EMCOR's (EME) Q2 Earnings & Revenues Top Estimates, Up Y/Y

EMCOR Group, Inc. EME reported impressive second-quarter 2023 results, with earnings and revenues surpassing the Zacks Consensus Estimate and increasing year over year.

Strength across the segments and market helped the company to achieve 11% higher organic revenues.

The company witnessed significant increases in high-tech manufacturing and network and communications market sectors, driven by strong demand for semiconductor, data center construction projects and EV value chain.

Following the results, shares of the company rose 6% during the trading session on Jul 27.

Earnings & Revenue Discussion

The company reported adjusted earnings of $2.95 per share, surpassing the consensus mark of $2.37 by 24.5% and increasing 48.2% from the year-ago quarter’s figure of $1.99.

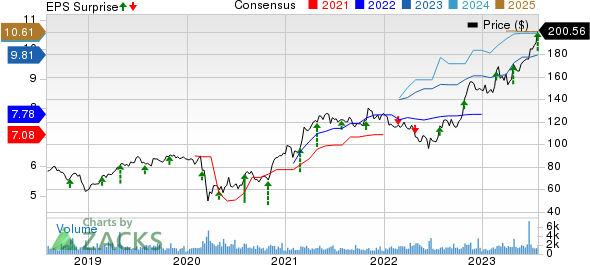

EMCOR Group, Inc. Price, Consensus and EPS Surprise

EMCOR Group, Inc. price-consensus-eps-surprise-chart | EMCOR Group, Inc. Quote

Revenues totaled $3.05 billion, surpassing the consensus mark of $3.02 billion by 0.8% and rising 12.5% year over year.

Segment Details

EMCOR currently operates in four reportable segments — U.S. Construction Services (Electrical and Mechanical Construction and Facilities Services), U.S. Building Services, U.S. Industrial Services and U.K. Building Services.

U.S. Construction Services: This segment's revenues were up 15.4% year over year to $1.87 billion year over year. Our estimate for segment's revenues was $1.91 billion. Segment operating margin increased 220 basis points (bps) year over year to 9.1%.

Within the U.S. Construction umbrella, the U.S. Electrical Construction and Facilities Services segment’s revenues increased 20.2% year over year to $678.2 million. Operating income went up 44.5% and margin expanded 130 bps year over year to 7.5%. The U.S. Mechanical Construction and Facilities Services segment’s revenues rose 12.9% from a year ago to $1.19 billion. Its operating income grew 56.4%, while its margin expanded 280 bps year over year to 10%.

U.S. Building Services: Revenues in this segment were up 12.9% from the prior-year quarter’s levels to $775 million, driven by strong demand for retrofit projects, building automation and controls and maintenance and service repair work. Our estimate was $745 million.

Operating income increased 19.9% year over year and margin improved 40 bps to 6%.

U.S. Industrial Services: This unit’s revenues increased 2.7% year over year to $292.3 million. Our estimate was $301.1 million.

Operating income grew 22.1% year over year and operating margin increased 40 bps to 2.7%. The modest increases in the demand driven by greater new build heat exchanger orders resulted in growth of this segment.

U.K. Building Services: This segment’s revenues declined 7.4% from the year-ago quarter to $106 million. Our estimate was $120.8 million.

Operating income declined 7.6% and operating margin were on par with the prior-year quarter’s levels of 5.6%. This decline was due to challenging market conditions.

Operating Highlights

Gross margin contracted 200 bps year over year to 16.1% in the quarter. Our estimate was 14.5%. Selling, general and administrative expenses — as a percentage of revenues — were 9.6% compared with prior-year quarter’s levels of 9.1%.

Operating income in the quarter amounted to $196.7 million, up 42.9% year over year. Our estimate was $153.5 million.

Despite persistent inflationary and supply chain woes, the operating margin of 6.5% expanded 140 bps from the prior-year quarter’s levels. Our estimate was 5.1%.

Liquidity & Cash Flow

As of Jun 30, 2023, EME had cash and cash equivalents of $503.1 million compared with $456.4 million at 2022-end. Long-term debt and finance lease obligations totaled $231.5 million, almost on par with the 2022-end level of $231.6 million.

Net cash provided by operating activities was $215 million in first half of 2023, versus $18.9 million net cash used in operating activities in the prior-year.

The remaining performance obligations or RPOs as for Jun 30, 2023, were $8.29 billion, up 28.2% year over year.

Maintained 2023 View

The company maintained annual revenues guidance range of $12- $12.5 billion.

Earnings per share are expected to be within $10.75-$11.25, up from the previously expected range of $9.25-$10.00. The effective tax rate is likely to be 27.5-28% for 2023.

Zacks Rank & Recent Construction Releases

EMCOR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVR, Inc. NVR reported mixed second-quarter 2023 results, with earnings surpassing the Zacks Consensus Estimate and revenues missing the same. The top and bottom lines declined on a year-over-year basis, thanks to delayed housing activities and macroeconomic woes.

NVR reported earnings of $116.54 per share, which topped the consensus mark of $100.98 by 15.4%. The reported figure, however, declined 6% from the prior-year quarter’s figure of $123.65 per share.

RPM International Inc. RPM reported decent fourth-quarter fiscal 2023 (ended May 31, 2023) results, with earnings and sales beating the Zacks Consensus Estimate. Despite a year-over-year decline in earnings, the company marked its sixth consecutive quarter of record sales, suggesting an increase.

Although challenging conditions impacted certain end markets, the company's adaptability and diverse business model helped it grow. The company benefited from businesses selling engineered solutions for infrastructure and reshoring-related capital projects.

D.R. Horton, Inc. DHI reported third-quarter fiscal 2023 (ended Jun 30, 2023) results, with earnings and revenues surpassing their respective Zacks Consensus Estimate.

On a year-over-year basis, although earnings declined, revenues increased. The company highlighted that the supply of both new and existing homes at affordable price points remains limited and that the demographics supporting housing demand remain favorable. This tailwind has helped this Arlington, TX-based homebuilder witness net sales order growth of 37% year over year in the fiscal third quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

RPM International Inc. (RPM) : Free Stock Analysis Report