Embrace 3 Opportunities Amid Geopolitical Chaos

War in the Middle East Breaks Out

Over the weekend, an all-out war broke out in the Middle East after the Palestinian militant group Hamas launched a large-scale attack on Israel. The dispute over the Gaza Strip is a long-standing conflict between Israelis and Palestinians, primarily involving issues of territory, borders, and sovereignty. Recently, the region has been under a tight blockade, leading to economic hardship and humanitarian challenges. However, over the weekend, the conflict dramatically escalated after Hamas launched an attack on Israel that was the largest-scale, most coordinated effort. As a result of the attack, Israeli Prime Minister Benjamin Netanyahu declared a state of war.

Stick to Data & Market Precedent – Not Opinions

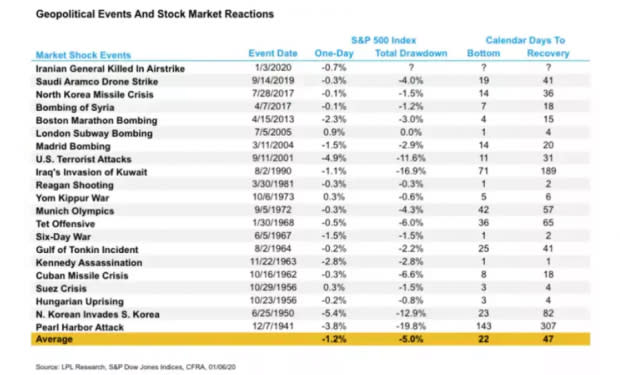

There is no arguing that war is concerning and sad for those involved and the world. Nonetheless, successful investors understand that to be successful, such emotions must be put on the back burner. Though it may sound counterintuitive to amateur investors, Wall Street history tells us that following a major geopolitical event, stocks tend to stumble in the short-term but quickly gain their footing and rally in the mid to long-term. For example, equities encountered short-term weakness but suffered a total drawdown of less than 5% after the bombing of Syria, the Boston Marathon bombing, and the North Korean missile crisis. In other words, regarding geopolitical events, crisis equates to opportunity in most instances. The table below provides a summary of the past several decades.

Image Source: LPL Research

Discover Winners Amidst Chaos

The best judge of strength and potential for a stock is relative price strength and robust fundamentals. Time and time again, stocks with these inherent characteristics tend to outperform when the dust settles. Below are 3 stocks that have both relative strength and robust fundamentals:

Palantir (PLTR)

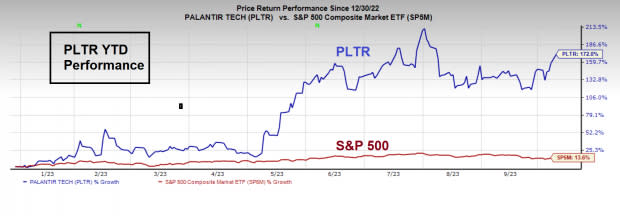

With US equities gapping down on Monday, Palantir shares shot higher by more than 5%. That’s because Palantir is a beneficiary of unrest. The unique company specializes in software, security, and artificial intelligence (AI) solutions. Governments worldwide, including defense and intelligence agencies, use Palantir’s software platforms to enhance their security and defense capabilities in several ways. PLTR is the definition of relative strength - shares are clobbering the general market and are up a whopping 174%!

Image Source: Zacks Investment Research

UK Contract Win

On the fundamental side, Palantir recently scored a $400 million contract win with the UK Department of Health. The win help 2023 earnings, and it may allow the company to parlay the contract into further contracts in Europe and the UK.

Cameco (CCJ)

Cameco is one of the world’s largest uranium producers, involved in the exploration, mining, refining, conversion, and fuel manufacturing stages of the nuclear fuel cycle. The company mines uranium ore from several high-grade mines in Canada and the United States. After mining, the uranium core is processed to create yellowcake, a concentrated form of uranium. Cameco also operates conversion facilities, where yellowcake is converted into uranium hexafluoride (UF6), a compound used in the enrichment process to produce fuel for nuclear reactors. The company supplies uranium products to nuclear power utilities around the world, playing a crucial role in supporting the global nuclear energy industry.

Geopolitical Catalysts

Kazakhstan is the world’s largest uranium producer at 45%. The ongoing war between Ukraine and Russia may provide supply shortages should the war escalate. Meanwhile, France derives about 70% of its electricity from nuclear, and a coup earlier this year in the West African nation of Niger impacted prices for the world’s largest nuclear energy nation. At this juncture, geopolitical uncertainties seem to be expanding, not decreasing any time soon.

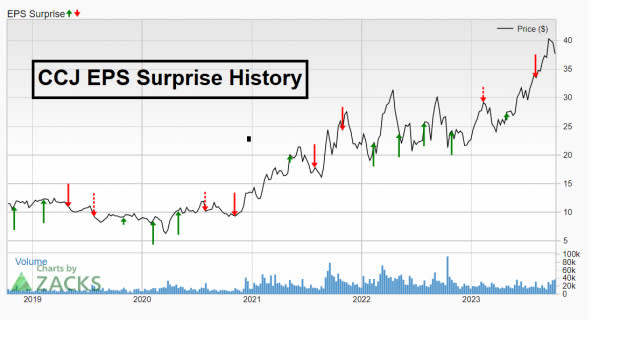

EPS Reaction History

Cameco delivered positive earnings surprises in five of the past seven quarters. Even after lowering production guidance last quarter due to challenges at two key mines, CCJ shares shook off the negative news and rallied over the past few months.

Image Source: Zacks Investment Research

Super Micro Computer (SMCI)

Zacks Rank #1 (Strong Buy) stock Super Micro Computer is a technology company that designs and manufactures high-performance server and storage solutions. The company’s products are used in various up-and-coming, high-growth industries, including enterprise IT, big data, cloud computing, the internet of things (IoT), and artificial intelligence (AI).

An AI Leader with A1 Fundamentals

Investment in AI is contributing to explosive demand for SMCI’s servers. Meanwhile, a server partnership with fellow AI leader Nvidia (NVDA) is helping to drive demand. High earnings growth and a high return on equity (ROE) indicate that management efficiently uses shareholder equity to generate profits. SMCI’s ROE of 35 dwarfs the S&P 500’s ROE of 25.

Image Source: Zacks Investment Research

Conclusion

In the wake of escalating conflict in the Middle East, investors should remember to focus on historical market data rather than emotional reactions. Geopolitical events, though concerning, historically lead to buying opportunities. Amidst the chaos, opportunities arise for investors who stick to data and market precedent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report