Emergent BioSolutions (EBS) Down 12% in a Week: Here's Why

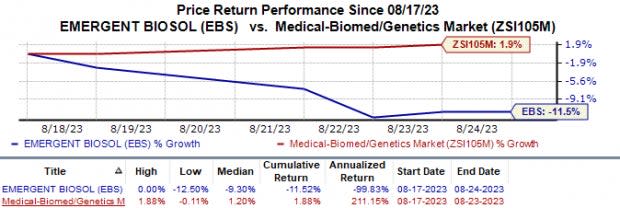

Since the past week, Emergent BioSolutions’ EBS shares have lost 11.5% against the industry’s 1.9% growth.

Image Source: Zacks Investment Research

The downside came after the S&P Global announced that Advance Auto Parts AAP will replace the company in the S&P SmallCap 600 index. Per S&P Global, Emergent no longer represents the small-cap market space, hence the substitution with Advance Auto Parts, which satisfies the index requirements. This change will be effective before the opening of trading from today, i.e., Aug 25, 2023.

Due to the removal from the index, several market participants, such as mutual funds and ETFs, which maintain positions on stock in the S&P SmallCap 600 index, are more likely to sell their positions in the company’s stock, which is no longer a part of this index. This will likely cause a downward pressure on the share price.

Moody’s Investors Service recently downgraded the company’s credit rating to Caa1 and issued a negative outlook on the stock. The main reason for this downgrade was the company’s “weak liquidity" and unpredictable revenue outlook amid the government's decision to defer purchases of the company’s vaccines.

In its Q2 earnings call, management stated that the fall in revenue guidance is due to lower expectations from anthrax and smallpox franchises following discussions with the United States government.

The downgrade also comes a couple of weeks after Emergent announced that it will implement strategic plans to reduce focus on its CDMO service business. The company plans on prioritizing the advancement of its core product businesses — medical countermeasures and Narcan Nasal Spray — and the timely delivery of its products to its existing customers, including the United States and allied governments. While the decision is expected to result in an annualized savings of almost $100 million, it will reduce the present workforce by nearly 400 employees.

Earlier this March, the FDA granted over-the-counter (OTC) status to Narcan nasal spray for emergency treatment of opioid overdose. Following the approval, Narcan is the first and currently the only naloxone NCI nasal spray available for opioid overdose in the U.S. market without a prescription. The medication will be made available later this year.

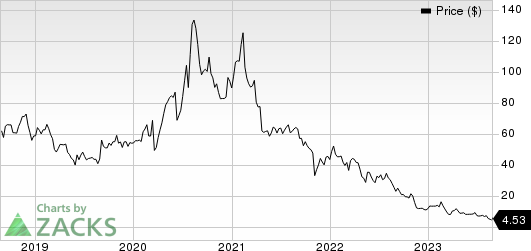

In the past couple of years, the company has lost significant market value, likely due to the loss of contract development and manufacturing (CDMO) services contracts from AstraZeneca AZN and Johnson & Johnson JNJ in 2021. Emergent suffered this setback when there was a manufacturing mishap at its Bayview facility where COVID-19 vaccine ingredients of J&J and AstraZeneca reportedly got mixed and led to several faulty batches of J&J’s vaccine. Emergent lost its contract for AstraZeneca’s vaccine following the mishap. In June 2022, Emergent and J&J announced their decision to terminate the deal, citing contract breaches.

Emergent Biosolutions Inc. Price

Emergent Biosolutions Inc. price | Emergent Biosolutions Inc. Quote

Zacks Rank

Emergent currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report