Emeren (SOL) Delivers 1GW Battery Storage Portfolio in Italy

Emeren Group Ltd. SOL recently announced that it has delivered almost 1 gigawatt (GW) of Battery Energy Storage Systems (BESS), which was in development in Italy. This achievement was preceded by the sale of additional two BESS by Emeren to Matrix Renewables.

Impressively, Emeren reached this achievement within just six months of signing the proprietary Development Service Agreement (DSA), which aims to develop up to 1.5 GW of a portfolio of BESS in Italy.

Progress of the Deal

Under the DSA, signed on Jun 27, 2023, Gravel A, a joint venture consisting of Emeren Limited, Enerpoint and Kaizen Invest Holding, joined forces with Matrix Renewables.

The battery storage projects under Gravel A comprise a total capacity of 293 megawatts (MW), with a discharge duration of four-eight hours for each project. The new projects, expected to reach Ready-To-Build status by early 2025, are situated in Apulia and Lazio.

Under this partnership, the company has so far successfully delivered more than 975 MW of BESS in Italy. We may expect Emeren to deliver more such projects in the coming days to duly meet its 1.5 GW target.

Emeren’s Expansion Plans in Europe

The rapidly increasing clean energy adoption is providing a competitive edge to the energy storage market. Consequently, nations across the globe are expanding their energy storage capacity to further boost their clean energy goals, with Europe being no exception.

To this end, it is imperative to mention that Emeren Group is steadily gaining momentum in Europe’s energy storage solar market, with its presence in Poland, England, France, Spain and Italy. As of Nov 30, 2023, Emeren Group had 6,440 MWh of advanced-stage battery storage pipeline in Europe. During third-quarter 2023, 68% of the company’s total revenues came from this region.

Such a solid project pipeline is likely to provide meaningful gains to Emeren Group in the days ahead, which can be further gauged by a recent projection from the Mordor Intelligence firm. Per the report by Mordor Intelligence, Europe’s energy storage market is expected to witness a CAGR of 18 % during the 2023-2028 period.

In light of such growth expectations, it is reasonable to assume that Emeren Group’s expansion plans in Europe could prove to be prudent, including the latest efforts to deliver energy storage projects to Matrix Renewables.

Peers to Benefit

Other prominent solar players like Canadian Solar Inc. CSIQ, SolarEdge Technologies Inc. SEDG and Enphase Energy Inc. ENPH are also expanding their footprint in Europe to reap the benefits of the energy storage market’s prospects.

Canadian Solar has a strong presence in Germany, Poland, Spain, Italy, France and the Netherlands. As of September 2023, the company had 20,597 MWh of battery energy storage development project pipeline in Europe, the Middle East and Africa. Its subsidiary, CSI Energy Storage, inked a supply agreement with Cero Generation and Enso Energy in Europe during the same time. The deal involves the delivery of 49.5 MW/99 MWh of turnkey battery energy storage solutions.

The Zacks Consensus Estimate for CSIQ’s 2023 earnings per share (EPS) implies growth of 7% from the 2022 reported figure. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 1.2% from the prior-year reported number.

SolarEdge has a strong presence in Germany, the U.K. and Switzerland. It expects the momentum to continue growing in Europe. With the third-quarter 2023 revenues from Europe comprising 62% of the total revenues, the company shipped 2,585 MW of energy to Europe.

SEDG has a long-term (three-to-five years) earnings growth rate of 18.7%. Its shares have risen 16.9% in the past month.

On Dec 5, 2023, Enphase launched its most powerful Enphase Energy System to date in Italy’s energy storage market. The system includes the IQ Battery 5P and IQ8 Microinverters, with a capacity of 5 kWh and a peak AC output power of 384 W, respectively. During the past three months, it also launched IQ8 microinverters in Austria and Switzerland.

ENPH has a long-term earnings growth rate of 18.3%. The stock delivered an average earnings surprise of 11.97% in the last four quarters.

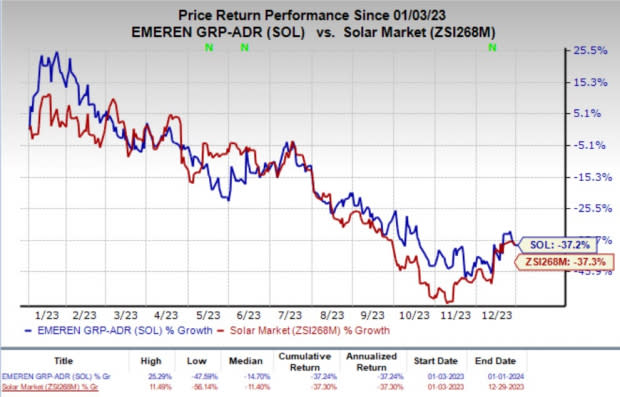

Price Performance

Over the past year, shares of SOL have lost 37.2% compared with the industry’s 37.3% decline.

Image Source: Zacks Investment Research

Zacks Rank

Emeren currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emeren Group Ltd. Sponsored ADR (SOL) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report