Embecta Corp (EMBC) Reports Modest Revenue Growth and Decline in Profitability in Q1 Fiscal 2024

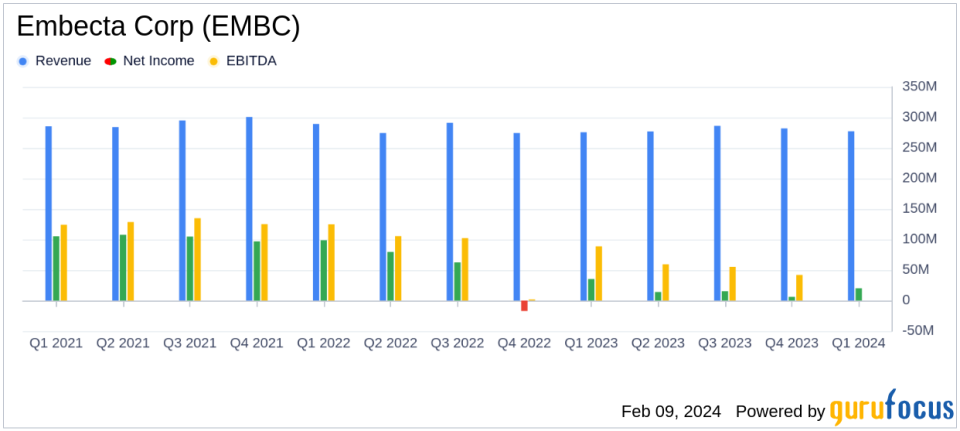

Revenue: Slight increase to $277.3 million, up 0.6% year-over-year.

Gross Margin: Decreased to 67.0% from 68.5% in the prior year period.

Operating Income: Significantly reduced to $45.5 million from $88.8 million year-over-year.

Net Income: Dropped to $20.1 million, with earnings per diluted share of $0.35.

Adjusted EBITDA: Declined to $90.4 million, with a margin of 32.6%.

Dividend: Announced a dividend of $0.15 per share.

Guidance: Raised for certain key financial metrics for fiscal year 2024.

On February 9, 2024, Embecta Corp (NASDAQ:EMBC), a global diabetes care company, released its 8-K filing, detailing the financial results for the first quarter of fiscal year 2024. The company, known for its innovative technology and solutions such as BD Pyxis and PureWick, reported a marginal revenue increase to $277.3 million, a 0.6% rise on a reported basis, though slightly down by 0.3% on a constant currency basis.

Embecta's U.S. revenues saw a 0.5% decrease, while international revenues grew by 1.8% on a reported basis. Despite the slight revenue growth, the company faced challenges in profitability, with gross profit and margin declining to $185.9 million and 67.0%, respectively, compared to $188.8 million and 68.5% in the prior year period. Operating income and margin saw a significant drop to $45.5 million and 16.4%, from $88.8 million and 32.2% in the prior year period. Net income also decreased to $20.1 million, with earnings per diluted share of $0.35, compared to $35.2 million and $0.61 in the prior year period.

Adjusted EBITDA and margin declined to $90.4 million and 32.6%, from $110.2 million and 40.0% in the prior year period. Despite these challenges, Embecta announced a dividend of $0.15 per share and raised its guidance for certain key financial metrics for the fiscal year 2024, reflecting confidence in its strategic initiatives and future performance.

Financial Performance Analysis

Embecta's balance sheet as of December 31, 2023, showed approximately $298.7 million in cash and cash equivalents, with $1.633 billion of debt principal outstanding. The company had not drawn on its $500 million Revolving Credit Facility. The transition to its own ERP system and the strategic filing of its open-loop patch pump with the FDA are notable achievements that underscore Embecta's commitment to growth and innovation in the diabetes care market.

The company's strategic highlights include strengthening its base business, with six abstracts accepted for presentation at the ATTD 2024 conference and hosting an industry-sponsored symposium. Embecta also completed significant infrastructure transitions, including ERP implementation and the finalization of the transfer of its Suzhou, China manufacturing entity from BD.

Embecta's updated financial guidance for fiscal year 2024 anticipates revenues between $1,094 million and $1,116 million, with adjusted gross margin percentages between 63.0% and 64.0%, and adjusted earnings per diluted share between $1.95 and $2.15. The company's focus on investing for growth is evident in its filing for an open-loop insulin delivery system with the FDA and the progression of a type 2 closed-loop insulin delivery system.

Value investors may find Embecta's commitment to innovation and strategic growth initiatives appealing, despite the current challenges in profitability margins. The company's ability to adapt and invest in new technologies may position it well for future success in the competitive medical devices and instruments industry.

For a detailed understanding of Embecta Corp's financial performance and strategic direction, investors and potential GuruFocus.com members are encouraged to review the full earnings report and consider the company's prospects in the context of the broader medical technology sector.

Explore the complete 8-K earnings release (here) from Embecta Corp for further details.

This article first appeared on GuruFocus.