Embraer (ERJ) Clinches $2B Order for 25 E195-E2 Aircraft

Embraer S.A. ERJ recently clinched a firm order from Porter Airlines for delivering 25 of its E195-E2 passenger jets. The fresh order enhances Embraer’s current 50 firm orders from this Canadian carrier, broadening its fleet with this aircraft.

The agreement, priced at $2.1 billion at list price, will contribute to ERJ’s Q4 backlog and increase Porter’s firm orders with Embraer to a total of 75, with 24 jets already being delivered to the company.

The steady stream of orders for Embraer’s E195-E2 jets underscores its effective ability to meet the growing jet demand of airlines.

Significance of Embraer’s E195-E2 Jets

The largest aircraft in Embraer’s E-Jet E2 family, the E195-E2, has been designed to maximize returns and efficiency on high-density routes. It is also considered to be the world's quietest and most fuel-efficient single-aisle aircraft.

With its high-aspect-ratio wings and swept tips, combined with other aerodynamic improvements, the E195-E2 achieves double-digit lower fuel consumption compared to current-generation E-Jets.

Due to such remarkable features, Embraer could witness a steady inflow of orders for the jet in the days ahead as well. This will bolster its revenue generation prospects.

Opportunities Ahead

The demand for air travel remains solid and continues to rise. Per the report released by the International Air Transport Association (“IATA”) in September 2023, total air traffic in September 2023 (measured in revenue passenger kilometers or RPKs) increased 30.1%, while global traffic stood at 97.3% of pre-COVID-19 levels.

The RPK can be expected to improve, considering the rise in travel demand for both domestic and international traveling. Per the data from IATA, domestic September 2023 traffic rose 28.3% from the September 2022 level, while international traffic climbed 31.2% compared to September 2022, with all markets witnessing significant growth.

Going forward, per the report from Allied Market Research, the global commercial aircraft market is expected to witness a CAGR of 4.2% over the 2021-2030 period. This entails significant demand for commercial jets in the days ahead, which brightens the prospects of aircraft manufacturers to shine in the northward-bound market.

In such a scenario, ERJ’s efforts to provide upgraded aircraft that ensure sustainability and fuel efficiency are likely to result in significant order wins for the company, like the latest one. Consequently, Embraer’s backlog at the end of the third quarter was $17.8 billion compared with $17.3 billion at the end of the second quarter of 2023. Such solid backlog strength of the company should enable it to eventually recognize significant revenue growth once the deliveries are made.

Peer Prospects

Other companies that stand to benefit from the growing commercial aircraft market are Airbus SE EADSY, Textron TXT and Boeing BA.

Airbus is one of the forerunners in the commercial aircraft segment. Its order backlog amounted to 7,992 commercial aircraft at the end of September 2023.

Airbus’ long-term earnings growth rate is pegged at 12.4%. Shares of EADSY have returned 30.3% value to its investors in the past year.

Boeing has been the premier manufacturer of commercial jetliners for decades. Its backlog at the end of the third quarter was $469.18 billion, up from $439.56 billion recorded at the end of the second quarter of 2023.

Boeing’s long-term earnings growth rate stands at 4%. Boeing shares have increased 25.5% in the past year.

Textron Aviation’s principal markets include general aviation aircraft, business jets and commercial transportation. The segment’s order backlog at the end of the quarter totaled $7.4 billion.

Textron boasts a long-term earnings growth rate of 11.7%. TXT stock has appreciated 4.8% in the past year.

Price Movement

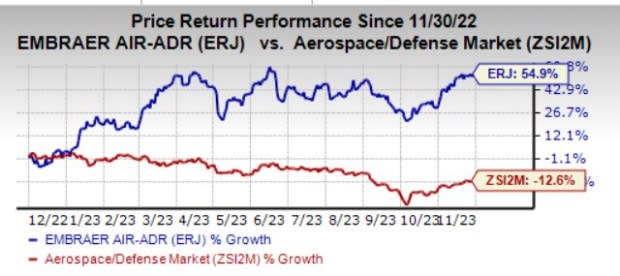

In the past year, shares of Embraer have rallied 54.9% against the industry’s decline of 12.6%.

Image Source: Zacks Investment Research

Zacks Rank

Embraer currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report