Emergent (EBS) Gets $235.8M DoD Contract for Anthrax Vaccine

Emergent BioSolutions EBS signed an indefinite-delivery, indefinite-quantity (IDIQ) procurement contract for a maximum value of up to $235.8 million with the U.S. Department of Defense (DoD) to supply its anthrax vaccine BioThrax.

The vaccine is intended for use by all branches of the United States military as pre-exposure prophylaxis (PrEP) for anthrax disease.

The procurement contract consists of a five-year base agreement ending on Sep 30, 2028, with an option to extend the contract for an additional five years to Sep 30, 2033.

Before the end of the initial five-year base period, the DoD should place a minimum guaranteed purchase order for $20.1 million worth of the vaccine product. For the following years, the annual order size should be at least $20 million for a total value of up to $235.8 million.

Emergent’s key Biodefense product, BioThrax, is the sole vaccine approved by the FDA for pre-exposure prophylaxis and post-exposure prophylaxis of anthrax disease.

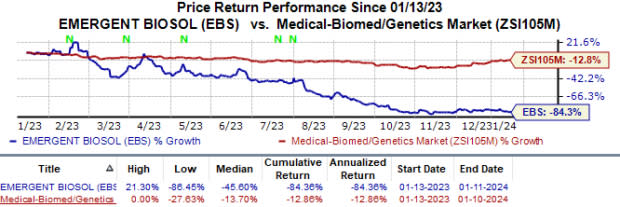

In the past year, shares of Emergent have plunged 84.4% compared with the industry’s 12.9% fall.

Image Source: Zacks Investment Research

Anthrax is an infectious disease caused by Bacillus anthracis, which occurs naturally in soil. Per the CDC, the disease commonly affects domestic and wild animals and people can contract anthrax if they come in contact with infected animals or contaminated animal products.

Apart from BioThrax, Emergent also markets Cyfendus, a two-dose anthrax vaccine for post-exposure prophylaxis use in adults aged 18 and older.

Emergent derives a substantial portion of its revenues from sales of its anthrax and smallpox vaccines to the U.S. government, which the latter procures for the strategic national stockpile (“SNS”). The company also supplies these vaccines to domestic and international non-government organizations and governments outside of the United States.

Recently, Emergent commercially rolled out an over-the-counter (“OTC”) version of Narcan nasal spray for emergency treatment of opioid overdose. The approval of the OTC version, granted by the FDA in March, makes Narcan the first and currently the only naloxone NCI nasal spray available for opioid overdose in the U.S. market without a prescription. The launch will likely help the company reduce its dependence on one single party for revenues.

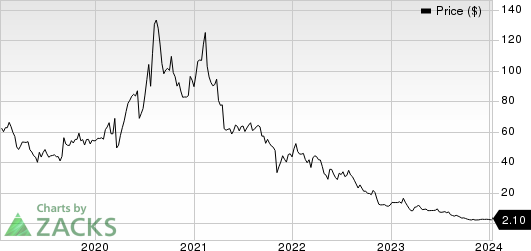

Emergent Biosolutions Inc. Price

Emergent Biosolutions Inc. price | Emergent Biosolutions Inc. Quote

Zacks Rank & Stock to Consider

Emergent currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include CytomX Therapeutics CTMX, Novo Nordisk NVO and Sarepta Therapeutics SRPT. While CytomX sports a Zacks Rank #1 (Strong Buy), Novo Nordisk and Sarepta carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics for 2023 have swung from a loss of 10 cents per share to earnings of 2 cents. During the same period, estimates for 2024 have narrowed from a loss of 22 cents to a loss of 6 cents. Shares of CytomX have lost 40.9% in the past year.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.62 to $2.64. During the same period, the earnings estimates for 2024 have risen from $3.07 to $3.16. Shares of NVO have surged 56.5% in the past year.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an average surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

In the past 60 days, Sarepta’s loss estimates for 2023 have improved from a loss of $7.53 per share to $6.62 per share. During the same period, earnings estimates per share for 2024 have risen from 46 cents to $1.99. Sarepta’s shares have lost 8.4% in the past year.

Sarepta’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 48.67%. In the last reported quarter, Sarepta’s earnings beat estimates by 72.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report