EMCOR's (EME) Building Services Unit to Acquire ECM Holding

EMCOR Group, Inc. EME inked a deal to acquire a leading national energy efficiency specialty services firm — ECM Holding Group, Inc. — all in cash.

The acquisition will strengthen EMCOR’s position in the energy efficiency specialty services and expand its energy conservation and sustainability solutions portfolio across the nation. Although the terms of the deal haven’t been disclosed yet, it is expected to close in the third quarter of 2023, subject to certain customary closing conditions.

Headquartered in Oshkosh, WI, ECM’s specific business units offer a variety of HVAC, lighting, water, weatherization and airflow management solutions. ECM’s estimated revenues for 2023 totaled $60 million. Its innovative turn-key energy conservation solutions are delivered cost-effectively with third-party-reviewed energy projections, professional project management and a comprehensive measurement and verification program.

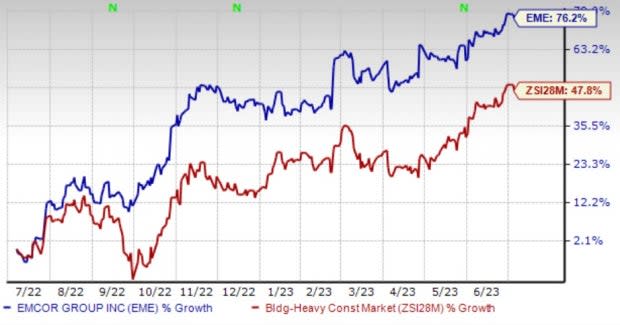

Image Source: Zacks Investment Research

Shares of EME have increased 76.2% in the past year compared with the Zacks Building Products - Heavy Construction industry’s 47.8% growth.

The company has been banking on solid acquisition strategies, strength in the U.S. Mechanical and Electrical Construction segments and impressive liquidity management. Also, its building services segment is experiencing facilities maintenance contracts with new customers and increased project work with existing customers.

During the first quarter of 2023, EME acquired two companies. One company has been clubbed into the United States Mechanical Construction and Facilities Services segment and provides mechanical and pipe fabrication services in the Midwestern region of the United States. The other acquired entity has been integrated into the United States Building Services segment and provides mechanical services in the Western region of the United States. In 2022, EMCOR acquired six companies, spending a total of $100.8 million.

However, the industry is witnessing higher costs, labor woes and supply constraints. Also, its connection with the highly volatile oil and gas industry concerns EMCOR and other industry players like Dycom Industries, Inc. DY, Primoris Services Corporation PRIM and Granite Construction, Inc. GVA.

Nonetheless, EME, a Zacks Rank #2 (Buy) company, is poised to regain on strong growth prospects. Earnings estimates for 2023 suggest 20.3% year-over-year growth on 10.2% higher revenues. The company currently has a VGM Score of A, supported by both Value and Growth Score of B.

A Brief Overview of Other Stocks

Dycom is benefiting from higher demand for network bandwidth and mobile broadband, extended geography, proficient program management and network planning services. The persistent impacts of a large customer program complexity, lower year-over-year revenues related to other large customers and higher fuel costs are a concern. The prospects of the telecommunications business look good, given increased customers’ needs to expand capacity and improve the performance of existing networks as well as, in certain instances, deploy new networks. Dycom expects considerable opportunities across a broad array of customers.

Dycom currently carries a Zacks Rank #1 (Strong Buy). Its earnings for fiscal 2024 are expected to grow by 41%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Granite Construction — a Zacks Rank #3 (Hold) company — is the largest diversified infrastructure company in the United States. The company has been banking on strategic initiatives, inorganic moves and strong bidding activity.

Estimates for GVA’s 2023 earnings are expected to climb by 10.4% year over year.

Primoris — a Zacks Rank #2 company — is a specialty contractor company operating in the United States and Canada. A robust backlog level of more than $4 billion and solid contract awards in the Energy/Renewables and Utilities segments depict incredible momentum in the future, despite the supply chain and permitting challenges. Utility-scale solar projects continued to drive the progress of the Energy/Renewables segment.

Primoris’ earnings for 2023 are expected to grow by 5.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Primoris Services Corporation (PRIM) : Free Stock Analysis Report

Granite Construction Incorporated (GVA) : Free Stock Analysis Report