher than the backlog of the beginning of the year. The increase in demand for the company products is mainly due to two trends that have prevailed over the past few years and which we anticipate will continue in 2023. The first one is the shift to manufacturing complex PCB in the manufacturing plants in Western countries from the East due to the IP and security consideration. We are mainly active in the military aerospace, aviation and defense market, which put out importance on these aspects. And therefore, we have benefited and continue to benefit from this trend.

The second trend that occurred during the last year is the political situation in Eastern Europe, which led many governments to increase their defense budget and issue orders for defense product. We estimate that about 60% of our revenues are PCBs for the defense industry. We continue to notice high demand from the Indian market for higher reliability flex-rigid PCB. We are constantly working on expanding our range of products, while adopting the latest production technologies using new raw materials and adopting our range of products due to the changed needs in the market. During 2022, we continue to invest in the new machines and equipment as well as the optimization of our manufacturing processes. In the first quarter of 2022, we decided to accelerate our investment plan and enter a Phase 1 of the plan, where we will invest approximately $8 million with the aim to enable us to increase sales.

This phase includes installation of new production lines and machines, and will allow for increased output, increase efficiency and manufacturers of product at higher technological level. We expect that anticipate increased efficiency and increase in sales will support our long-term growth -- our long-term plan for gross margin of target of 24%. In June and July 2022, we successfully dealt with the fire that broke out one of our production rooms. As of today, we have not finished the negotiation with the insurance company to receive a full compensation for the damages we suffered. We hope to conclude this negotiation soon. During Q4, we received final approval from the Israeli Innovation Authority, IIA, for 40% royalty bearing participation in approximately $800,000 one-year development program, which started in January 2023.

This program is part of our investment in research and development activity to bring new high-quality products to the market and drive future growth. We ended 2022 with a net profit of $3.2 million, EBITDA of $4.5 million, a cash balance of approximately $7.4 million and net cash provided operating activity of $3.8 million. Our strong balance sheet and consistent profitability are an excellent starting point for 2023, in which we plan to continue the growth in the company revenue and profitability. I will now turn the call over to Ron Freund, our CFO, to discuss our financial results.

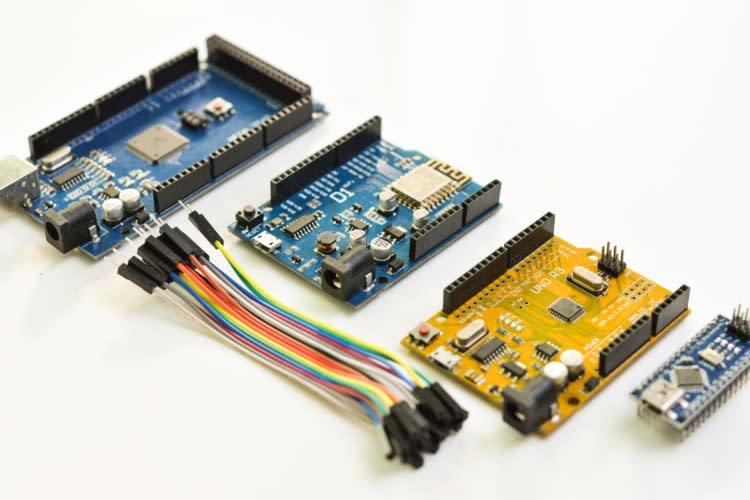

frank-wang-ogxlyCA1BQc-unsplash

Ron Freund: Thank you, Eli. I would like to draw your attention to the financial statements for the year ended December 31, 2022, and for the fourth quarter of 2022. During this call, I will also discuss certain non-GAAP financial measures. Eltek uses EBITDA as a non-GAAP financial performance measurement. Please see our earnings release for its definition and the reasons for its use. First, I will go over the highlights of 2022. All numbers mentioned are in US dollars. Revenues for the full year of 2022 totaled $39.6 million compared to $33.8 million in 2021, an increase of 17%. The increase in revenues is mainly due to the effect of the COVID-19 crisis on our customers' demand for products during 2021, the shortage in raw materials in Q1 2021, and the increased demand for our products in 2022, as Eli mentioned before.

Gross profit increased by 20%, reaching $8.3 million compared to a gross profit of $6.9 million in 2021. The increase is mainly due to the increase in revenues. Operating profit amounted to $3 million in 2022 compared to $1.9 million in 2021. In 2022, we have recorded financial income in the amount of $0.9 million compared to financial expense of $0.5 million in 2021. The increased income is due to the devaluation of the NIS against the US dollar. Profit before income tax amounted $3.9 million in 2022 compared to $1.5 million in 2021. Tax expenses amounted $0.7 million compared to tax income of $3.5 million in 2021. The tax income in 2021 is due to recording a deferred tax asset in regard to the company's tax loss carry-forwards. Net profit was $3.2 million or $0.55 per share in 2022, compared to net profit of $5 million or $0.86 per share in 2021.

EBITDA was $4.5 million in 2022, compared to $3.8 million in 2021. During 2022, we enjoyed positive cash flow from operating activities of $3.8 million, compared to $3.9 million in 2021. As of December 31, 2022, we had cash and cash equivalents of $7.4 million compared to $9.3 million at the end of 2021. This decrease is due to dividend distribution of $1 million, the devaluation of the NIS against the US dollar and the investment in new machines for which we still did not receive compensation from our insurance company. I will now go over the highlights of the fourth quarter of 2022 compared to the fourth quarter of 2021. Revenues for the fourth quarter of 2021 were $10.5 million compared to $9.5 million in the fourth quarter of 2021. Gross profit amounted to $2.2 million in the fourth quarter of 2022 compared to $2 million in the fourth quarter of 2021.

Net profit in the fourth quarter of 2022 was $0.8 million or $0.14 per fully diluted share, compared to net profit of $3.8 million or $0.65 per fully diluted share in the fourth quarter of 2021. In the fourth quarter of 2021, we have recorded a tax benefit in the amount of $3.6 million. EBITDA was $1.2 million in the fourth quarter of 2022, compared to EBITDA of $1.1 million in the fourth quarter of 2021. Cash flow from operating activities was $1.3 million compared to $0.4 million provided by operating activities in the fourth quarter of 2021. We are now ready to take your questions.

See also 30 Biggest SaaS Companies in the World in 2023 and 13 Best Annual Dividend Stocks to Buy Now.

To continue reading the Q&A session, please click here.