Emergent (EBS) Q2 Earnings Miss Estimates, Revenues Beat

Emergent BioSolutions Inc. EBS reported a second-quarter 2023 adjusted loss of $1.06 per share, wider than the Zacks Consensus Estimate of a loss of 98 cents. In the year-ago quarter, EBS reported a loss of 86 cents per share.

Revenues in the quarter totaled $337.9 million, up 39.2% from the prior-year period’s level. The top line beat the company’s guided range of $210-$230 million.It also outpaced the Zacks Consensus Estimate of $212 million.

Quarter in Detail

Total product sales rose 27% from the year-ago quarter’s level to $302.2 million. The figure beat our model estimate of $181.8 million.

Sales of Anthrax Medical Counter measures (Anthrax MCM), comprising of Cyfendus (previously known as AV7909), BioThrax, Anthrasil and raxibacumab, totaled $21.2 million in the reported quarter, down 78% year over year. This decline can be attributed to unfavorable timing of deliveries related to Cyfendus and BioThrax, partially offset by higher demand for Anthrasil.

Revenues from Anthrax MCM segment missed our model estimate of $36.4 million.

In the reported quarter, Cyfendus was approved by the FDA as an anthrax vaccine for people aged between 18 and 65. The biologics license application seeking approval for AV7909 was accepted for review by the FDA in April 2022.

Narcan (naloxone HCl) nasal spray added $133.9 million to product sales, up 32% year over year. This rise was due to higher volumes of branded Narcan sprays sold to public customers in Canada and public interest channels in the United States. Narcan revenues beat our model estimate of $72.7 million.

Sales of smallpox vaccine totaled $123.9 million compared with $16 million in the year-ago quarter due to favorable timing of a government order. In the quarter, EBS fully delivered the $120-million option exercised by the U.S. government to procure ACAM2000. Revenues from smallpox vaccine beat our model estimate of $36.4 million.

Other product sales amounted to $23.2 million, down 3% year over year. The decrease was primarily due to lower Botulism Antitoxin Heptavalent (BAT) sales, partially offset by higher Reactive Skin Decontamination Lotion Kit (RSDL) sales.

Revenues from contracts and grants plunged 10% year over year to $6.6 million.

CDMO service revenues totaled $26.4 million in the second quarter compared with $2.7 million in the year-ago period.

Updated 2023 Guidance

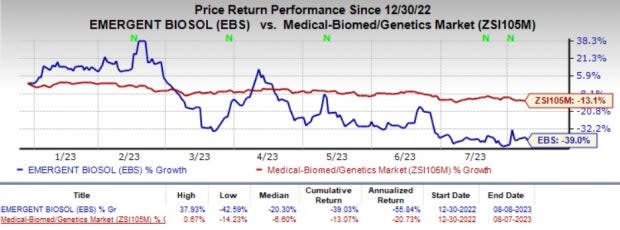

Emergent has updated its previously issued guidance for 2023, reflecting continued strength in Narcan, offset by reduced expectations across other products and services. Shares of the company lost almost 3% on Aug 8. The stock fell 39% in the year-to-date period compared with the industry’s 13.1% decline.

Image Source: Zacks Investment Research

Total revenues for 2023 are projected in the $1-$1.1 billion range compared with the previous guidance of $1.1-$1.2 billion. Emergent expects total revenues in the band of $210-$250 million for third-quarter 2023.

EBS anticipates a net loss of $465-$415 million for 2023 compared with the previous guidance of a loss of $185-$135 million. It also projects an adjusted net loss of $195-$145 million compared with the previous guidance of a loss of $85-$35 million.

Adjusted gross margin is expected in the range of 36-39% (earlier estimate: 39-42%).

Management expects Anthrax MCM sales in the band of $200-$220 million compared with the previous guided range of $260-$280 million. Revenues from the Narcan nasal spray are expected in the band of $425-$445 million compared with the previously estimated range of $360-$380 million.

Product sales from Smallpox MCM (comprising ACAM2000, Vigiv and Tembexa) are expected in the band of $180-$200 million compared with the formerly projected range of $235-$255 million. EBS expects revenues of $100-$120 million (previously $120-$140 million) from other products.

It projects CDMO revenues in the range of $60-$80 million compared with the formerly estimated band of $90-$110 million.

Other Updates

Earlier yesterday, Emergent implemented strategic plans to reduce operations and de-emphasize focus on its CDMO service business. The company plans on prioritizing the advancement of its core product businesses — medical counter measures and Narcan Nasal Spray — and timely delivery of its products to its existing customers, including the U.S. and allied governments.

These cost-saving measures will lead to a workforce reduction of 400 employees across all areas of the company. These measures are expected to result in an annualized savings of almost $100 million.

Emergent Biosolutions Inc. Price and Consensus

Emergent Biosolutions Inc. price-consensus-chart | Emergent Biosolutions Inc. Quote

Zacks Rank & Stocks to Consider

Currently, Emergent has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same industry are ADC Therapeutics ADCT, Acadia Pharmaceuticals ACAD and ImmunoGen IMGN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for ADC Therapeutics has narrowed from a loss of $2.77 per share to a loss of $2.61 for 2023. The consensus estimate has narrowed from a loss of $2.59 per share to a loss of $2.55 for 2024 during the same time frame. Shares of the company have lost 58.3% year to date.

ADCT’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 10.70%.

In the past 90 days, the Zacks Consensus Estimate for Acadia Pharmaceuticals has narrowed from a loss of 58 cents per share to a loss of 41 cents for 2023. The consensus estimate has improved from a loss of 9 cents per share to a profit of 47 cents for 2024 during the same time frame. Shares of the company have rallied 67.9% year to date.

ACAD’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 20.33%.

In the past 90 days, the Zacks Consensus Estimate for ImmunoGen has narrowed from a loss of 55 cents per share to a loss of 21 cents for 2023. The consensus estimate has improved from a loss of 31 cents per share to a profit of 3 cents for 2024 during the same time frame. Shares of the company have rallied 185.1% year to date.

IMGN’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 31.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report