Emerging Market ETFs Diverge from S&P 500

Emerging market ETFs fell to a new 2013 low on Monday as a risk-off bout swept through global markets on worries over elections in Italy. Funds pegged to emerging economies are down year to date and lagging developed-market indices such as the S&P 500.

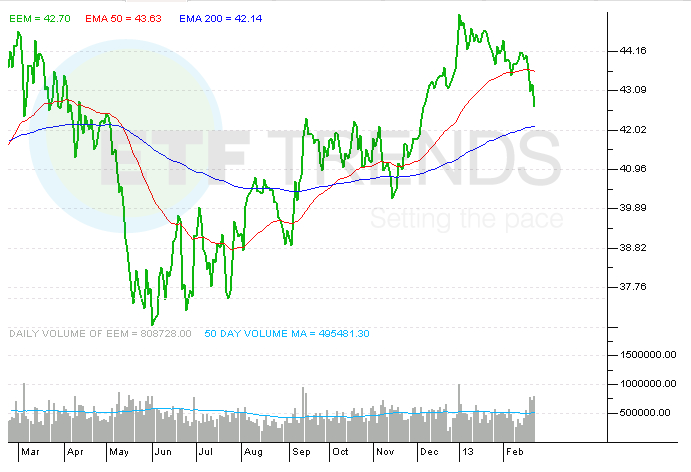

The iShares MSCI Emerging Markets Index (EEM) lost over 1% on Monday and fell to the lowest level since December.

“If the emerging market fundamentals don’t change overnight, sentiment is souring,” Seth Freeman, chief executive officer at EM Capital Management LLC, said in a report. “Italy has a high level of borrowing and debt, and that part makes investors very nervous and highlights the importance of governance.” [Where the ETF Inflows are Going]

The divided parliament in Italy is leaving a situation that may call for another election, reports Victoria Stilwell and Maria Levitove for Bloomberg. As a result, if Italy is without a government the European Union’s chance of austerity aimed at resolving the region’s debt crisis and pulling it out of recession will lessen. The Eurozone economy is forecast to contract this year, rather than expand, according to the European Commission. [Emerging Market ETFs Lagging as U.S. Economy Stalls]

In response, the recent pullback in emerging markets has investors piling back into U.S. Treasuries. [Treasury ETF Tests 50-Day Average]

The pullback in emerging markets and the related iShares ETF, EEM, is not too surprising. EEM has been lagging the broad market SPDR S&P 500 (SPY) since the beginning of 2013 . This suggests that investors were already scaling back on risk earlier in the year. SPY is up 5% this month while EEM has lost 3.3%. [Rising Interest in Riskier Emerging Market ETFs]

“Over the last 12 months, U.S. markets have rallied 10%. Emerging markets, on the other hand, have been down as much as 16% – and have barely fought back to breakeven,” Matthew Weinschenk wrote for Wall Street Daily.

iShares MSCI Emerging Markets Index

Tisha Guerrero contributed to this article.

Full disclosure: Tom Lydon’s clients own EEM.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.